Arbitrum price gains have brought the altcoin significantly closer to registering a new all-time high. Doing so would also be highly profitable to thousands of investors.

However, the slightest drawdown could mean losses worth millions of dollars to ARB investors. What would be the likely outcome?

Arbitrum Price Needs a Little Push

Arbitrum price trading at $2.16 is close to establishing a new all-time high. The former ATH of $2.42 was established at the beginning of this year, and ARB warrants an 11% rally to break through this. The chances of this happening are high for two reasons. The first is support from investors, and the second is market conditions.

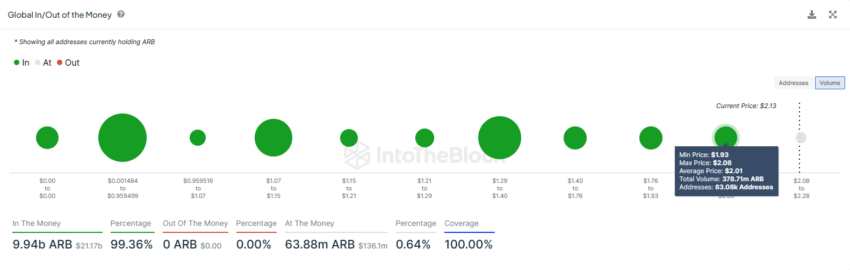

ARB holders are likely poised to hold off on selling until the aforementioned level is breached. This is because about 64 million ARB worth over $140 million is at the cusp of turning profitable.

Secondly the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both signalling a bullish sentiment at the moment. RSI is a momentum oscillator measuring the speed and change of price movements, indicating overbought and oversold conditions.

MACD, on the other hand, is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price. It consists of a MACD line, a signal line, and a histogram, which helps identify trend changes and momentum shifts.

The former is in the bullish zone above the neutral line, and the latter indicates an active bullish crossover.

ARB Price Prediction: Watch out for This Level

Looking at the aforementioned conditions, Arbitrum’s price has enough steam to complete the 11% rally over the coming days, making 64 million ARB profitable. At the same time, doing so would also result in the altcoin marking a new all-time high.

However, given ARB has been moving sideways for the past few days, a potential decline should investors opt to sell cannot be ruled out.

A solid support floor is established at $2.00, but losing this level would likely invalidate the bullish thesis since $841 million worth of ARB would face losses. Consequently, Arbitrum price might end up testing $1.68 as the next support.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.