Axie Infinity (AXS) price gained 20% last week after a rare gaming tournament triggered an unexpected bull rally. With the tournament still ongoing, on-chain data suggests that the rally may not be over. Can the bulls push for me AXS price gains?

The finals of the AxieTH World Battle Bangkok 2023 kickstarted on June 25. Within a week, network activity soared and pushed AXS price above the critical $6.50 resistance. While the price has declined slightly in the last few days, on-chain data suggests that more gains could be ahead.

Axie Infinity Network Activity Has Increased Significantly

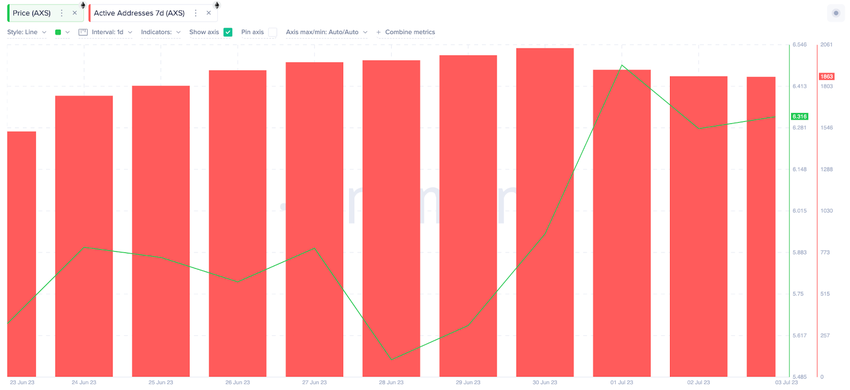

According to data compiled by blockchain forensics platform Santiment, the spike in network activity has played a pivotal role in the ongoing price rally. On June 23, Axie Infinity only attracted 1,524 active users. As AXS Price Gains 20%, network activity has also risen comparatively.

The chart below shows that AXS Daily Active Addresses have risen by 22% to 1,864 by the close of July 3.

The Active Addresses (7d) measure changes in user activity by aggregating the daily number of unique wallet addresses carrying out transactions.

It is a bullish signal when it rises, suggesting that more users could be in the market for the underlying token in the coming days.

With the ongoing Axieth gaming competition, Axie Infinity will likely sustain this high level of user activity in the coming days. If that happens AXS price could rise even further.

Read More: Best Crypto Sign-Up Bonuses in 2023

The Gaming platform still Appears to be Undervalued

After the AXS price gained 20% over the past two weeks, it still appears to be undervalued. The Network Value to Transaction Volume (NVT) ratio has dropped since mid-June. From June 17 to July 4, AXS witnessed an 87% drop in the NVT ratio.

The NVT ratio evaluates the growth in underlying economic activity on a blockchain network relative to the token price. When it drops, it signals that the token is underbought and could potentially make more gains.

If this pattern holds true, the AXS bulls could seize control again in the coming days.

AXS Price Prediction: More Gains Could Power it Toward $7

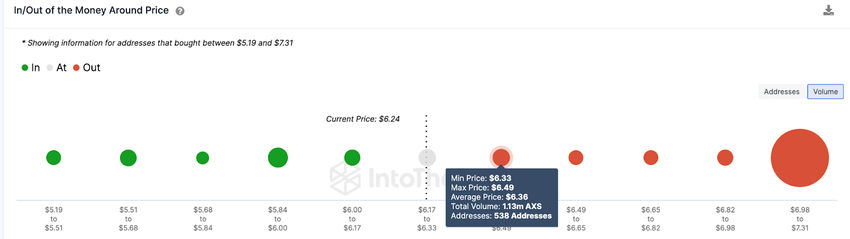

Given the abovementioned factors, AXS will likely deliver more gains and push toward $7 in the coming days. But first, the bulls must scale the resistance at $6.50. Here, 538 investors who have bought 1.13 million at $6.49 could trigger another pullback.

Conversely, the bears could negate the bullish stance if AXS drops below $6.

However, the 520 holders who had bought 260,000 Axie Infinity tokens at the average price of $5.91 could offer support.

But if that support line fails to hold, then AXS could retrace further toward $5.

Read More: Best Upcoming Airdrops in 2023