In a recent court filing, Binance, Binance.US, and CEO Changpeng ‘CZ’ Zhao have formally asked for the dismissal of the United States Securities and Exchange Commission (SEC) lawsuit filed against them.

“The SEC’s claims against BHL and Mr. Zhao fail as a matter of law,” the filing stated.

Binance Aims to Dispel All Allegations in Lawsuit

According to a recent court filing, Binance, Binance.US, and CEO Changpeng Zhao have filed a request to dismiss all the counts in the SEC lawsuit.

On June 5, the SEC filed the lawsuit, leveling 13 charges against the crypto exchange. It includes allegations of operating unregistered exchanges, broker-dealers, and clearing agencies.

However, the recent filing asserts that investors did not suffer any harm:

“Significantly, the SEC does not claim that BHL or Mr. Zhao committed any fraud or harmed a single investor.”

Furthermore, it raises the issue of the lawsuit’s validity. It underlines its argument on the SEC’s lack of clarity regarding the definition of a security:

“If there is any doubt that the SEC’s novel spin on the meaning of “investment contract” is wrong, then the major-questions doctrine resolves that doubt against the SEC.”

It further disputes BNB – a token introduced by Binance – being labeled a security during the initial coin offering (ICO) period.

Binance Continues To Face Ongoing Challenges

Regardless of any arguments presented, it asserts that the accusation is “time-barred.”

This is due to the offering taking place over five years before the SEC initiated the case. Additionally, it argues that the SEC has failed to “plausibly allege” that the offering was a “domestic transaction.”

Binance and CZ also contend that only the US Congress has the authority to make policy decisions of the “magnitude” the SEC asks the court to make.

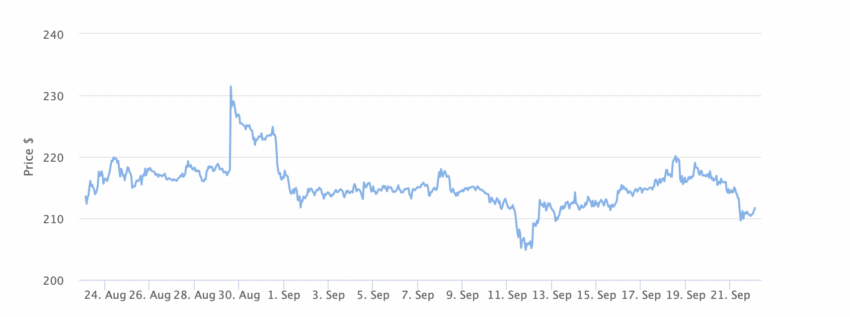

This comes after the resignations of legal and risk executives at Binance.US.

On September 14, BeInCrypto reported that Krishna Juvvadi, the head of legal, and Sidney Majalya, the chief risk officer, had both stepped down from their roles with immediate effect.

Only a day prior, Brian Shroder, the CEO of Binance.US, left the exchange, leading to the temporary appointment of Norman Reed, Chief Legal Officer, as his replacement.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.