Mark Dow, a financial analyst who once worked for the International Monetary Fund (IMF), predicts a hopeful future for Bitcoin — despite apparent criticisms.

In 2017, when Bitcoin (BTC) was at its near $20,000 peak, Dow entered into a short position on BTC. He closed a year later when Bitcoin was reaching yearly lows under $4,000.

CCN and other sources discussed several of Dow’s tweets made between Jan 2 and 3, 2019 in which he offered several criticisms against Bitcoin. While these articles made good gossip pieces, they failed to highlight the real issues at hand.

A Use-Value for Bitcoin

In one of the tweets reported on by other sources, Dow complains because nobody has given a practical use-value for Bitcoin. Of course, such a use-value was defined over ten years ago as part of the original formulation of the Nakamoto Theory of Decentralization. Bitcoin’s use value is currency. It is to be used as an alternative to nationalized fiat currencies. If BTC ever reaches mass adoption, it will be used similarly to the way in which the American dollar is used. An individual could go into a coffee shop and buy their espresso with bitcoins rather than dollars.I've yet to hear a positive, credible use case for #bitcoin. Plus, I see a lot of delusional arguments & scammy promotion. However, truth is I know v little about it. What I do know is it has been highly tradeable based on patterns, and I suspect it will continue to be. $BTC $XBT

— Dow (@mark_dow) January 2, 2019

Beyond Bitcoin

Bitcoin, Litecoin, Peercoin, and similar cryptocurrencies are only one type of crypto asset. Using blockchain technology, these decentralized networks permitted peer-to-peer transactions new virtualized currencies without the necessity of financial institutions. In 2013, the emergence of Ethereum (ETH) marked the development of the second type of crypto asset. Integrating smart contracts with blockchain technology, ETH developed the first platform capable of developing decentralized applications (DApps). EOS, NEO, WAVES, and others followed. Third-generation crypto assets include ERC20 and ERC721 tokens and platforms built on top of the Ethereum Virtual Machine designed with purposes other than currency. [bctt tweet=”The mass adoption of Bitcoin is not likely to happen in isolation from this technological history.” username=”beincrypto”] Currently, new first-generation cryptocurrencies, second-generation DApp development platforms, and third-generation DApps have emerged as three distinct types of crypto assets. Alternatives to Bitcoin are emerging as well as crypto assets which might aid its mass adoption and social integration.

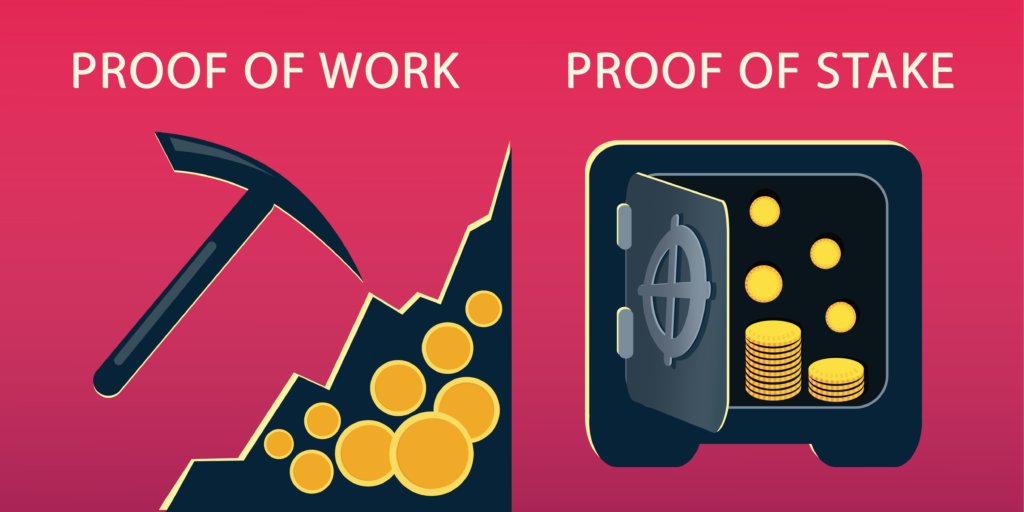

Problems With Proof-of-Work

Bitcoin may not attain mass adoption for many reasons that have nothing to do with scammy marketing campaigns or the volatility of BTC price. Two major problems are caused by Proof-of-Work (POW) and POW mining. They are:- The increasing centralization of authority over the network by POW miners and ASIC manufacturers

- Incredible energy inefficiency and environmental costs including the destruction of irreplaceable natural resources and consequent air, land, and water pollution

Conclusion

Dow’s comments are interesting, but there are much bigger issues that deserve converge. As an investor into Bitcoin shorts, it would seem reasonable to assume that Dow would know the use-value of Bitcoin. It seems strange that an experienced investor and internationally renown economist would not fully investigate the assets into which he invests. While addressing his critiques is important, it is also important to look at the deeper issues at play. Social integration of crypto assets is sometimes overlooked in the discussion about cryptocurrency. It is important to remember that cryptocurrency is only one type of crypto asset, and it will likely integrate itself into society with the assistance of other types of crypto assets. After all, social integration of blockchain technology requires integration in both economic and non-economic sectors of society. What do you think the future holds for Bitcoin? Is it still relevant or is it time to focus on other crypto assets? Let us know your thoughts in the comments below! Correction: This article has been amended, as it incorrectly named ‘Mike Dow’ instead of ‘Mark Dow’ at the time of publication.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Alexander Fred

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

READ FULL BIO

Sponsored

Sponsored