America’s banking crisis may be far from over, with one of its largest banks reporting an increasing amount of unrealized losses on its book. Nevertheless, banks are still raking in profits from high interest rates.

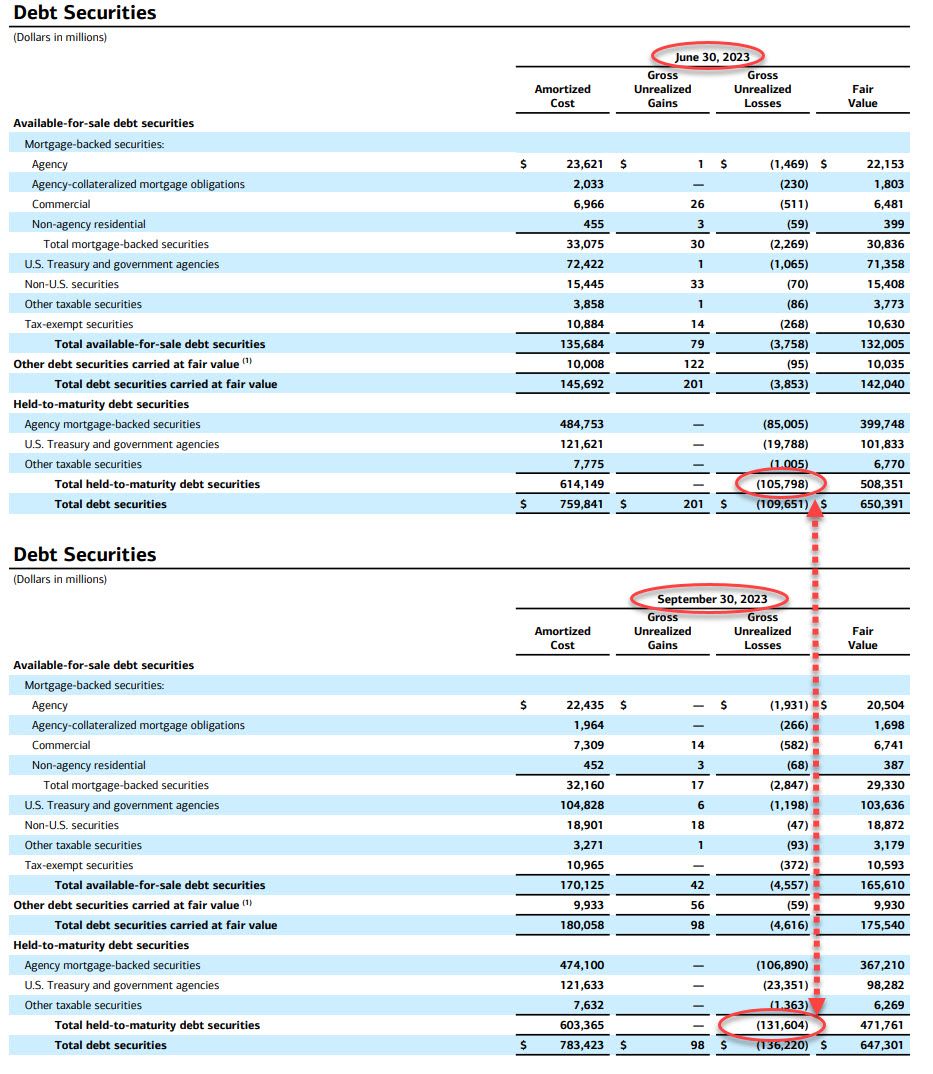

Bank of America has reported unrealized losses of $131.6 billion on securities in the third quarter, growing 24.4% from the second quarter.

Banking Crisis Continues

BoA’s bond market paper losses have been under scrutiny since the collapse of several US banks earlier this year.

America’s second-largest bank, with $2.5 trillion in total assets, could be forced to sell these bonds at a loss if depositors want their money in a hurry.

However, the bank, which released its Q3 earnings report this week, does not expect the alarming portfolio will generate actual losses in the long term.

Moreover, analysts say it is highly unlikely the bank would sell the securities at a loss. This is because the lender has strong liquidity with consumer deposits and higher capital, according to Reuters.

Get the lowdown on the 2023 U.S. banking crisis: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

Gold investor Peter Schiff commented on the bank’s reported 10% profit growth to $7.8 billion:

“For the 1st half of the year Bank of America reported pre-tax income of $48.1 billion, yet ignored an additional $95.9 billion loss on its “held-to-maturity” securities. So the bank actually lost $47.8 billion. It’s in worse shape now than it was when it was bailed out in 2008.”

Moreover, US banks could be looking at more than $650 billion of unrealized losses. This is according to an estimate from Moody’s.

However, they only become a problem if the banks are forced to sell them. This scenario may arise if there is a run on banks or deposits dwindle to dangerously low levels.

Big Banks Raking in Profits

BoA wasn’t the only bank posting solid revenue reports. JPMorgan Chase, Citigroup, and Wells Fargo all topped expectations when posting third-quarter earnings.

Banks have profited massively from high interest rates. They generally offer savers a lower rate and charge borrowers a much higher rate.

However, the US government’s Bank Term Funding Program has hit an all-time high of $109 billion, according to the St Louis Fed. The Fed’s emergency lending program has been bailing out smaller banks since it was launched in March.

In related banking news, Singapore’s financial regulator will conduct an on-site inspection of Credit Suisse Group. The move comes after at least one of its customers was charged in a $2 billion money laundering scandal.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.