Arbitrum (ARB) price ended April positively despite bearish concerns about the recent $120 million airdrop. On-chain data shows the recent ARB price surge can be attributed to large investors HODLing firm on their bullish positions. Can ARB scale the $1.40 resistance?

Arbitrum (ARB) made headlines last week after it announced an Airdrop of 113 million tokens worth nearly $120 million to reward early builders.

However, a week later, the price surged 4% to dispel concerns about impending price retracement. Here’s how the HODLing whales could help power another bull rally despite ongoing media FUD.

Massive FUD Still Surrounds Arbitrum

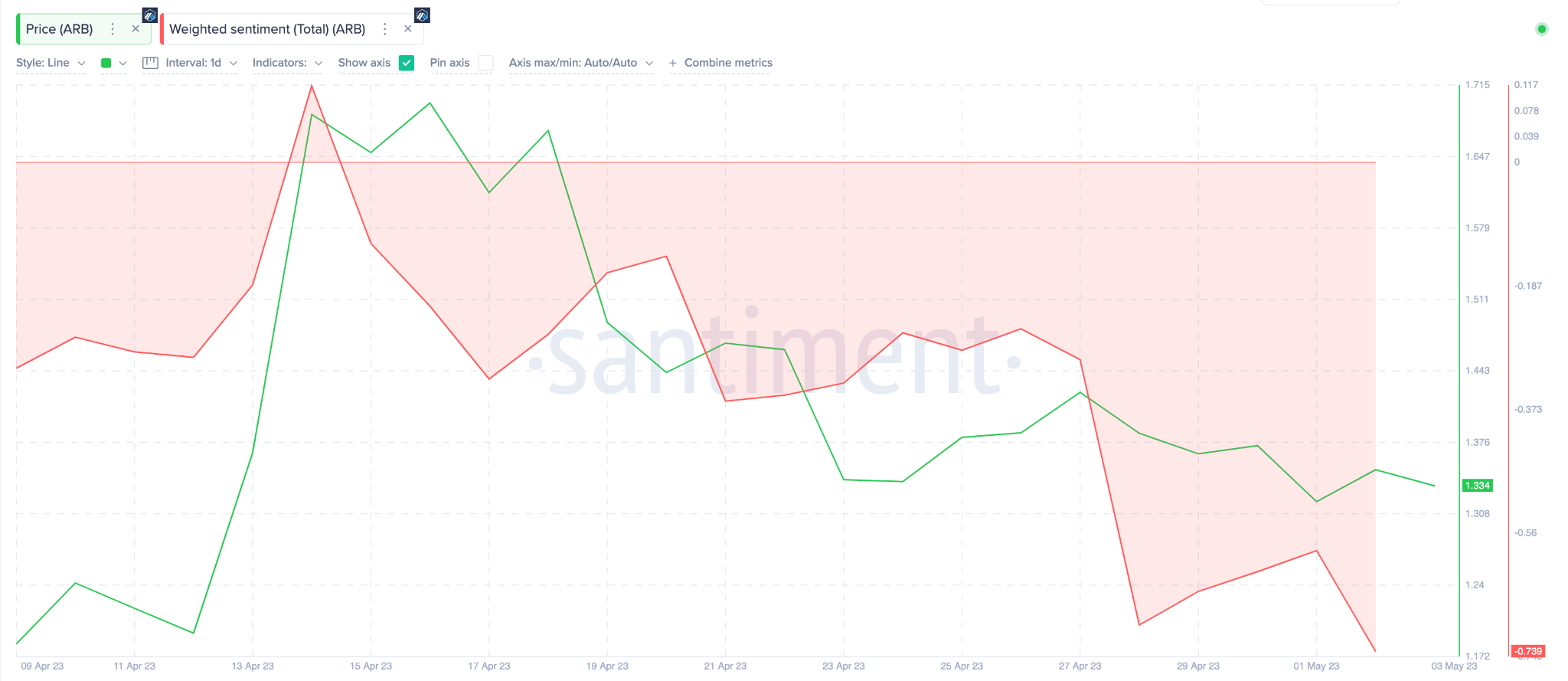

Arbitrum ended April 2023 strongly, yet, the social perception surrounding the rising Ethereum layer-two (L2) scaling network is still largely negative. On-chain data shows that the number of negative mentions of Arbitrum currently exceeds the positives.

The chart below illustrates how the ARB Weighted Sentiment has been trending negatively since the price dropped from the recent local high on April 14. Between April 14 and the close of May 2, it has dropped from 0.11 to -0.73.

Weighted Sentiment is a contrarian metric in the sense that price typically moves in the opposite direction of the market’s expectations. And with the social perception now approaching dysphoric levels, strategic investors could consider it good timing to take long positions on ARB.

Whales Remain Undeterred

In confirmation of the bullish outlook, crypto whales holding one million to 100 million ARB appear unmoved despite the ongoing media FUD and supply saturation concerns from the April 24 Airdrop.

