Ondo Finance, one of the prominent players in the real-world asset (RWA) tokenization sector, has received a significant endorsement from the Arbitrum STEP Committee.

The committee has recommended diversifying 6 million Arbitrum (ARB) tokens from the Arbitrum DAO Treasury into Ondo Finance’s USDY. With ARB’s current market price at $0.75, this amount translates to approximately $4.5 million.

Arbitrum’s Allocation Comes Amid Tokenized Treasury Boom

The STEP Committee’s recommendation includes six selected products from over thirty applications. The committee aimed to avoid spreading the allocation too thinly, instead focusing on products managing over $100 million in existing assets under management (AUM).

USDY met the necessary criterion, securing a significant portion of the funds, representing over 17% of the allocation. This places it second only to BlackRock’s BUIDL, which received 11 million ARB (approximately $8.25 million).

Read more: RWA Tokenization: A Look at Security and Trust

Ondo Finance expressed gratitude for the committee’s thorough evaluation process. The platform also acknowledged the contributions of various committee members and organizations pivotal to this initiative.

“We are proud that the high-quality nature of USDY has been recognized and appreciate the committee’s thorough diligence process. We look forward to the Arbitrum community vote and stand ready to further extend collaboration efforts,” the Ondo Finance team wrote on its X (Twitter) account.

In addition to USDY and BUIDL, other selected applicants include Superstate’s USTB, Mountain USDM, OpenEden’s TBILL, and Backed Finance’s bIB01. USTB receives an allocation of 6 million ARB, while the remaining applicants are awarded 4 million ARB (roughly $3 million) each.

This decision aligns with the broader goal of promoting the growth of the real-world asset tokenization ecosystem. The committee also plans to make 1% treasury diversification via the RWA ecosystem an annual event.

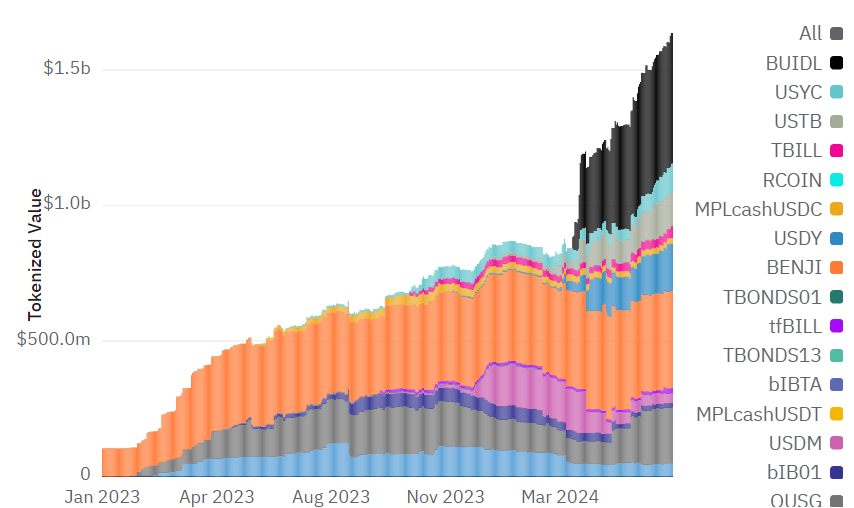

The committee’s recommendation signifies additional recognition for the tokenized treasury segment. BeInCrypto recently reported an unprecedented surge in the value of tokenized US Treasury products, experiencing an over 1,000% increase since early 2023. This increase led the value to reach $1.64 billion by June 23.

Read more: What is The Impact of Real World Asset (RWA) Tokenization?

At the time of writing, Ondo’s USDY tokenized value is $175.23 million. This figure represents a 10.7% market share.