Bankrupt crypto lending platform BlockFi has received approval to commence the repayment process for its customers as part of an amended liquidation plan.

This approval follows the company’s conditional authorization to reimburse customers before proceeding with the company’s winding-down process.

Uncertain Factors Surround Bankrupt Crypto Lender BlockFi’s Plan

According to a recent court filing, the United States Bankruptcy Court of New Jersey has approved crypto lender BlockFi’s third amended Chapter 11 bankruptcy plan.

It also highlights that BlockFi’s chief restructuring officer, Mark Renzi, has declared his support for the amended plan. Meanwhile, the previous objection raised by the FTX Debtors regarding the plan has been partially resolved.

However, the United States Securities and Exchange Commission’s (SEC) “limited objection” to the plan has only been partially resolved.

Read more: 5 Best BlockFi Credit Card Alternatives In 2023

On the other hand, the “filing of technical modifications” to the amended plan is still yet to be resolved.

According to the filing, the next action in the plan involves the debtors submitting a compiled registry. This will include a consolidated list of all creditors, as well as the top 50 unsecured creditors.

Additionally, the debtors intend to redact certain “personally identifiable information” of individual creditors.

A recent report indicates that unsecured creditors of BlockFi could potentially receive varying payouts. These could range from 35% to 63% of their owed amounts. Additionally, certain creditors are set to receive partial payments in the form of Bitcoin or Ethereum.

BlockFi’s CEO Faces Controversial Allegations

BlockFi has attributed the liquidity crisis that ultimately led to its bankruptcy to the now-defunct crypto exchange FTX.

On the other hand, creditors of FTX recently alleged that BlockFi CEO Zac Prince was already aware of FTX’s financial troubles prior to its November 2022 collapse.

Amid the allegations, the court received a strong request from BlockFi creditors. They asked to appoint a new management firm to oversee BlockFi’s bankruptcy plan.

The creditors contended that there was a misallocation of funds. They pointed to the financial decision to liquidate crypto assets in November.

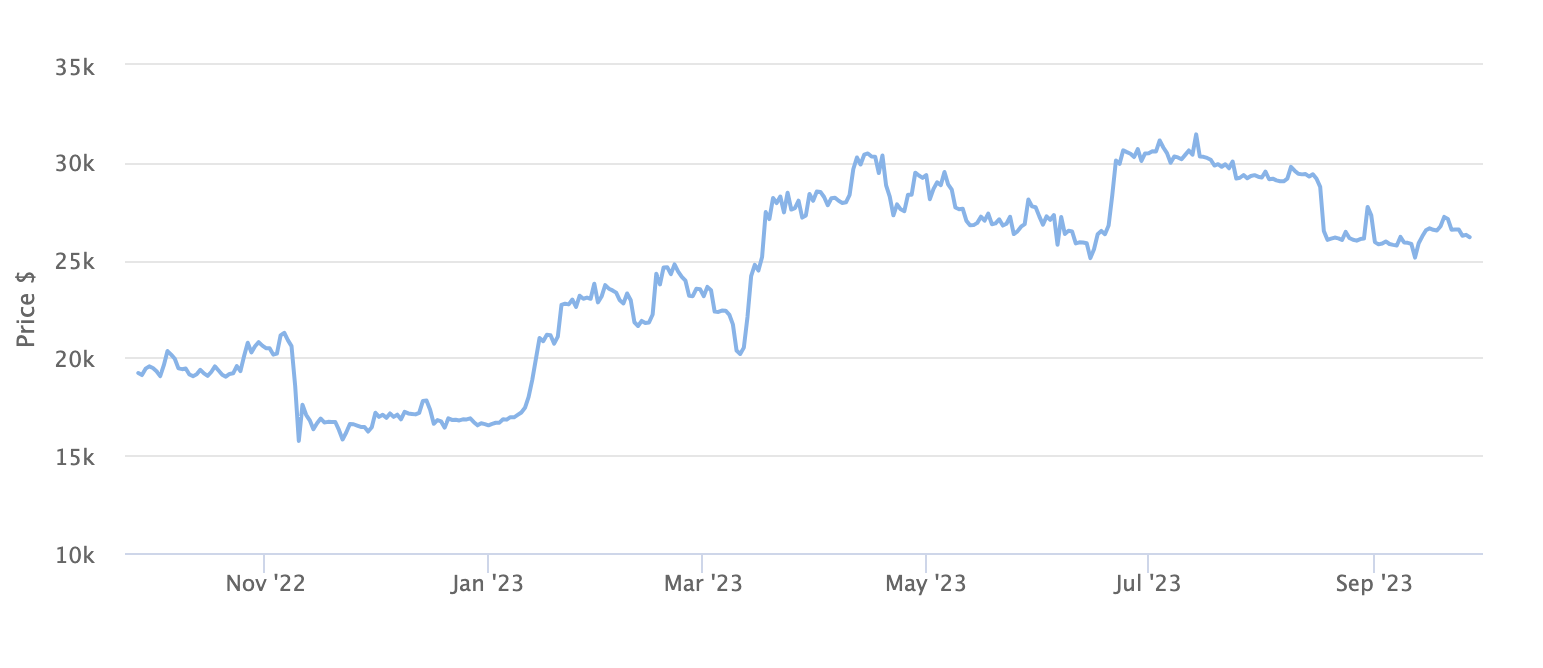

They alleged that BlockFi’s sale of $240 million in crypto after the bankruptcy led to a loss of over $100 million during the subsequent market upswing.

On November 30, 2022, Bitcoin was trading at $16,441. Meanwhile, at the time of publication, Bitcoin’s price is $26,241, marking an approximate 62% increase.

In a previous filing, Renzi noted the importance of maximizing recovery for BlockFi customers in the proceedings:

“BlockFi’s mission through this process has been to maximize recoveries for our creditors, and conditional approval of our Disclosure Statement moves us one step closer to accomplishing that goal. We are confident that our Plan provides the best path to expeditiously return crypto to our clients and we strongly urge BlockFi’s clients to vote to accept it.”