Aevo is a decentralized options platform that utilizes an off-chain order book for matching orders while the actual trades are executed and settled on-chain through smart contracts. It received investments from big players like Paradigm, Dragonfly Capital, Coinbase Ventures, and more. Also, AEVO airdrop recently drove a lot of attention to its ecosystem.

The AEVO token was recently listed on Binance, and a significant token unlock is planned for May 2024. How could these movements impact the AEVO price?

On-Chain Data Shows AEVO Is Trying to Keep Its Momentum

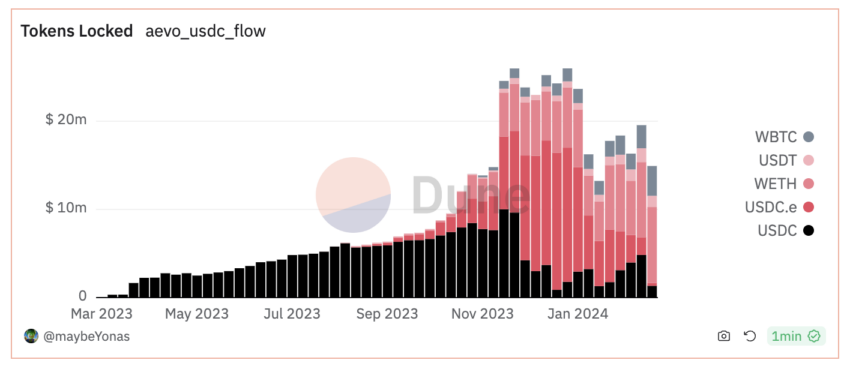

The Total Value Locked (TVL) within AEVO is currently positioned at over $14 million. This figure, however, peaked in the closing month of 2023 and the onset of 2024, soaring to an impressive peak exceeding $25 million during this interval. Such a trend shows a substantial contraction of 44% in the TVL in a brief span of under three months.

TVL serves as a critical barometer for gauging the aggregate value of assets deposited by users, offering insights into the collective confidence in and the expansive scale of the platform. A robust TVL is often interpreted as a marker of heightened user faith and active participation in the platform’s offerings. While AEVO TVL continues to command a significant volume, this metric has experienced a marked downturn post-January.

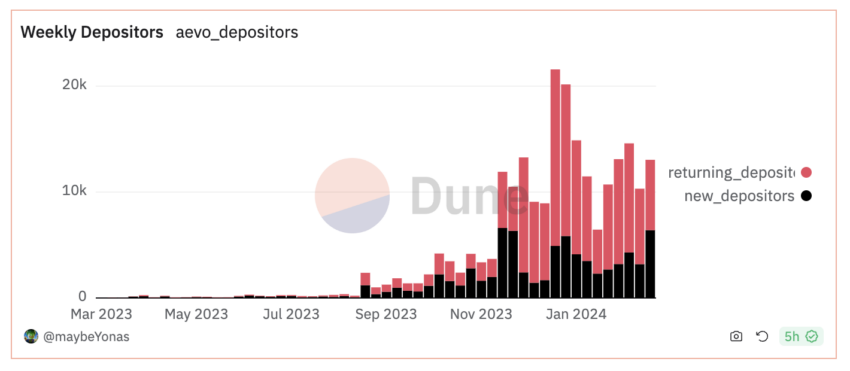

To date, AEVO has attracted over 78,000 unique depositors. Nonetheless, akin to the trajectory observed in TVL trends, the influx of weekly depositors exhibits a parallel pattern.

Read More: What are Crypto Airdrops?

Particularly in the second week of January, the influx reached nearly 22,000 before it commenced a downward trend, thereafter stabilizing between February and March 2024. Amidst fluctuating deposit numbers, this stabilization might suggest a consolidation phase for AEVO.

The metric of unique depositors, particularly for AEVO, matters because it clearly indicates the platform’s growth and user engagement over time. Despite the previous drop, a stable number of depositors between February and March 2024 suggests a solidifying user base that could indicate a level of loyalty or satisfaction among users.

Was AEVO Airdrop Succesful?

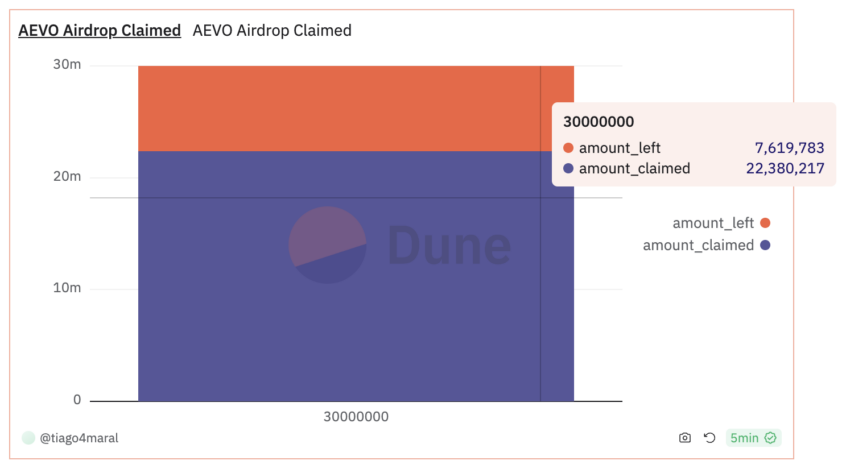

The AEVO airdrop was initiated on March 13, introducing 30 million units of its token into the market. As of the current date, a substantial proportion, nearly 75%, of the tokens made available through this airdrop has been successfully claimed by eligible participants.

