BeInCrypto looks at five altcoins that increased the most from the entire crypto market last week, more specifically from Dec. 2 – 9.

These digital assets have taken the crypto news and crypto market spotlight:

- Axie Infinity (AXS) price is up 18.19%

- Synthetix (SNX) price is up 11.83%

- THORChain (RUNE) price is up 10.89%

- Stacks (STX) price is up 10.37%

- EOS (EOS) price is up 10.12%

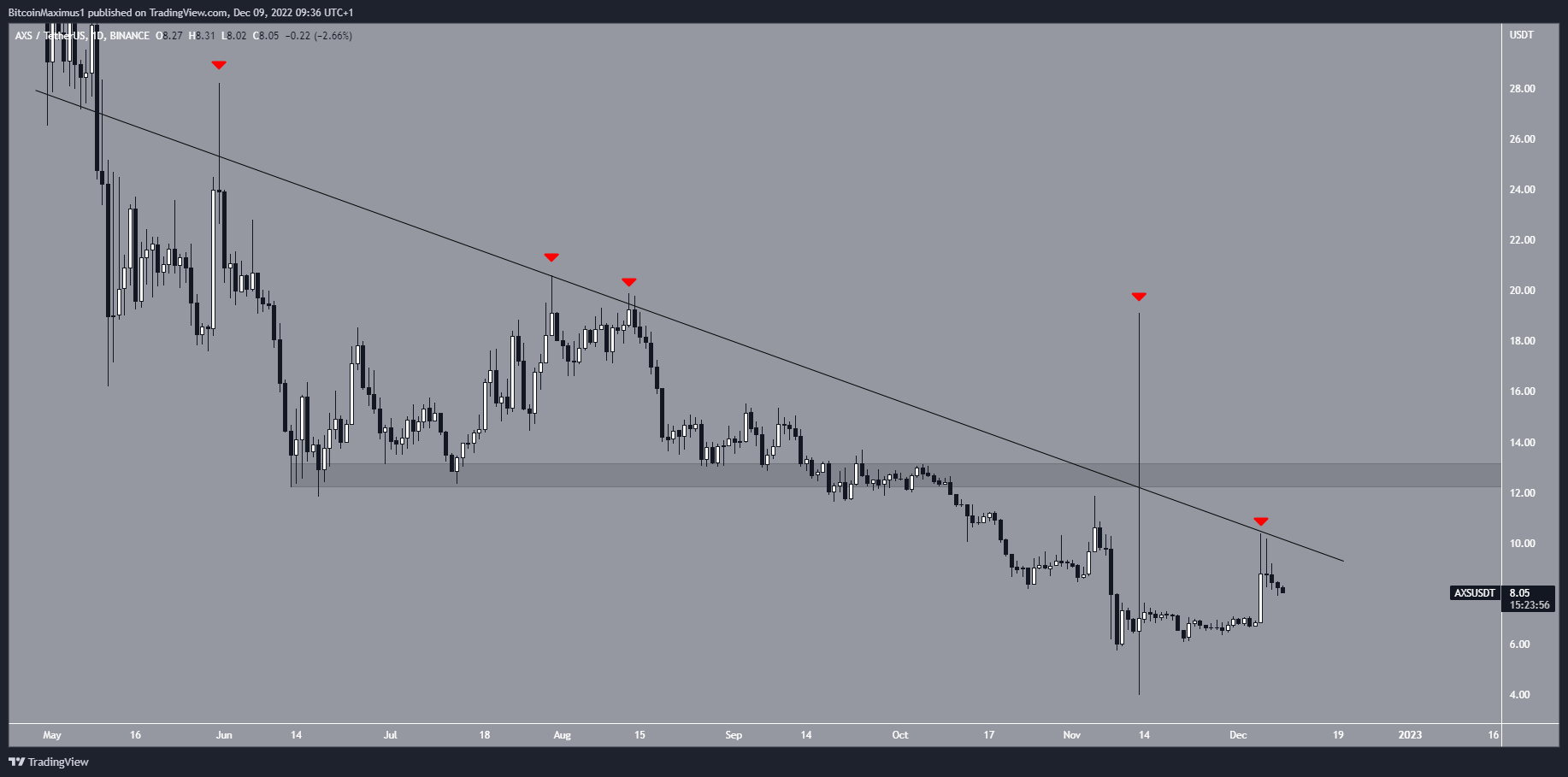

AXS Leads Crypto Market Gainers

AXS is the native token of the Axie Infinity ecosystem, a play-to-earn game in the Ethereum blockchain. The AXS price has increased since Nov. 13, when it created a bullish candlestick with long wicks on each side.

The rate of increase accelerated on Dec. 5, possibly due to positive crypto news in the form of the Axie Core update on Dec. 5. This led to an unsuccessful attempt at breaking out from a descending resistance line that has been in place since the beginning of May.

