Binance.US has rescinded its offering of Federal Deposit Insurance following a consultation with the Federal Deposit Insurance Corporation (FDIC). The exchange confirmed an update to the “deposit language insurance” in an email to clients.

The new terms of services now confirm that customer deposits are not eligible for FDIC insurance, having previously qualified for a maximum of $250,000. The revised services also mandate that US dollar (USD) withdrawals must first be converted to stablecoins or other cryptocurrencies.

Accept or Leave: Binance.US to Customers

According to the letter, the new terms will go into effect today, and continuing to trade on Binance.US will constitute an acceptance of those terms. Those who don’t agree with the changes can close their accounts, provided they are in good standing.

Read more: 7 Best Binance Alternatives in 2023

The previous terms and conditions, published on Oct. 18, 2019, stated that:

“USD deposits are eligible for FDIC insurance coverage. All USD deposits are held in pooled custodial accounts at multiple banks that are insured by the FDIC.

“The pooled custodial wallets are maintained in a manner that provides access to pass-through FDIC insurance coverage up to the depositor coverage limit, which is currently $250,000.”

The exchange confirmed it is also halting direct USD withdrawals after suspending deposits in June.

Community reactions to the rescission of USD withdrawals and the need to convert dollars to other assets before withdrawal were mixed. Some, like SpillnCryptoTea, view the removal of the dollar withdrawals as a way to reduce dependence on the dollar.

Others have argued that it pushes people toward other stablecoins whose reputations have suffered. BUSD, the Binance-branded, Paxos-issued stablecoin, was recently labeled a security under US law, while Tether, the world’s largest stablecoin, has faced scrutiny from regulators in multiple countries.

Binance.US has not commented on the USD or FDIC changes.

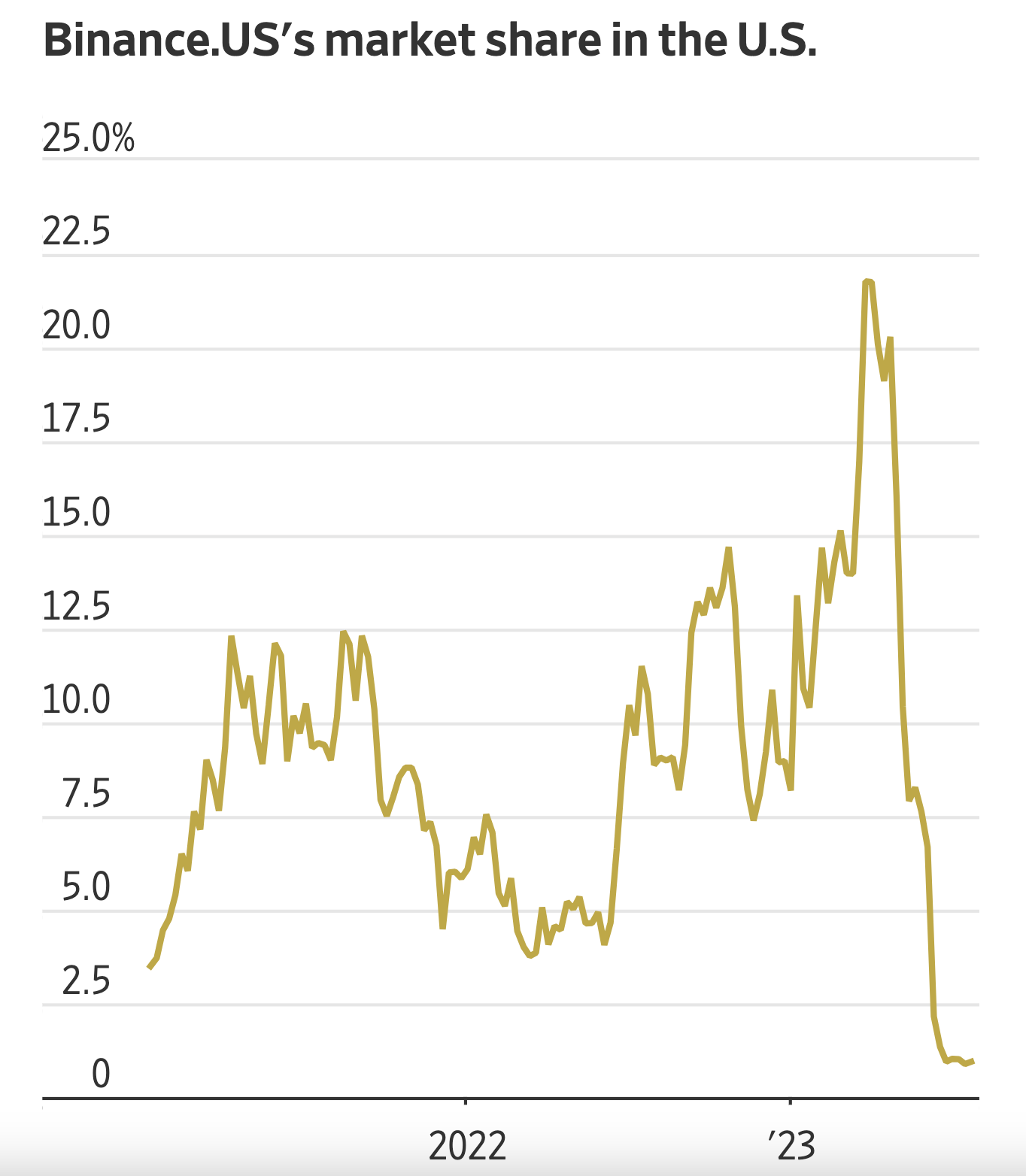

Binance.US Market Share Plummets

The exchange’s share of US trading volumes has fallen sharply since US regulators cracked down on crypto earlier this year. After the US Securities and Exchange Commission (SEC) accused Binance.US of not having in place enough measures to prevent wash trading, the exchange’s share of the US market fell to less than 1%.

It successfully contested the SEC’s attempt to freeze customer assets amid allegations of commingling. However, the lawsuit hurt its reputation, causing volumes to fall.

Earlier in the year, the US Commodity Futures Trading Commission (CFTC) accused Binance.US global affiliate, Binance, of allowing US market makers to access its derivatives trading desk. The move also dropped spot and derivative volumes on the global exchange amid a wider decline in exchange trading activity.

Read more: Binance vs. Binance.US: A Detailed Comparison

Do you have something to say about Binance.US suspending USD withdrawals, its rescission of FDIC insurance, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).