Binance has introduced a new token called Wrapped Beacon ETH (WBETH). that will give users more flexibility when it comes to using their staked ETH in DeFi protocols.

Binance is bringing more options to the Ethereum liquid staking market with its Wrapped Beacon ETH (WBETH) launch. The exchange announced on April 24 that it had rebranded its ETH 2.0 Staking to ETH Staking, but more importantly, it had introduced the Wrapped Beacon ETH (WBETH) on its ETH Staking service.

Wrapped Beacon ETH (WBETH); Binance’s LSD Product

Each WBETH token represents 1 BETH. Stakers can use the token to participate in DeFi projects outside of Binance, the exchange states, but can also accrue staking rewards.

The WBETH service will begin operations on April 27 at 08:00 UTC, and users can wrap their BETH into the new tokens. Binance states that the initial conversion rate is 1:1, though it is subject to change. It also expects that the value of BETH will increase over time “in accordance with the daily APR on ETH Staking.”

WBETH essentially allows users to do a lot more with staked ETH while also being able to receive rewards. Currently, only Ethereum and BNB Smart Chain are supported, but the exchange states that more networks will be supported in the future.

Liquid Ethereum Staking Going Strong Following Shapella

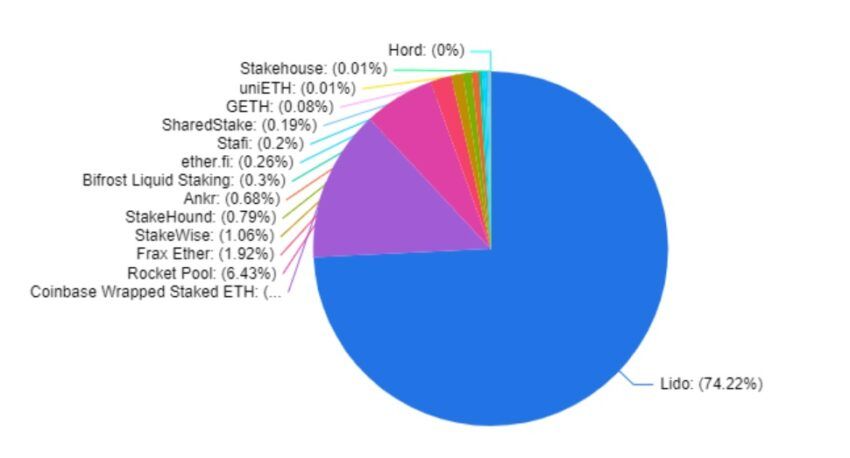

Liquid staking of ETH is as strong as ever, with Lido dominating the niche currently. It holds 74.2% of the total share, with over 6.1 million ETH staked. Coinbase’s liquid ETH staking follows with about 1.1 million staked ETH, which amounts to 13.84% of the market share.

Liquid staking has been one of the hottest trends in Q1 2023, with a CoinGecko report showing that it had the highest growth in the quarter. It has played a critical role in pushing the DeFi market up this year.

Liquid staking providers like Rocket Pool have also been bringing new updates to incentivize staking. The latter recently implemented an update that grants users quicker access to ETH staking rewards.

Ethereum Shapella Upgrade a Success By All Measures

After the Shapella upgrade was rolled, Ethereum saw over 572,000 ETH staked in a week — a record influx. The staked ETH largely came from institutional staking service providers.

Of note is the fact that deposits of ETH are continuing to grow while withdrawals are falling. This is a positive sign for Ethereum and bodes well as it prepares for its next major upgrades.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.