With the collapse of FTX, their stadium naming rights have voided, which could have implications for other crypto sporting sponsorships.

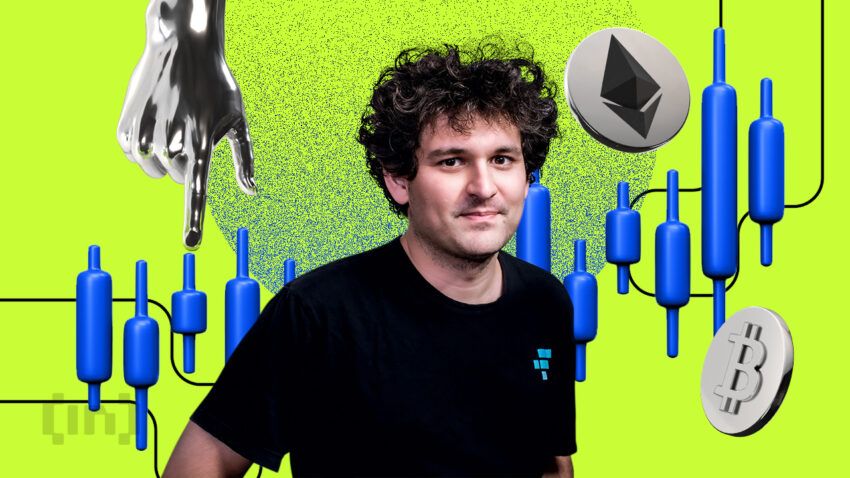

Sam Bankman-Fried’s cryptocurrency exchange became one of the most well known during its tenure, largely thanks to strategic sponsorship deals. Star athletes like Tom Brady, Steph Curry and Naomi Osaka became global ambassadors for FTX in exchange for an equity stake in the company. Now, with the demise of FTX, these athletes appear to have lost big.

FTX Loses Deal With Miami Heat

In addition to star athletes, Bankman-Fried also made prominent deals to purchase the naming rights of sports stadiums. The highest profile of these deals was securing the naming rights for the arena of NBA team the Miami Heat.

The 19-year deal worth $135 million saw the stadium take the name FTX Arena from June 2021. As part of the deal, the NBA team would have received $2 million per year, while Miami-Dade County would have gotten roughly $90 million over the duration of the contract.

However, now that FTX has filed for bankruptcy, both the team and county have officially terminated the naming rights partnership. The team and county are currently looking for a replacement sponsor, and said “the reports about FTX and its affiliates are extremely disappointing.”

FTX signed a similar deal with UC Berkeley for the naming rights at California Memorial Stadium. In a 10-year deal worth $17.5 million, the venue was dubbed FTX Field at California Memorial Stadium. The fate of the naming rights remains unclear, as it was undisclosed whether the transaction was paid in full.

However, professor of sports management at Columbia University, Joe Favorito, shed some light on the likely outcome. “If there’s no company, the branding goes away,” he said.

Crypto.com and the 2022 FIFA World Cup

Since it came to light that FTX’s financials were unsound, other crypto exchanges have been scrambling to reassure markets. Binance CEO Changpeng Zhao said that transparency is essential to regain trust, revealing the company’s reserves. Other exchanges have promised to follow suit, but some efforts have not inspired confidence.

In a similar attempt at transparency, Crypto.com prepared a Proof of Reserves dashboard displaying the allocation of its assets. However, this seemed to backfire spectacularly for them, revealing that nearly 20% of its reserves were in memecoin Shiba Inu. Suspicious transactions just prior to the audit also raised suspicions that it was faking its proof of reserves. This subsequently caused its native token CRO to drop by 30%.

While FTX achieved some high profile sports sponsorships, Crypto.com may have secured one of the largest there is. The crypto platform is one of the main sponsors for the 2022 FIFA World Cup in Qatar, starting next week.

If the company potentially faced a similarly swift collapse, this could significantly undermine one of the major crypto promotion events to take place so far.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.