Arthur Hayes, the former CEO of BitMEX, suggests that the Federal Reserve implement an unlimited dollar-yen swap agreement with the Bank of Japan (BOJ) to curb the yen depreciation.

This move could sharply devalue the US dollar, increasing global dollar liquidity, which might benefit the crypto market, particularly Bitcoin.

Hayes’ Perspective on Dollar-Yen Swap

Arthur Hayes explains that the proposed dollar-yen swap would function similarly to yield curve control. The Federal Reserve would swap dollars for the yen with the BOJ unlimitedly.

“The depreciation of the US dollar means a sharp increase in global US dollar liquidity. This will benefit the crypto market, led by Bitcoin,” Hayes said.

The former BitMEX CEO further notes that the BOJ and Japan’s Ministry of Finance would use these dollars to stabilize the yen by purchasing it, avoiding the need to sell US Treasury securities to raise dollars. This strategy helps Japan avoid raising interest rates, which would negatively impact its financial institutions that heavily invest in Japanese government bonds (JGBs).

Read more: Bitcoin Price Prediction 2024/2025/2030

Geopolitically, a stronger yen could affect China, Japan’s direct export competitor. If Japan strengthens the yen through this swap agreement, China might devalue the yuan to maintain its export competitiveness.

The macroeconomic backdrop remains crucial for crypto, especially Bitcoin. Recent US data has reduced the likelihood of further rate hikes. Meanwhile, China has significantly increased stimulus measures, adding positive liquidity momentum.

The People’s Bank of China (PBOC) recently announced plans for an ultra-long bond issuance and a historic rescue package to stabilize the property sector, essentially amounting to quantitative easing (QE) for real estate.

The growing liquidity from the US and China creates a favorable environment for Bitcoin. Spot BTC ETF inflows have increased, with $716 million in net inflows last week, reversing April’s outflows. Major institutional investors are also interested, with Millennium Management holding significant shares in Bitcoin ETFs.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

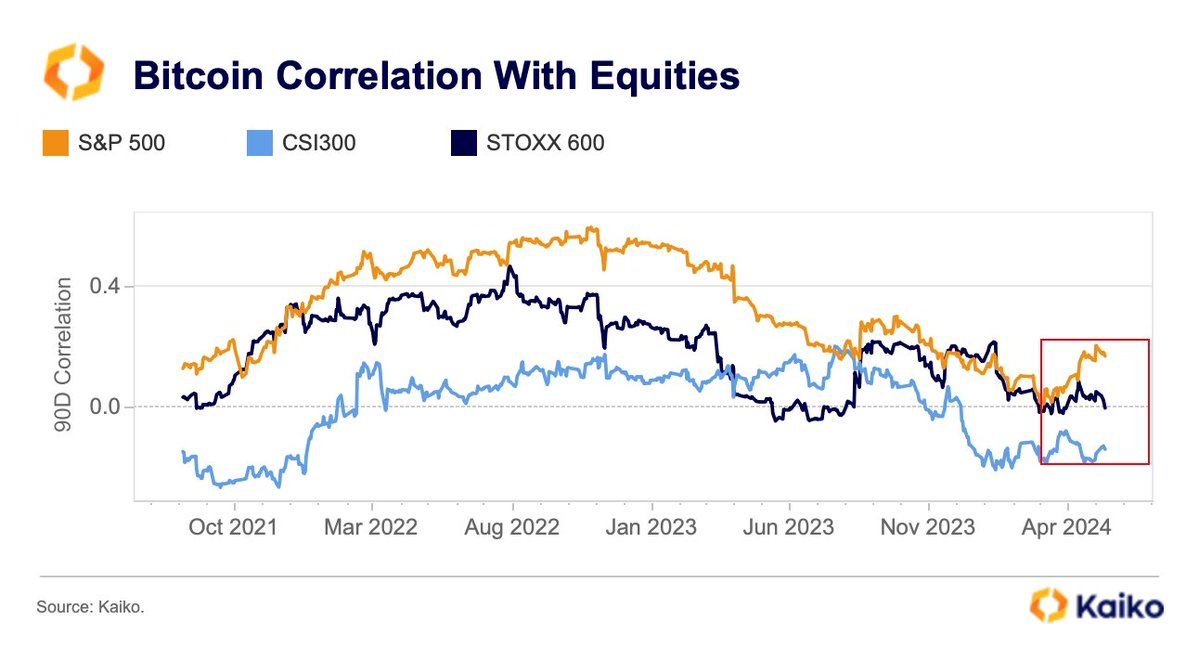

The correlation between Bitcoin and US equities remains a key metric to watch. Last week, Bitcoin’s 90-day correlation with US equities rose to 0.17 from a multi-year low of 0.01 in March. This development highlights the importance of active monitoring and analysis in the current market environment.

In conclusion, the Federal Reserve’s potential implementation of an unlimited dollar-yen swap represents a significant policy shift. This could have far-reaching effects on global liquidity, asset prices, and the competitive dynamics between major economies like Japan and China.