Arbitrum (ARB) price is looking to challenge the norms of the descending triangle pattern after observing an escape over the past few days.

With the support of investors, ARB could manage to note further gains provided it can breach key resistance levels.

Arbitrum Investors Could Note the Benefits

Arbitrum’s price is looking to chart a rally to $1.21. The possibility of this happening is largely dependent on the investors as well. If ARB holders make a move in the positive direction, the altcoin would have a shot at recovery.

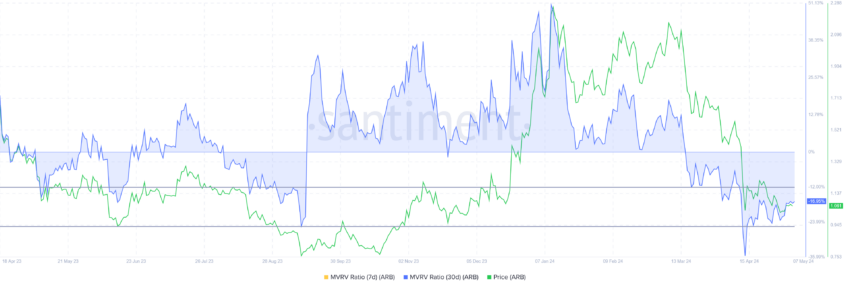

This could be the case for ARB in the coming days since investors are in the optimal spot for accumulation right now. The Market Value to Realized Value (MVRV) Ratio shows that Arbitrum is currently undervalued.

The MVRV ratio assesses investor profit or loss. Arbitrum’s 30-day MVRV sits at -17%, signaling losses, potentially prompting accumulation. Historically, ARB recovery occurs within the -12% to -25% MVRV range, labeling it as an accumulation opportunity zone.

Thus, should ARB holders move to accumulate, they could make the most of the potential rally.

In addition to its investors, Arbitrum’s price could also benefit from the price action of Bitcoin. The biggest cryptocurrency in the world is looking to secure $65,000 as a support floor, and a breakout from it could trigger recovery.

Given that Arbitrum shares a high correlation of 0.91 with BTC, it is possible that ARB would end up following Bitcoin’s cues.

Read More: Optimism vs. Arbitrum: Ethereum Layer-2 Rollups Compared

This would help Arbitrum’s price push upwards.

ARB Price Prediction: Breaking out of the Chains

Arbitrum’s price escaped the descending triangle it was stuck in for nearly a month. The bearish pattern denoted a potential correction, but ARB managed to prevent a decline below $1.00, cementing it as a support floor.

Keeping this psychological level as support will further enable Arbitrum’s price to rally and recover the recent losses. Propelled by the aforementioned factors, ARB could achieve the rise provided it can breach and flip the resistances at $1.10 and $1.21 into support.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

However, if the breach fails, Arbitrum’s price could be fated to either consolidation or a potential decline below the support of $0.99. This would invalidate the bullish thesis, extending investors’ losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.