The Avalanche (AVAX) price broke out from a short-term bullish pattern following news of a partnership with Amazon. It is in the process of reclaiming the $15 area.

At the end of 2022, the International Chess Federation (FIDE) announced its partnership with the Avalanche platform to bring chess into Web3. Avalanche will work with the federation in order to tackle various challenges on-chain, such as publishing tournament data and calculating player ratings. Additionally, Avalanche will feature as a sponsor in official FIDE tournaments.

However, the more important Avalanche news hit on Jan. 11. The world’s leading cloud computing service provider, Amazon Web Services (AWS) announced a partnership to help with scaling the adoption of blockchain technology in different industries. The partnership will make it simpler for people to launch nodes on Avalanche, the Layer-1 blockchain of Ava Labs.

The AVAX price has responded positively to this news and has increased since Dec. 31., greatly accelerating the rate of increase on Jan. 11.

AVAX Price Teases Potential Breakout

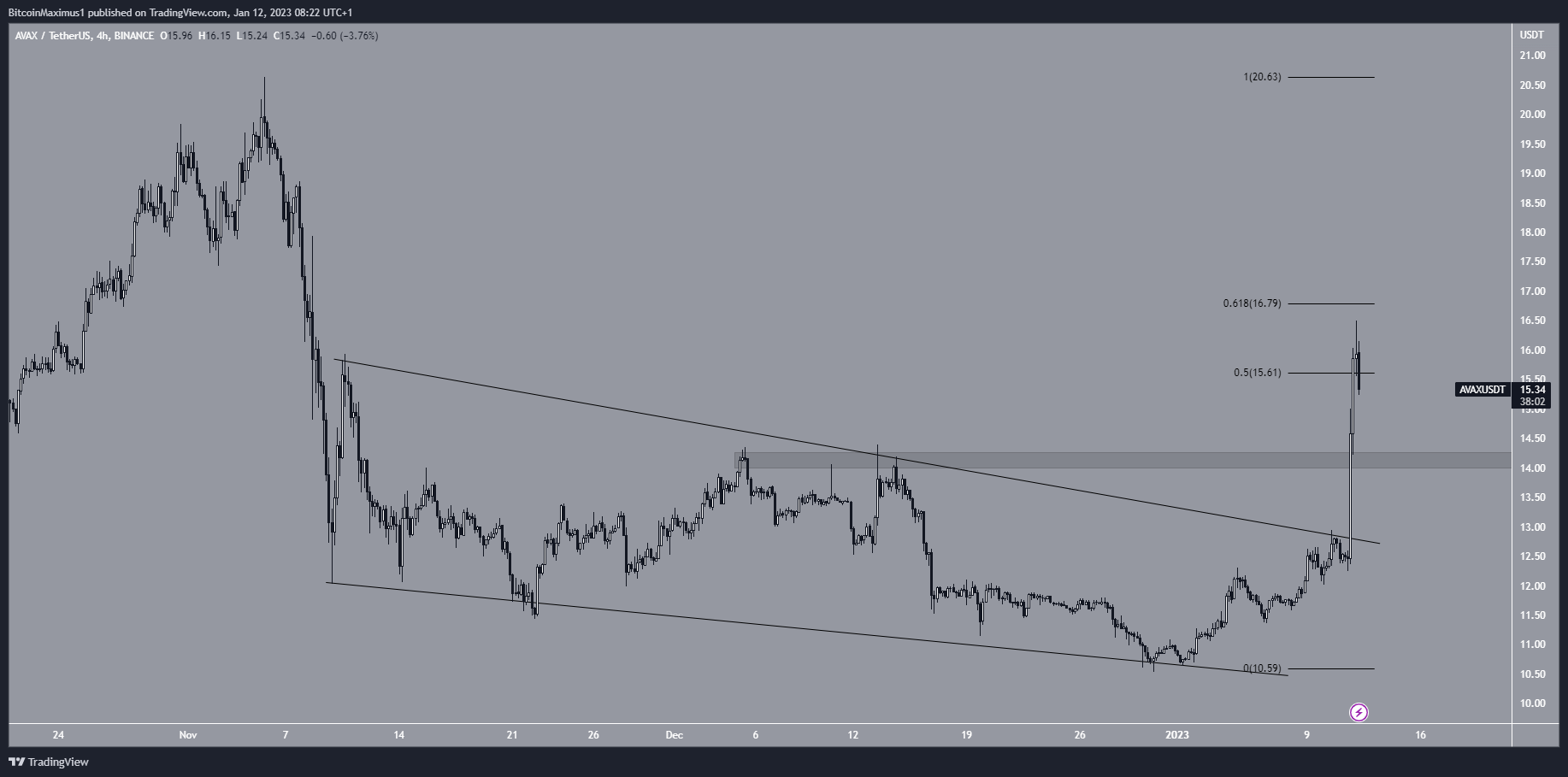

The AVAX price has decreased under a descending resistance line since Aug. 8. The downward movement caused a breakdown from the $15 horizontal support area, which had been in place since June.

Despite the downward movement, technical indicators show bullish signs. This is visible in the bullish divergence in the RSI (green line) and breakout from a descending resistance line (black).

Moreover, the AVAX price broke out from a descending resistance line on Jan. 8. The upward movement accelerated after three days and the AVAX price reclaimed the $15 area. This is a bullish price action that bodes well for the future price.

If it successfully validates it as support, the next resistance area is between $18.43 and $20.83, the 0.382 – 0.5 Fib retracement resistance levels.

On the other hand, a drop below the resistance line would indicate that the previous breakout was not legitimate.

AVAX Short-Term Price Prediction

The technical analysis from the short-term four-hour chart shows that the AVAX price broke out from a descending wedge on Jan. 11. It is now trading inside the 0.5-0.618 Fib retracement resistance area at $15.61 to $16.79.

If successfully moves above it, it would confirm the bullish reversal. Failure to do so could lead to a re-test of the $14 support area.

The AVAX price was rejected on the first attempt but has not closed below the resistance area, allowing for the possibility of another attempt at breaking out.

The price movement from the even shorter-term hourly chart supports the continuation of the upward movement. It seems that AVAX has begun wave three of a five-wave upward movement (black), which has extended. The sub-wave count is given in red, showing that the Avalanche price is correcting in sub-wave four. If the count is correct, the AVAX price will reach another high toward $17.36 (the 3.61 extension) before a more significant correction.

As for the high of the entire movement, the previously outlined $18.43-$20.83 would be an ideal level for a top.

A decrease below the sub-wave one high at $1.95 (red line) would invalidate this bullish count.

To conclude, the AVAX short-term price prediction is bullish because of the breakout from a descending wedge. Reclaiming the $15 area would indicate that the long-term trend is also bullish.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.