Bitcoin Cash (BCH) price failed to take off as investors anticipated after the recent network upgrade. On-chain data reveals the critical factors that invalidated the bullish BCH price prediction. But how long could the downtrend last?

On May 16, Bitcoin Cash (BCH) made glowing headlines after its recent successful “Cash Tokens” network upgrade. The upgrade will bring NFTs and smart contracts to the Bitcoin Cash ecosystem.

But instead of a Bitcoin Cash price pump, as anticipated by many stakeholders, BCH has entered a downtrend. With Miners selling and Long-term holders booking profits, investors are now wondering how long the bearish outlook could last.

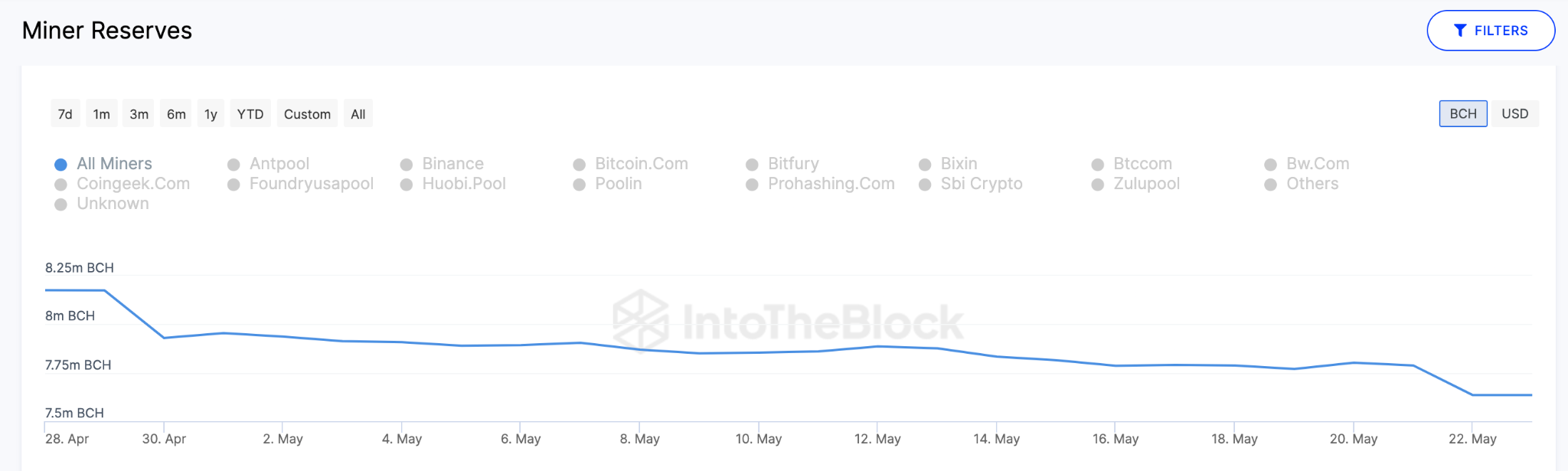

Bitcoin Cash Miners are Offloading their Reserves

Miners on the Bitcoin network appear to be selling off their block rewards, indicating their bearish sentiments. IntoTheBlock’s BCH Miner Reserves data evaluates the number of coins held in the wallet addresses of recognized miners and mining pools.

The chart below shows how BCH miners have offloaded over 550,00 coins between April 29 and May 23.

At the current market value of $113, the coins sold over the past month are worth over $62.15 million. The persistent sell-off appears to be a major driver behind the recent Bitcoin Cash price retracement.

BCH miners hold about 2.8% of the total Bitcoin Cash circulating supply. Consequently, this selling pressure among the miners could cause other strategic investors to become bearish themselves over the coming days.

Long-term Holders Have Been Selling this Week

This week, long-term investors on the BCH network have increased their selling activity. This further confirms the general bearish sentiment surrounding the Bitcoin Cash ecosystem at the moment.

