In today’s video, BeInCrypto’s Jessica Walker explains the most recent fundamentals of the ethereum (ETH) rally and the direction this market is moving towards.

On Feb 3, ethereum broke its all-time high and touched a price of $1,571. Ethereum’s consistent bull run started as far back as April 2020, following the price dip in March when fears surrounding the spread of the coronavirus were at their highest.

After three bearish years, ETH has still managed to become the third-most staked token in terms of percentages relative to total supply, just below Cardano and Polkadot.

Watch BiC’s Latest Crypto Video News Show Here:

Ethereum Network Products in Demand

With only 2% of its total supply staked, there are almost $4 billion locked within the ETH 2.0 contract. These are funds from early adopters who are eager to participate in the next stage of the project, collecting fees in return.

In essence, this indicates growing demand for products on the Ethereum network, mostly fueled by Decentralized Finance (DeFi), which has exploded in popularity over the last year. The Total Value Locked (TVL) in DeFi rose from less than 1 billion in early 2019 to $30 billion currently.

This is also attracting the interest of institutional investors, who are starting to see the value of the asset. Recently, Grayscale Investments reopened its Ethereum trust after suspending the service in December 2020. This may be the green light for regulated investors looking to gain additional exposure to the growing asset class.

The ETH Supply is Falling on Exchanges

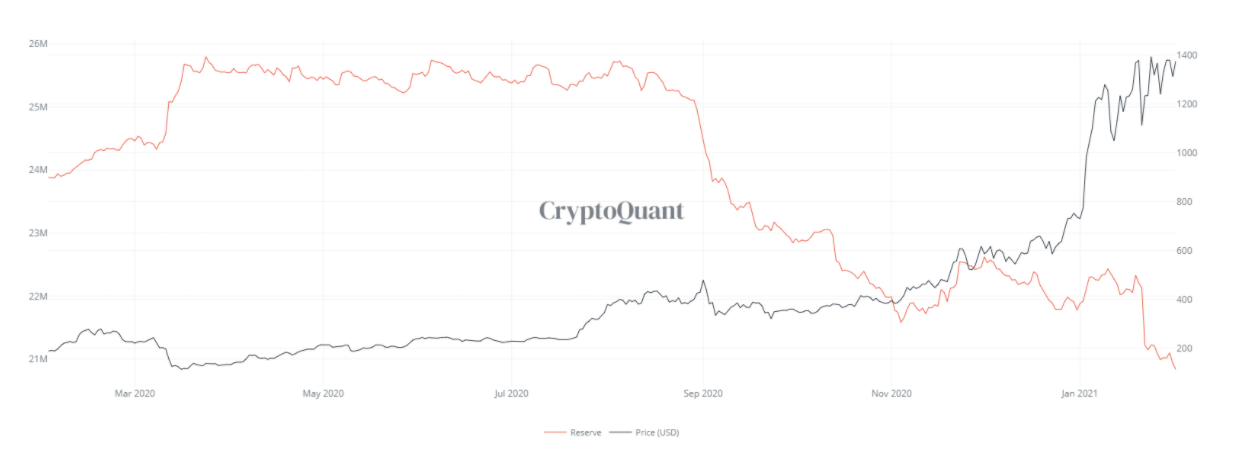

The scarcity narrative is now moving to Ethereum as ETH continues to leave exchanges. A full chart from CryptoQuant shows how exchange reserves have been decreasing considerably since September 2020.

Most of this ETH is being moved to lucrative DeFi services that provide better interest opportunities, usually on platforms that allow assets to be staked or borrowed. Users are likely taking advantage of the many products DeFi has to offer.

DeFi Markets and Bitcoin Dominance

The surge in ETH gas fees often coincides with new all-time highs (ATH), and this time is no different.

The wider crypto community took advantage of these increased fees to promote other projects that solve this and facilitate faster transactions. Grayscale has nevertheless added 47,000 ETH to its stash, worth almost $87 million.

Ethereum’s latest rally has caused the Bitcoin Dominance Rate (BTCD) to dip considerably. While altcoins have surged since the beginning of 2021, BTCD has fallen from the 71.5% resistance area and is yet to reverse.

The Bitcoin Dominance Rate should soon find a bottom and initiate an upward bounce. Ethereum’s bullish trend will likely continue in the short to medium-term, particularly in light of the upcoming CME launch.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.