Last week, Arbitrum (ARB) price delivered considerable gains as the bulls made multiple attempts to reclaim the $1.20 zone. A deep dive into the on-chain data shows that the bears are now firmly in control. Will they force a downswing to validate the $1 Arbitrum price prediction?

Arbitrum appeared to gain significant traction in the last few weeks, it has not translated into a commensurate increase in economic value. With the largest whale cohort in the Arbitrum ecosystem now taking bearish positions, how far will the ARB price drop?

Network Traction Gains Have not Translated into Economic Activity

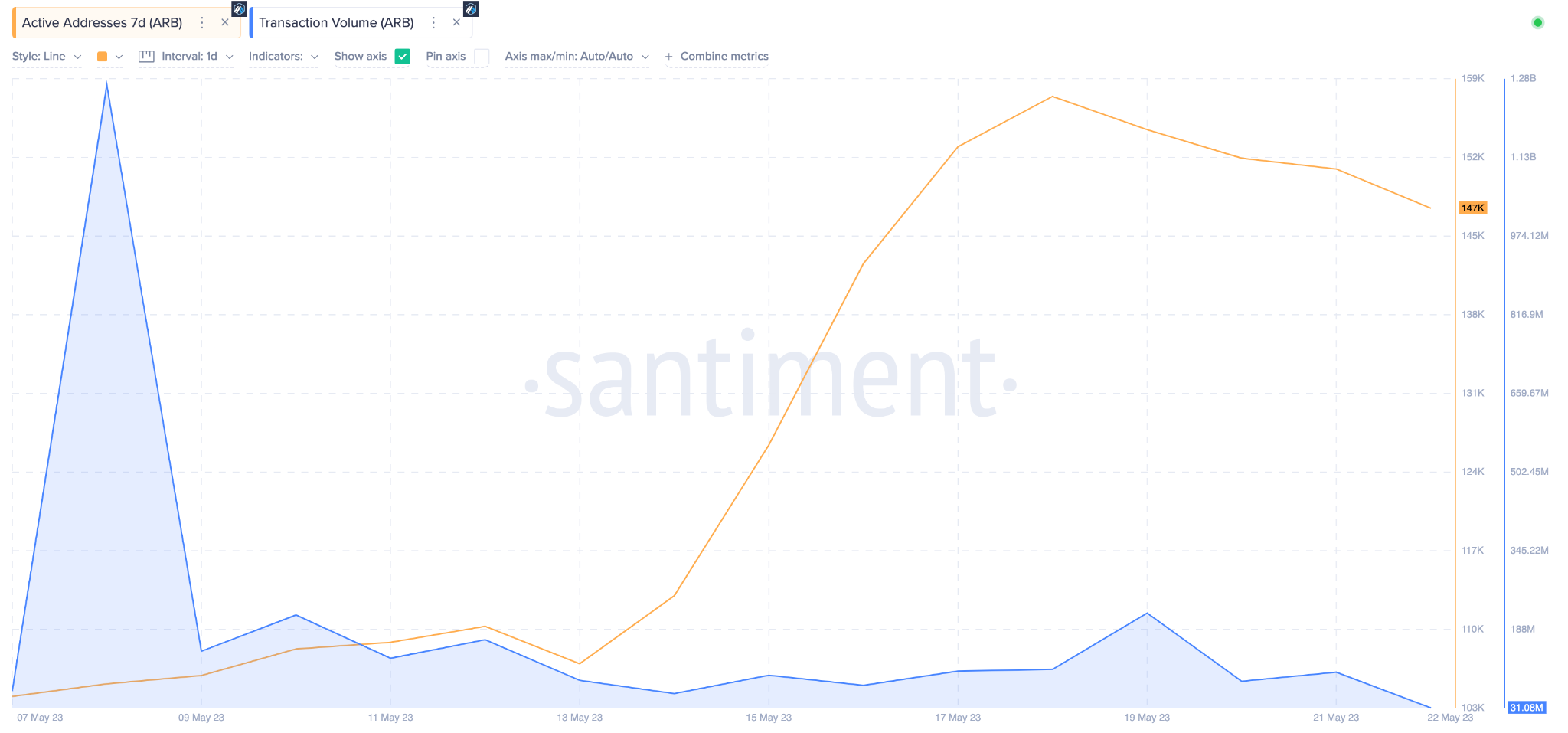

While Arbitrum has made headlines for its growing adoption and increased network activity. Despite the traction gains, ARB transaction volume has continued to decline.

The chart below shows how Active Addresses (7d) soared by 41% between May 8 and May 22.

But daily ARB Transaction Volumes dropped 92% from its peak of 1.27 billion to 102.38 million ARB tokens transacted within the same period.

