The total altcoin market capitalization is in a consolidation that dates back to mid-2022. Technical indicators currently suggest the possibility of a breakout, which may ignite a new altcoin season.

Still, this will require new capital inflows, increased altcoin trading volume, and a sustained close above a critical resistance area.

Altcoin Market Capitalization on the Rise

The altcoin market capitalization is in the process of forming its fourth consecutive weekly green candle. Each candle had a body size of about 6%, but together with the wicks, these represent a 35% price increase over the past month.

This upward move is significant, pushing the altcoin market cap to the long-term resistance area at $657 billion. This crucial resistance barrier has existed since mid-2022, even acting as support several times during the 2021 bull market.

The altcoin market cap also formed triple bottom support at $494 billion, creating a solid structure for a potential bull market. Indeed, the first higher high in 1.5 years was created in April, while June, August, and October managed to hold a higher low at the support zone.

If the altcoin market capitalization continues to increase, it will not only break out of the long-term resistance area but also generate another higher high. This could potentially confirm the start of a new bull market on the long-term chart.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

It is worth noting the declining trading volume, which has been dropping since mid-2021. The compression pattern seems very mature, so a breakout can be expected in the coming weeks or months. A breakout above resistance and the generation of a higher high with rising volume will be an additional confirmation of the start of a new altcoin season.

Bullish readings are also provided by the Relative Strength Index (RSI), which is rising and approaching bullish territory above 70. As the RSI reaches the highest level since November 2021, it further confirms the change in market sentiment.

A Bullish Breakout After A Short Correction

The analysis of the daily interval supports the bullish outlook from the weekly time frame. First, the altcoin market capitalization has reached resistance at $657 billion. Here, a short-term consolidation and possible correction can be expected.

If the correction is shallow, it is possible to retest the previous resistance area at $608 billion and validate it as support. This level corresponds with the 0.382 Fib retracement of the recent upward movement.

The daily RSI is already in overbought territory, above 70 on the daily chart. However, it has not yet generated a bearish divergence, as a steady increase in the RSI accompanies the price rise.

Interestingly, unlike on the weekly chart, the first signs of an increase in trading volume are already visible. The descending resistance line has been in place since March and has been broken several times over the past few days. If this trend continues, it may soon become visible in the weekly trading volume.

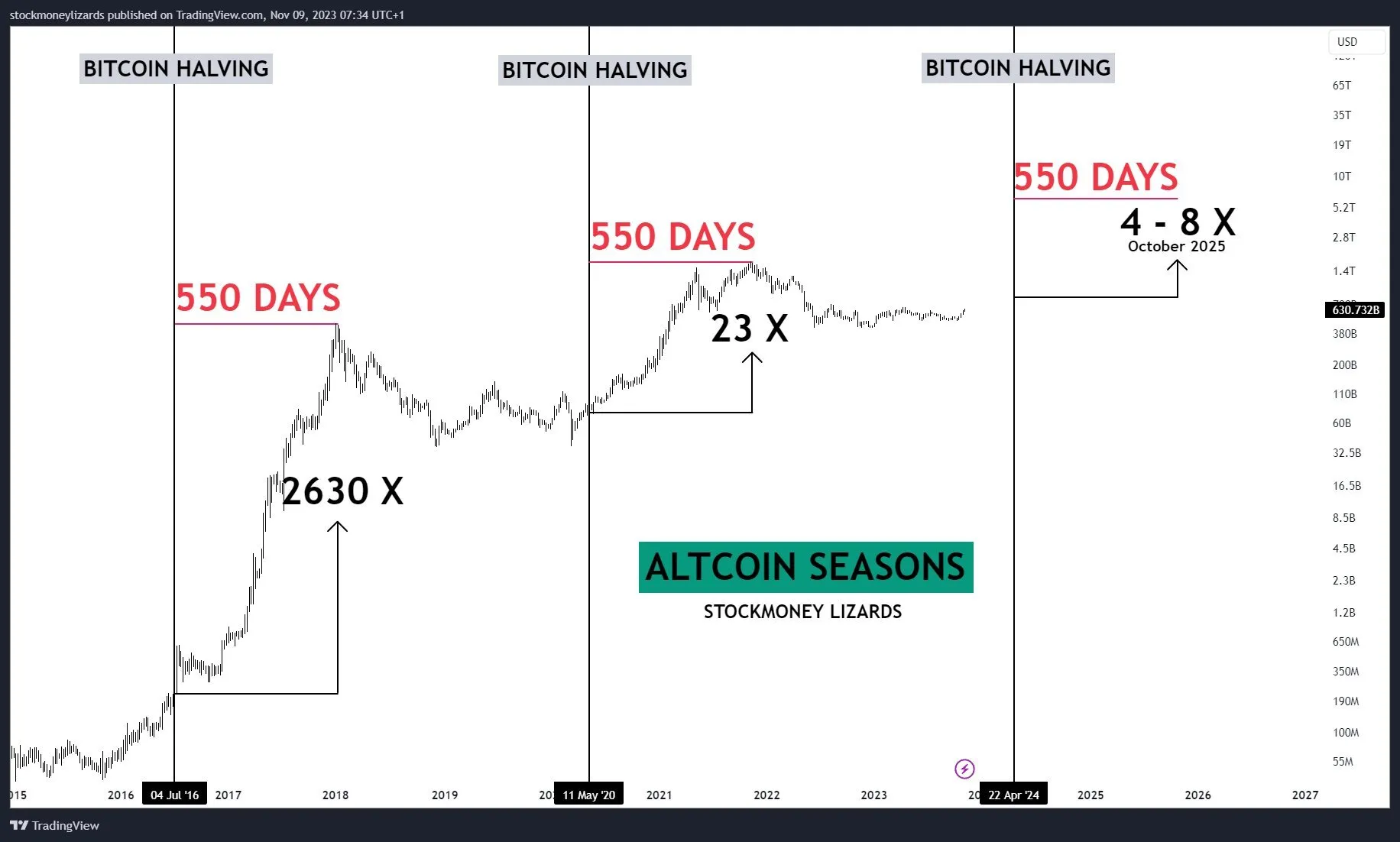

Altcoin Season: The Money Flow Cycle

Renowned crypto analyst Stockmoney Lizards sayid, “Altcoin season is around the corner.” His analysis considers how altcoin market capitalization increased after Bitcoin’s previous halving. In his view, the altcoin market cap reached the peak of the cycle at 505 days after the Bitcoin halving.

If this situation were to repeat itself, the current price action could be just a prelude to a 4x to 8x altcoin season, which the market may not experience until 2024 – 2025.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

During the highly anticipated altcoin season, another analyst, Crypto Clearly highlights the standard money flow during a crypto bull market. The standard pattern begins with the surge of Bitcoin. Then, the main beneficiary becomes Ethereum.

Later, capital flows to more altcoins, from those with large market caps to medium to small caps. When the last and smallest altcoins increase exponentially, it signals the end of the altcoin season.

In addition, Crypto Bitcoin Chris supplements this scheme with the direction of progression during the altcoin season independent of market capitalization.

In his opinion, the freshness of the project also plays a big role, as usually, the market promotes projects representing innovative technologies at the beginning. They are the leaders of each market cycle.

This is followed by the rise of less popular altcoins, which still have high quality and hold value against Bitcoin.

The end of the altcoin season is marked by the growth of old projects, often considered “dead.” Every project, even “garbage” ones, increases in this phase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.