The Santiment chart below shows that BCH Age Consumed has increased progressively since May 20.

In simple terms, Age Consumed evaluates the number of recently moved coins multiplied by the number of days spent in their previous wallet addresses.

Between May 20 and May 23, it has soared from 12,929 to 4.8 million.

When Age Consumed rises, as seen above, it indicates that long-term holders are increasingly selling off their tokens.

Considering that Long Term investors hold about 59% of the total BCH circulating supply, a prolonged selling frenzy among them could see the market get saturated.

In summary, miners and long-term investors are critical to the viability of any blockchain ecosystem. A prolonged selling action among them could indicate more imminent BCH price downswings.

BCH Price Prediction: Will it Drop to $100?

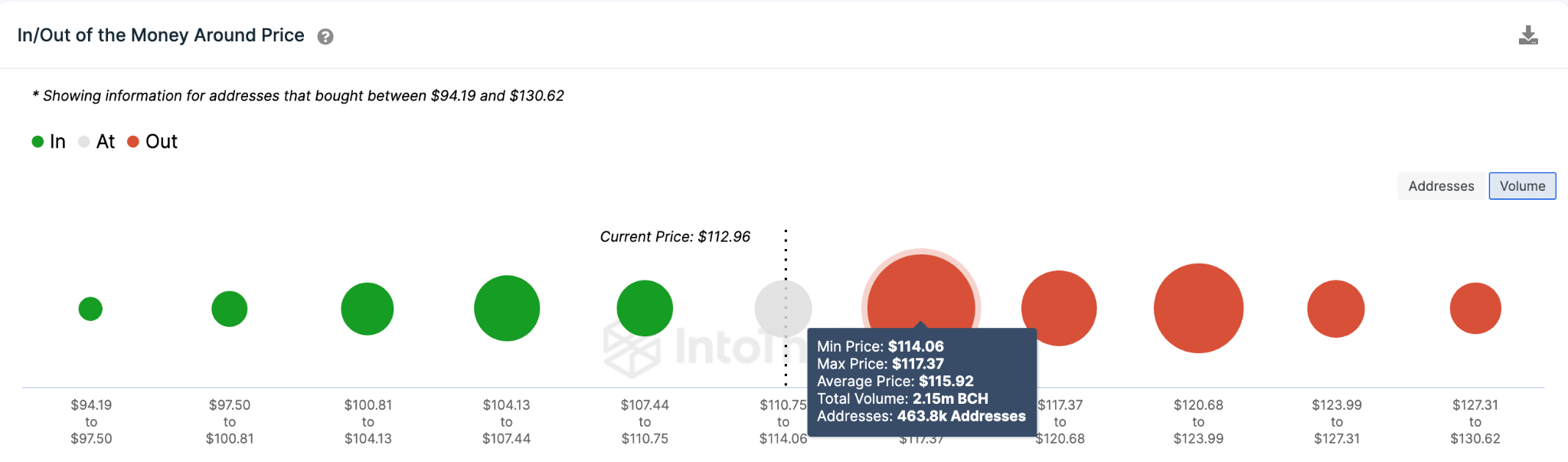

IntoTheBlock’s In/Out of the Money data shows that the $115 resistance could prove too strong for the bulls. And with the current market dynamics outlined above, a decline toward $100 is the more likely BCH price prediction.

However, the bears could face stiff competition from 284,000 bullish investors who had bought 383,000 BCH at an average price of $110.

If the bears can breach that critical $110 support zone, Bitcoin Cash price will likely drop to $100.

On the other hand, the bulls could invalidate the bearish Bitcoin Cash price prediction if BCH breaks above the critical $115 resistance.

But the potential sell pressure from the 463,800 investors that bought 2.15 million BCH at an average price of $116 could trigger a pullback.

If the price manages to breach the $115 resistance, BCH could proceed to reclaim the $120 milestone.