Active Addresses (7d) measures the number of unique addresses interacting on a network. While the Transaction Volume evaluates the degree of transactional activity that occurs during a specific trading period.

Worryingly, such negative divergence could be interpreted in different ways. To begin with, the increase in active addresses suggests a growing number of individuals or entities participating in the network.

However, the decrease in transaction volume might imply that these new participants are not conducting transactions at the same frequency or volume as existing users.

Secondly, the active users could be performing non-transactional activities other than the traditional value exchange. For example, it could result from users testing new decentralized applications (dApps), token swaps, staking, or governance voting.

Summarily, it appears that the majority of the active users on Arbitrum are utilizing other platform features that don’t involve direct transactional value transfers.

Unless daily ARB transaction volume increases, ARB holders could witness a considerable price drop in the coming days.

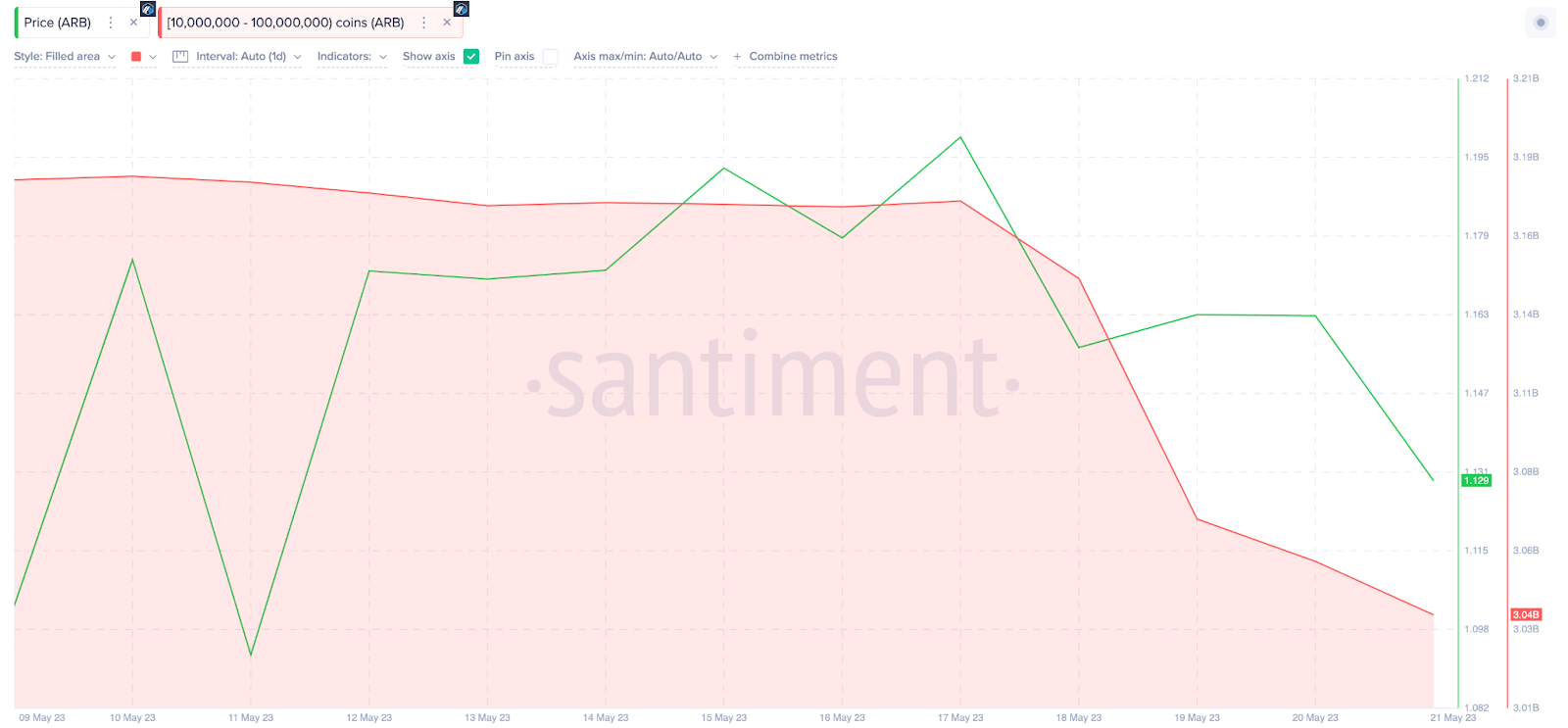

The Largest ARB Whales Have Started Selling

The most influential Arbitrum whale cohort holding balances of 10 million to 100 million ARB tokens, has started another sell-off.

After two weeks of holding steady, the chart below shows how they have offloaded over 130 million ARB between May 17 and May 22.

At the current market price of $1.12, the tokens sold are worth approximately $145 million.

