Arbitrum (ARB) price looks set to break out of its consolidation phase within the $1.10 – $1.15 territory. On-chain analysis explains how increased network activity on the Arbitrum network could trigger another price upswing in the days ahead.

Arbitrum has emerged as one of the top-performing Layer 2 scaling networks in 2023 so far. Here’s how the increasing adoption rate could push ARB price to a new yearly peak as the crypto market rally intensifies.

Arbitrum Approaches New Milestone

Arbitrum, Optimism (OP), and Base are some of the leading Layer 2 scaling networks that have received significant network usage and investor interest this year. A closer look at on-chain data trends shows that Arbitrum is approaching a network adoption milestone.

According to IntoTheBlock, ARB funded addresses crossed 14,690 on Nov. 8. This implies that 55% of the total addresses registered on the Arbitrum network are now funded.

An increase in the funded addresses metric, otherwise called the non-zero balance addresses, indicates growing adoption and expansion of the blockchain network.

Read more: What Is Arbitrum?

If the funded addresses keep growing, the rising demand could push Arbitrum price toward the $1.50 mark as the crypto market rally progresses.

Arbitrum is Attracting an Unusually High Number of New Users

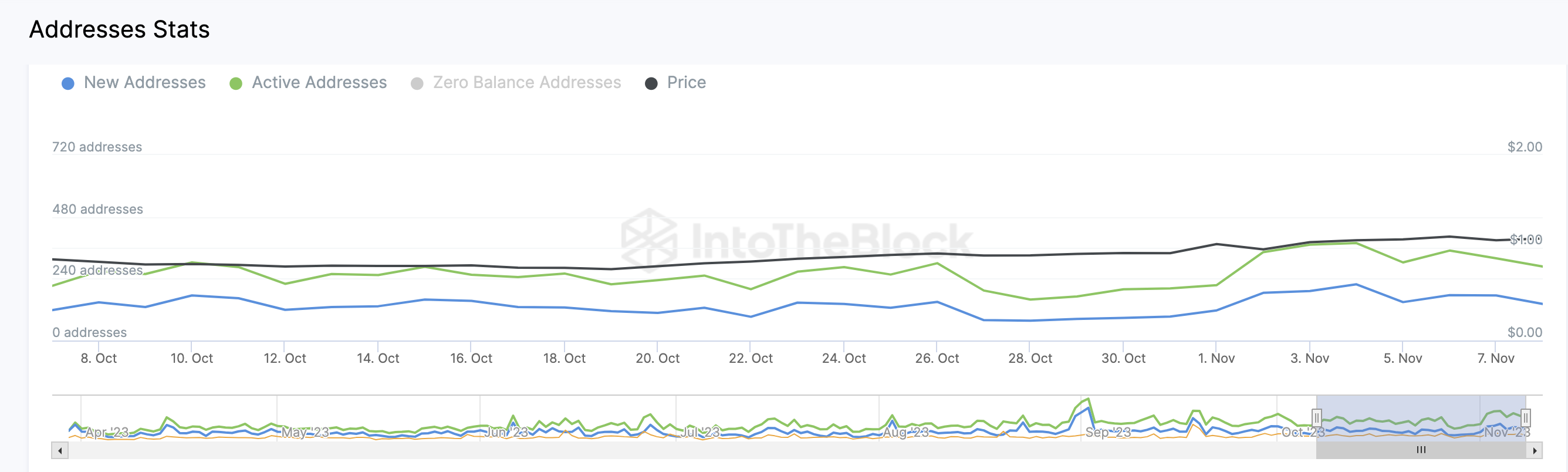

In further confirmation of the growing network demand, Arbitrum has experienced a significant increase in New Users this month. According to IntoTheBlock, new addresses registered on the Arbitrum network reached a 50-day peak of 218 New Addresses on Nov. 4. This also sent the total active addresses to a monthly peak of 349 unique wallets.

The new addresses metric measures the total number of new wallets created on a blockchain network on a given day. Meanwhile, the total active addresses sum up the total unique addresses interacting on the network. These metrics provide a clear insight into the rising demand and Arbitrum network usage.

In summary, an increase in funded addresses and the growing network activity affirm that Arbitrum has experienced organic network growth. If it evolves into explosive market demand, it could drive ARB price toward the $1.50 area.

Read more: Optimism vs. Arbitrum: Ethereum Layer 2 Rollups Compared

ARB Price Prediction: Possible Breakout Toward $1.50

Drawing inferences from the data points analyzed above, ARB price will likely retest $1.50 in the days ahead.

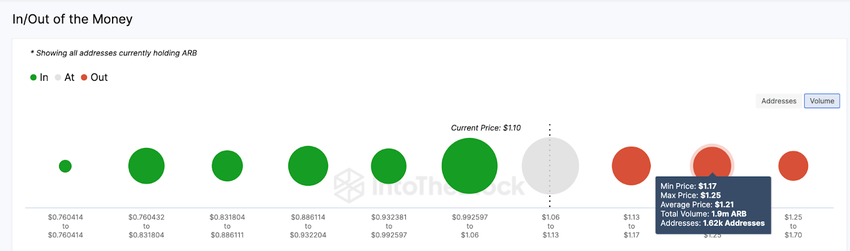

The Global In/Out of the Money (GIOM) data, which groups the current Arbitrum investors according to their entry prices, also confirms this bullish narrative.

It, however, shows that Arbitrum’s price must first scale the initial resistance at $1.25 for the bulls to be confident of reclaiming $1.50. As depicted below, 1,620 holders had bought 1.9 million ARB at the maximum price of $1.25. If those holders exit early, they could slow down the Arbitrum price rally.

But if the bulls can scale that resistance level, ARB price will likely reclaim $1.50 as predicted.

Still, the bears could negate that optimistic prediction if the ARB price reverses below $0.80. But, in that case, the 884 ARB holders that bought 5.52 million ARB at the average price of $1 could mount a support wall. If those investors can HODL firmly, Arbitrum will likely avoid a significant price retracement.

Read More: Top 9 Telegram Channels for Crypto Signals in 2023