Uniswap (UNI) price is now up 7% since the voting proposal on Liquidity Fees began on May 10. Whale investors appear to be positioned for the upside that could accrue from the potential increase in protocol revenue. Will the bullish $6 Uniswap Price prediction be validated?

Uniswap (UNI) is the top-ranked global decentralized exchange by trading volume. On May 10, the Uniswap community began voting on a proposal to “make protocol fees operational” on the DEX trading platform.

If successfully passed, the proposal will implement a protocol fee equal to one-fifth of the pool fee across all Uniswap v3 pools and also turn on the fee switch for Uniswap v2.

This week, the price of UNI, the Uniswap governance token, jumped 7% as investors seek to acquire voting power and position for a potential yield surge.

Whales are in an Accumulation Frenzy

In response to the recent community proposal, UNI has been attracting considerable investment from a strategic cohort of crypto whales. On-chain data reveals that crypto whales holding 100,000 to 1 million UNI tokens are already positioned for a potential rally.

The Santiment chart below shows how they added another 2.48 million tokens to their wallet balances between May 15 and May 18.

At the current market value of $5.30, the new investment by the large investors is worth $13.1 million. If the whales sustain the current momentum and continue buying, other strategic investors could follow suit and trigger a UNI price rally.

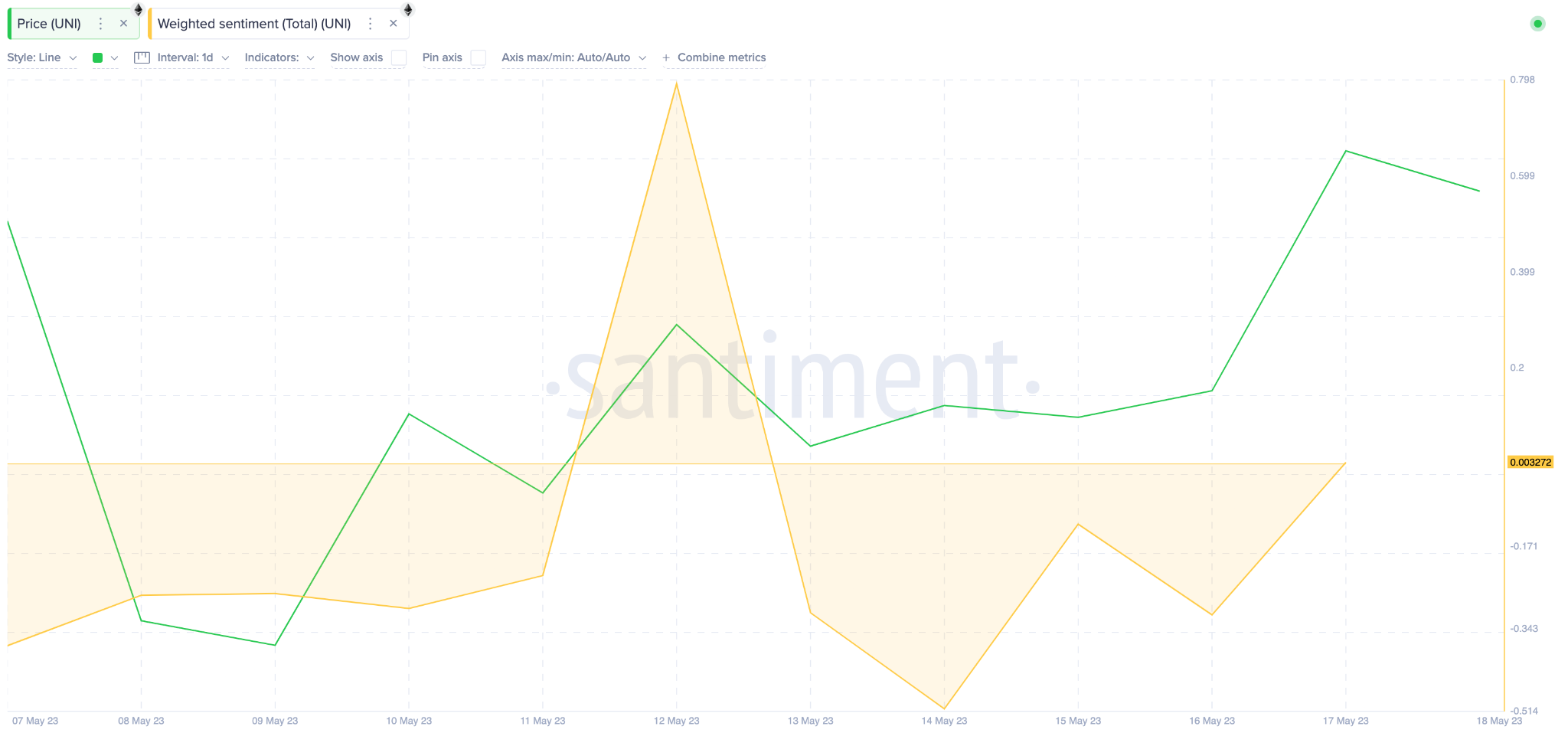

Social Sentiment is at Crossroads