Recall that a large chunk of the recent $120 million Airdrop went to this cluster of large institutional investors.

It appears that they are now cashing in. Considering these whales’ influence on price, ARB could drop below $1 if they keep selling.

ARB Price Prediction: Another Retracement Below $1?

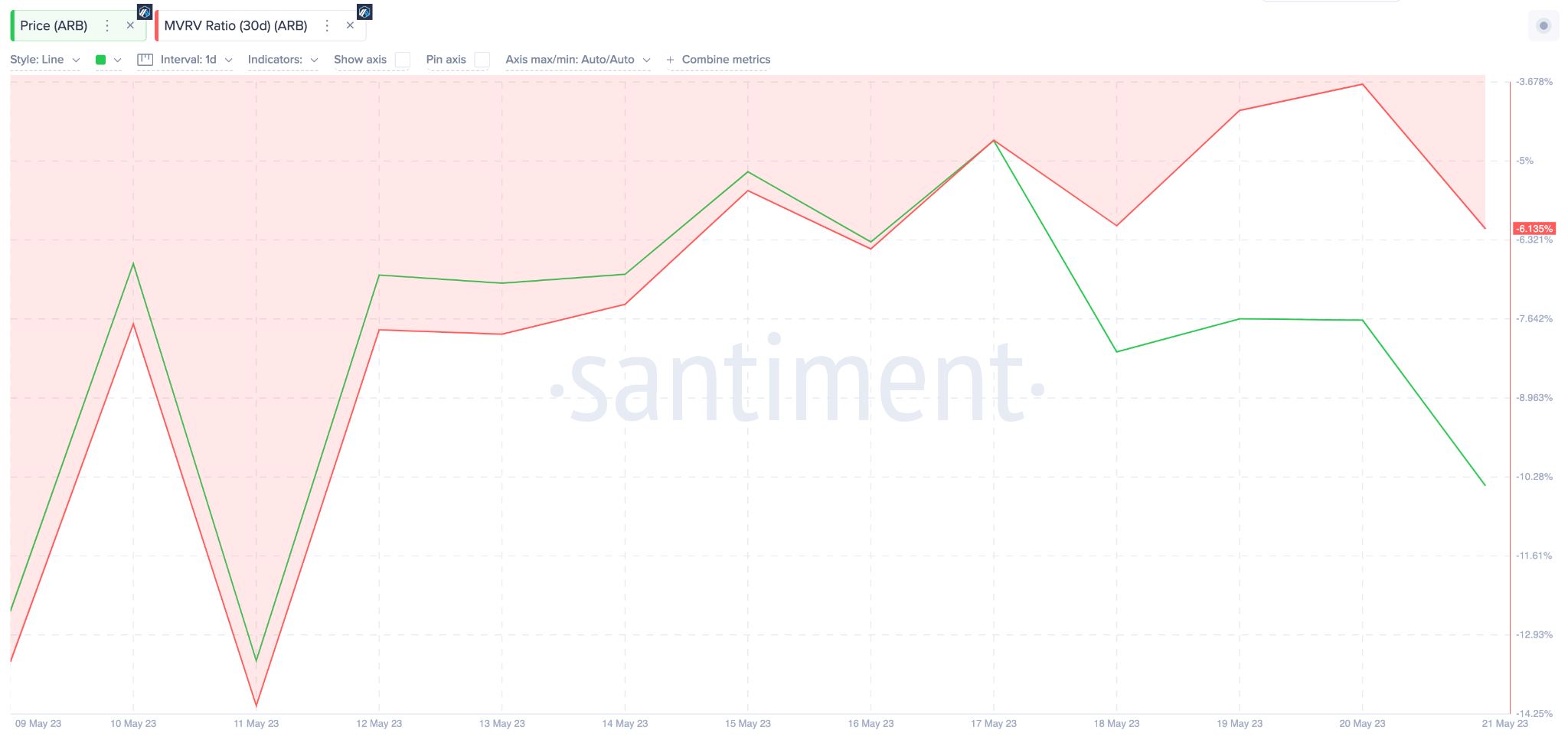

The Market Value to Realized Value (MVRV) ratio, which evaluates the financial position of current Arbitrum holders, suggests a drop of $1 is the most likely ARB price prediction.

Most investors that bought ARB in the last 30 days are 6% underwater. Historical data suggest ARB holders could continue to sell until the price drops by another 8% toward $1.

And if the $1 support cannot hold, ARB could drop further toward $0.90

In contrast, the bulls could find the momentum to negate the bearish ARB price prediction if it reclaims the $1.20 milestone. However, holders could start selling once the price approached their break-even point around $1.19.

Nevertheless, if the bulls breach that $1.19, ARB could rally toward $1.30.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.