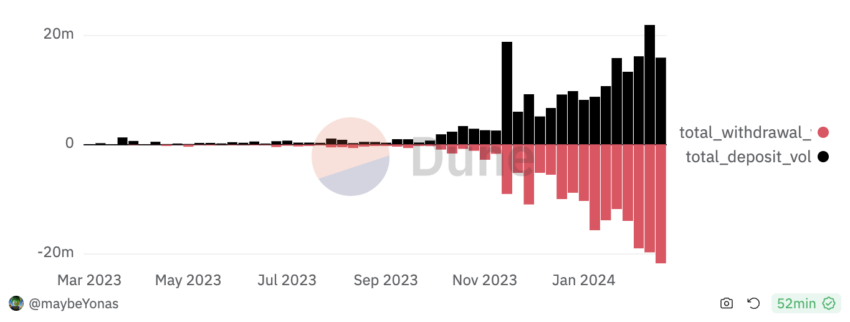

Interestingly, the airdrop appears not to have markedly influenced the activity levels of deposits and withdrawals on the AEVO platform. A closer examination of the patterns of weekly deposits and withdrawals indicates that, particularly from the end of 2023 leading into the early part of 2024, the volume of deposits significantly surpassed that of withdrawals.

However, despite an overall growth in both deposits and withdrawals in the subsequent weeks, the pace at which withdrawals have increased has begun to eclipse that of deposits. There was a notable disparity in the most recent week, with $15.86 million being deposited compared to a larger sum of $21.72 million being withdrawn. This culminates in a net negative flow of $5.86 million from the platform.

An upward trajectory in deposit volumes typically reflects a bolstering of user engagement and reinforced confidence. On the other hand, a surge in withdrawal activities could indicate diminishing trust among users or a strategic move to realize profits, pointing to a more cautious stance towards the platform.

AEVO Price Prediction: Should Airdrop Holders Sell Now?

Despite the recent AEVO airdrop and its listing on Binance, the journey of AEVO price is telling a bittersweet story. It peaked at $3.34 at one point, only to experience a near 10% correction in the following hours.

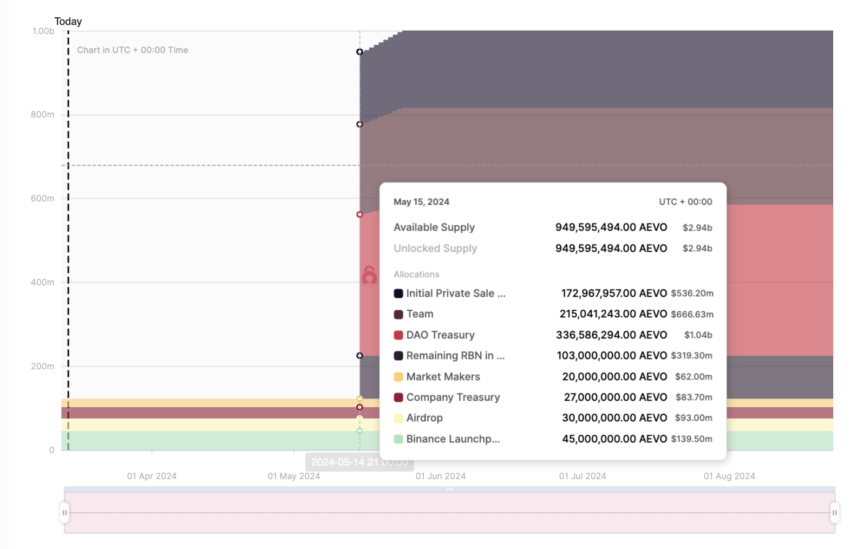

On May 15, 2024, AEVO will release 878 million tokens, increasing its supply from 122 million in ten days. This will bring AEVO total supply to 1 billion tokens.

Analysis of the upcoming May unlocks reveals that 36% of AEVO’s total supply will go to the DAO Treasury, with 23% allocated to the team.

In the short term, AEVO might sustain its momentum. The excitement around its Binance listing, potential deposit increases, and the availability of remaining airdrops to claim could drive this momentum.

Read More: An Introduction to Crypto Options Trading

However, the impending sevenfold increase in its supply poses a considerable challenge. Such a rapid expansion of the token supply could serve as a cautionary signal to investors. This could potentially trigger a widespread sell-off that could significantly impact AEVO’s price.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.