Binance suspended Bitcoin transactions for the second time in a few hours. The network has become heavily congested, causing transaction fees to skyrocket.

[Update May 8, 2023, 05:25 UTC] Binance CEO Changpeng Zhao tweeted that the exchange’s fee parameters did not ‘anticipate the recent surge in BTC network gas fees. To help clear the backlog of Bitcoin transactions, Binance raised withdrawal fees and enabled Lightning Network withdrawals.

On May 7, Binance, the world’s largest crypto exchange, suspended Bitcoin transactions. It cited network congestion and stated that it was working on a fix.

A couple of hours later, the company reported that transactions had resumed again.

However, on May 8, Binance suspended Bitcoin withdrawals again “due to the large volume of pending transactions.” About an hour later, it stated:

“There is a large volume of withdrawal transactions from Binance still pending as our set fees did not anticipate the recent surge in $BTC network gas fees.”

Binance added that the team was working to accelerate the confirmation of all pending transactions.

Bitcoin Network Demand Surges, Binance Back On

Binance stated that it was replacing the pending BTC withdrawal transactions with a higher fee so that they get picked up by mining pools. The latest update from the company a few minutes ago read:

“BTC withdrawals are now resumed on Binance. Pending transactions are being processed by replacing them with higher transaction fees.”

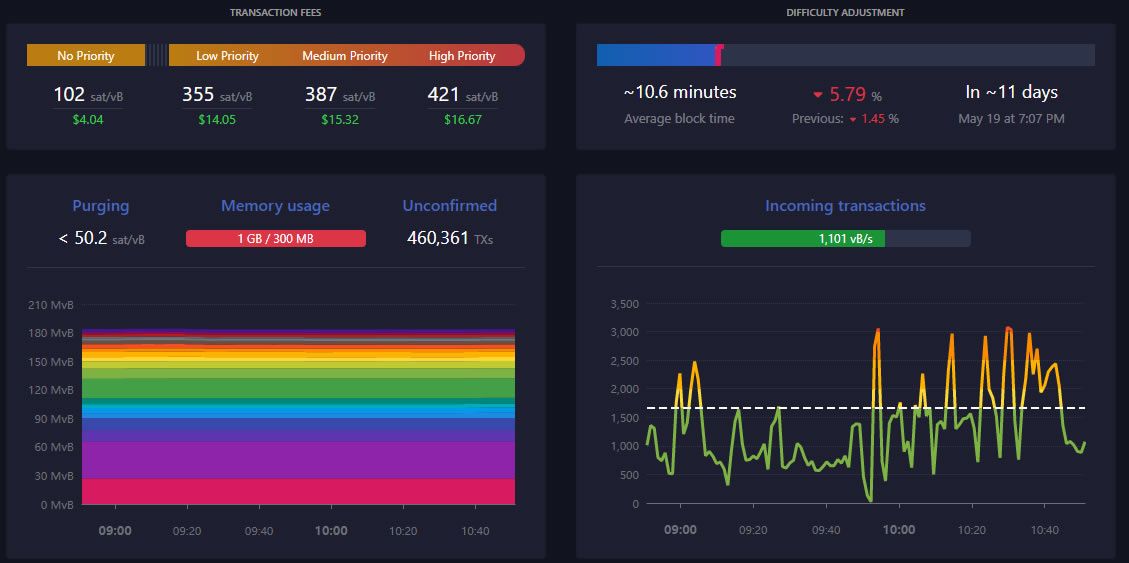

A surge in Taproot usage and ordinal inscriptions has put pressure on the Bitcoin network. This has caused transaction fees to skyrocket and the mempool to clog up.

Furthermore, Bitcoin transaction fees have exceeded the mining subsidy of 6.25 BTC for the first time since 2017. BTC pioneer Jameson Lopp commented on the

“Block 788695 marks a historic moment in which transaction fees due to high demand for block space have exceeded the mining subsidy. The model for thermodynamic security has been proven possible. The only remaining question is if this demand is sustainable.”

At the time of writing, there were more than 450,000 pending transactions, according to Mempool.Space data. Furthermore, average transaction fees had surged to over $15.

The spike in activity has been attributed to the memecoin madness and ordinal inscriptions. A surge in network activity involving BRC-20 transactions has pushed transaction fees to multi-year highs.

BTC Price Retreats

Bitcoin prices are going the opposite way to transaction fees at the moment. BTC has retreated 2.2% on the day to trade at $28,214 at the time of writing.

Furthermore, the asset failed to breach the heavy resistance at $30,000 over the weekend. It notched up a weekly high of $29,724 before falling back during the Monday morning Asian trading session.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.