Rather than sell, the largest Arbitrum whale cohort has actually increased their holdings marginally since the Airdrop. Between April 26 and May 2, the whales added one million ARB tokens worth $1.3 million to their balances.

This mild accumulation trend indicates that large institutional investors remain confident in the long-term viability of the Arbitrum network. This could inspire other retail investors and prospective whales to become bullish themselves.

Ultimately, the green signals from the aforementioned on-chain metrics could trigger an ARB price upswing in the coming days.

ARB Price Prediction: The $1.30 Support Could Prove Too Strong for the Bears

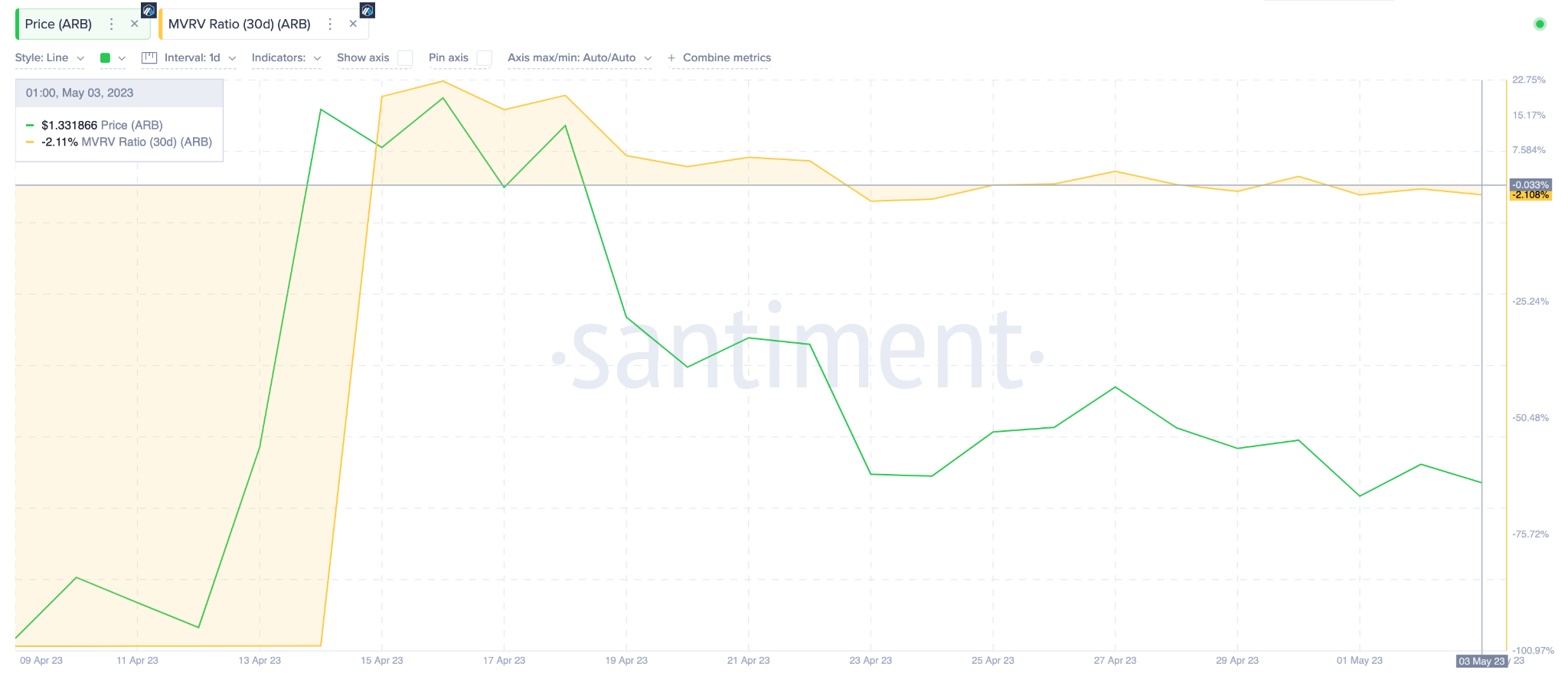

Over the past week, bullish ARB holders have defended the $1.30 support level. And Santiment’s Market-Value to Realized-Value (MVRV) data suggests more upswing ahead.

Notably, most crypto investors that bought ARB within the past month are sitting on unrealized marginal losses of about 2%. This indicates that they could be unwilling to sell until they reach a profitable position.

Hence, investors will likely hold out for 5% gains before they start selling en masse around $1.42. And If ARB can break beyond that $1.42 resistance level, it could enter a prolonged rally toward the $1.50 zone before the bears get a chance to regroup.

Conversely, the bears could flip the positive narrative if the ARB price drops below $1.30. Nevertheless, investors will likely offer bullish support at this level as they look to keep their loss position below 5%.

Otherwise, ARB could drop much further toward the next significant psychological support level at $1.20.