Despite the failure to break out, this was the fifth attempt (red icons) at doing so. Since lines get weaker each time they are touched, an eventual AXS price breakout from the line is expected. A breakout from the line and subsequent reclaim of the $13 resistance area is required for the trend to be considered bullish.

SNX Creates Bullish Pattern

The SNX price has fallen below a descending resistance line since Aug. 13. The line caused a rejection on Nov. 5 and led to a low of $1.54 10 days later. This was slightly above the yearly low of $1.42. In turn, it created a double bottom pattern (green icons). The SNX price has increased since.

A breakout from the descending resistance line is required to confirm the double bottom pattern. If this occurs, it could lead to an upward movement toward the $2.60 resistance area.

Conversely, a rejection will likely lead to a new yearly low.

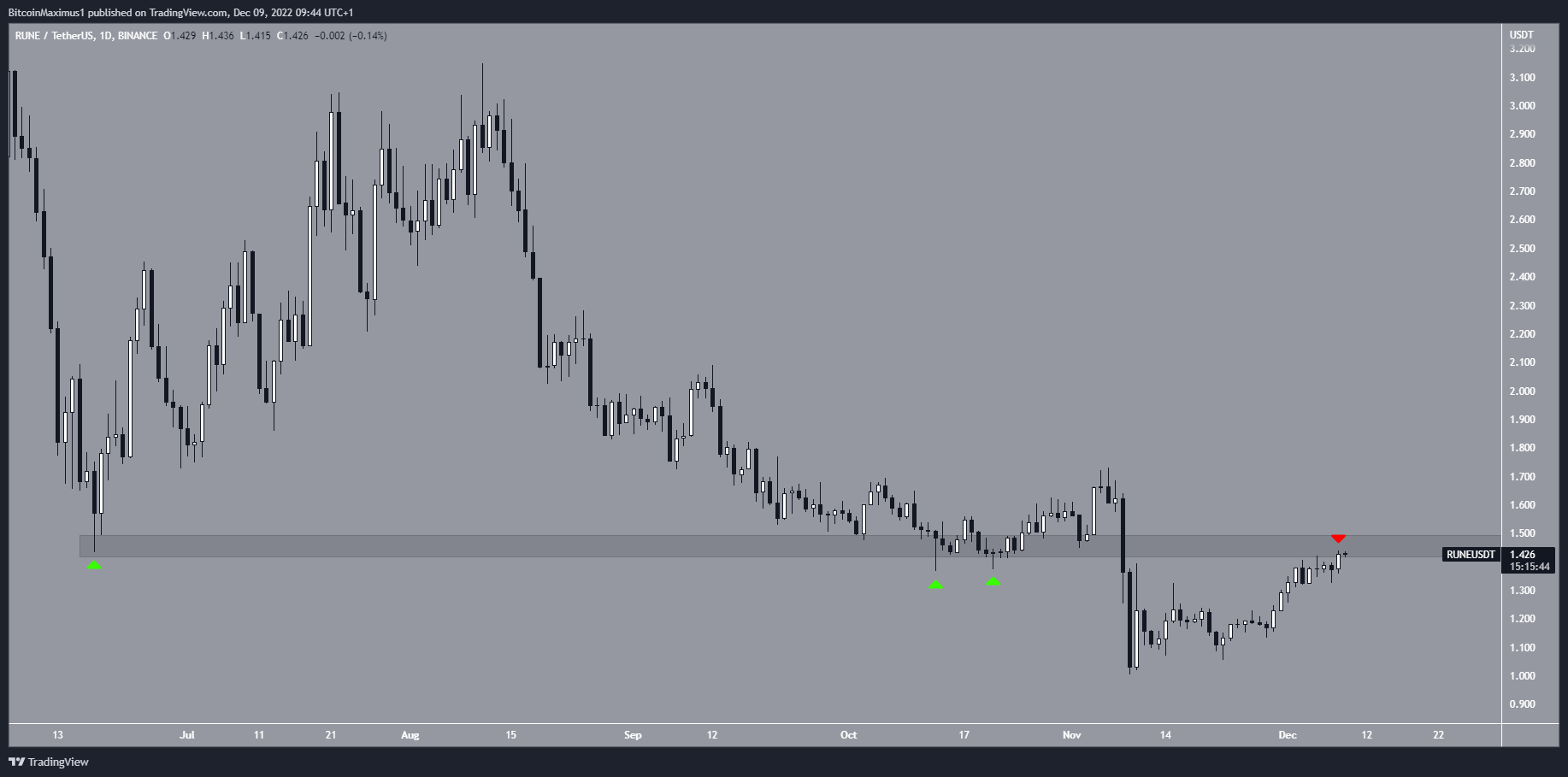

RUNE Bounces After Yearly Low

The RUNE price was subject to a sharp fall on Nov. 8, leading to a new yearly low of $1 the next day.