The online Uniswap community has reacted positively to recent developments in the ecosystem. On-chain data from Santiment reveals that the social perception surrounding UNI has improved significantly in the past week.

Specifically, on May 14, Uniswap’s Weighted Sentiment was in the negative zone at -0.50. But as of May 18, the chart below shows that it is now trending neutral.

When Weighted Sentiment trends upward into the neutral zone, strategic investors could consider this perfect timing to enter the market.

And with social sentiment still significantly lower than the recent euphoric high of 0.79 recorded on May 12, the UNI price could still climb considerably higher.

UNI Price Prediction: Time to Reclaim $6?

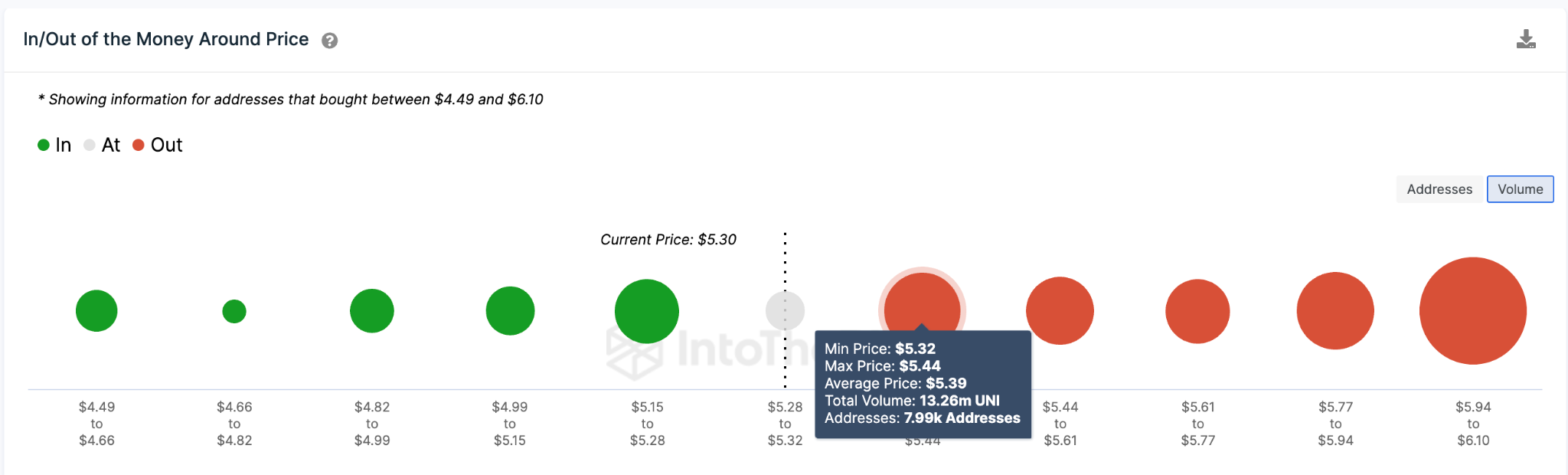

IntoTheBlock’s Global In/Out of Money (GIOM) data suggests that the Uniswap price could reach $6.

For the bulls to be confident of the bullish Uniswap price prediction, UNI must first clear the initial resistance at $5.4. But profit-taking by 8,000 investors that bought 13.2 million UNI tokens at an average price of $5.39 may prevent it.

The bulls can garner enough momentum to push for the $6.10 target if the positive UNI price prediction plays out.

Still, the bears could invalidate the positive stance if UNI retraces unexpectedly below $5.15. Although, 6,500 addresses that bought 8.3 million tokens at a minimum price of $5.15 can offer support.

If that support level breaks, the bullish Uniswap price prediction could be invalidated and trigger a larger drop toward $4.5.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.