The Bitcoin Cash (BCH) price has been on a tear since June 10, outperforming Bitcoin (BTC) and nearly pacing the entire cryptocurrency market.

The readings from various indicators and the price action all legitimize the increase. As a result, it is possible that BCH is mired in a strong bullish trend reversal.

What’s Behind the Massive Bitcoin Cash Price Increase?

The BCH price had fallen under a descending resistance line since February 21. The decrease culminated with a new yearly low of $90 on June 10.

However, the price almost immediately reversed its trend, creating a very long lower wick in the process. This is considered a sign of buying pressure since sellers were not able to push the price down.

On June 21, the price broke out from the line, confirming that it has completed its correction. Moreover, the BCH price cleared the $136 resistance area and is validating it as support.

The daily RSI supports the continuing increase. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and to decide whether to accumulate or sell an asset.

Readings above 50 and an upward trend indicate that bulls still have an advantage, whereas readings below 50 suggest the opposite. The indicator is above 50 and increasing, indicating a bullish trend.

BCH Price Prediction: Wave Count Suggests New Highs Await

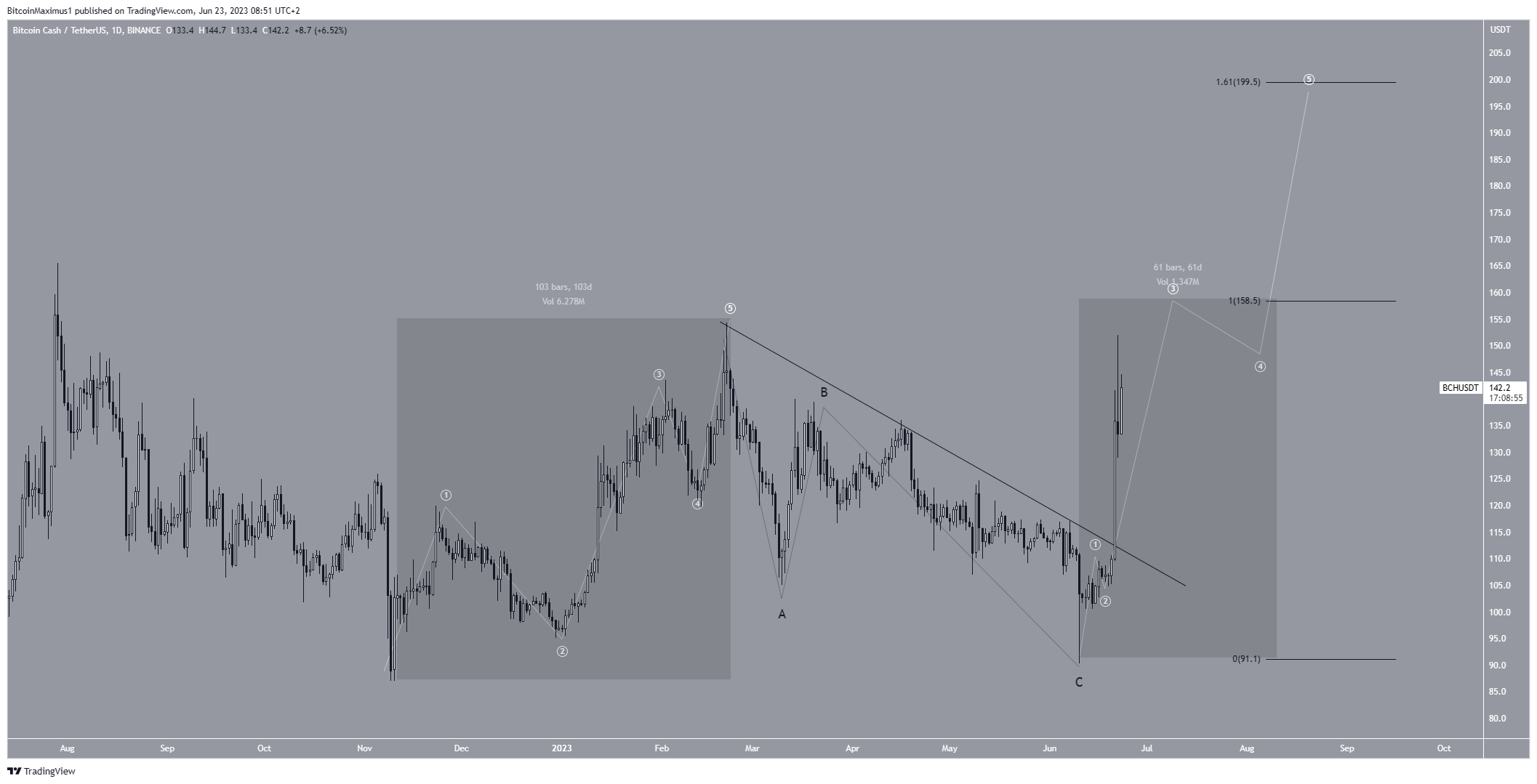

A closer look at the technical analysis from the daily time frame while including Elliott Wave theory supports the continuing increase. Utilizing the Elliott Wave theory, technical analysts examine long-term price patterns and investor psychology that recur to determine the direction of a trend.

Since November 2021, the wave count shows a completed five-wave increase (white) and an ensuing A-B-C correction (black). If the count is correct, the BCH price has now begun a new upward movement that will take it at least to a new yearly high and possibly much higher.

If both bullish increases (highlighted) have a 1:1 ratio, the BCH price will reach a high of $159. However, if the movement extends, giving the increases a 1:1.61 ratio, BCH can reach a high of $200. Due to the steepness of the current increase, the extension seems more likely.

Despite this bullish BCH price prediction, a drop below the wave one high (red line) at $110 will invalidate the bullish count since wave four would drop into wave one territory. In that case, the price would return to a new yearly low and likely reach $60.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here.