The price has increased since and has been trading close to the $1.45 resistance area over the past 24 hours. This is a crucial area since it previously acted as support since May 15 (green icons).

As a result, the trend is considered bearish until RUNE reclaims the $1.45 resistance area.

STX Begins Relief Rally

The STX price has increased since Nov. 14, when it fell to a new yearly low of $0.20. Despite the upward movement, the price is trading well below the $0.30 resistance area. This is a crucial level since it has previously acted as support since June 13.

Like RUNE, the trend is considered bearish until STX reclaims the $0.30 resistance area

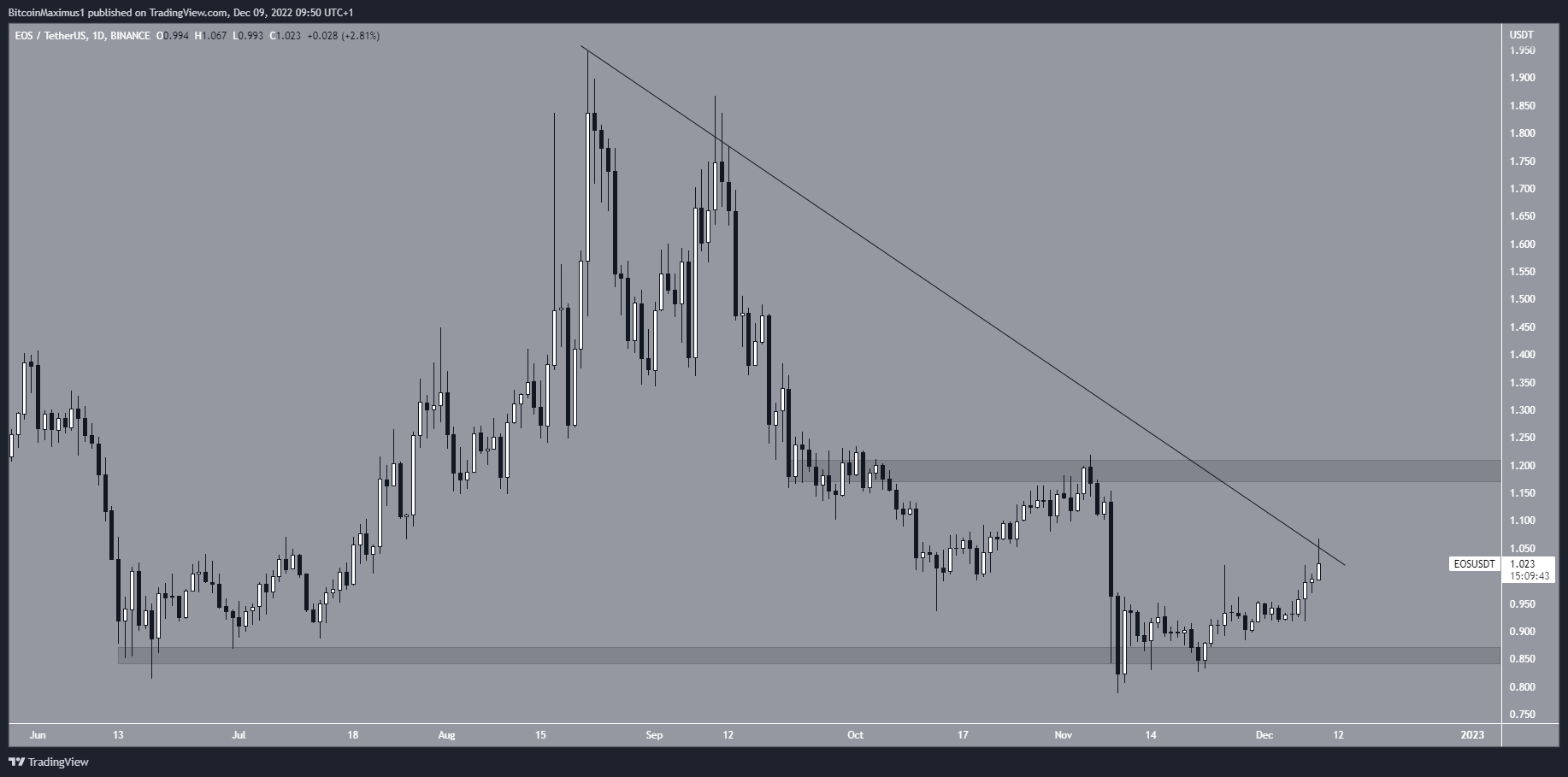

EOS Makes Breakout Attempt

On Nov. 9, the EOS price fell to a new yearly low of $0.788. This seemingly caused a breakdown from the $0.86 horizontal support area.

However, the price reclaimed the area afterward and validated it as support again.

Currently, EOS is in the process of attempting to break out from a descending resistance line that has been in place since Aug. 19. If successful, this could lead to a price target of $1.15

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.