The US Securities and Exchange Commission (SEC) filed new papers expressing frustration at Binance.US’s lack of cooperation. According to the agency, the exchange’s response failed to allay concerns about the status of customer funds.

Despite good faith attempts to cooperate, the agency said that Binance has not proved that customer assets are held in the US. It has also not proved that its business is separate from the international entity.

SEC Petitions Court on Issues Binance.US Suggests Are Baseless

Instead, Binance.US allegedly produced 220 pages of documents with screenshots that lack authority due to the absence of signatures and dates. The SEC also claims the company denied access to key staff members it intended to depose, including chief executive Changpeng Zhao.

Binance.US also allegedly deferred the agency’s request to understand the custody of customer assets to Ceffu, an offshore custodian. The SEC alleges that, despite denying Ceffu’s initial involvement, Binance later admitted the custodian created the keys for Binance.US’s cold wallets.

As a result, the agency asks the court to order Binance to produce responsive documents and deny its opposition to the original SEC consent order. It also requests an extended discovery period of 14 days should its latest court filing be approved.

The SEC filed its original order against Binance.US on June 17, alleging inappropriate relationships between the Binance.US platform and Binance.com. It accused Binance.US of mismanaging customer funds, moving large amounts offshore, and ceding much of its management to other Binance entities.

Understand the difference between Binance and Binance.US here.

Earlier this week, Binance.US said the SEC had no evidence of mismanagement and has demonstrated “that all customer assets are fully accounted for.”

“[Binance.US] has produced over 5,000 pages of documentary discovery…and made multiple employees available for depositions,” a spokesman said.

BeInCrypto has reached out to Binance.US but has not heard back.

Binance.US Claims Departures Ensure Its Survival

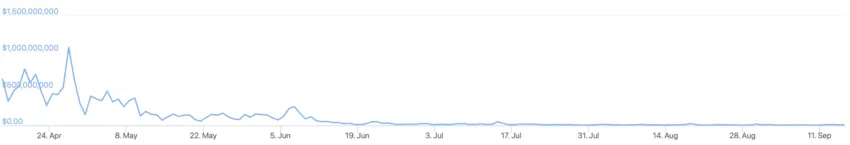

In the past few months, Binance entities have seen the departures of several key figures, including its US CEO Brian Shroder and Chief Strategy Officer Patrick Hillman. Shroder’s exit coincided with the exchange’s second major wave of layoffs it claims gives it “seven years of financial runway…to serve our customers…as a crypto-only exchange.”

The most recent tranche axed a third of the exchange’s workforce and follows the departure of 1,000 employees earlier this year. In addition to Shroder, Binance.US also lost its legal chief Krishna Juvvadi and chief risk officer Sidney Majalya, BeInCrypto reported earlier.

Last week, two Russian executives, including vice-president Gleb Kostarev, announced their departures.

Worried about Binance’s future? Find other venues to trade crypto here.

Got something to say about the SEC’s request for evidence on Binance.US mismanagement of customer assets, the recent key staff departures, or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.