Bitcoin (BTC) could finally realize its potential as a global currency by 2030, according to a recent post by Ki Young Ju, CEO of CryptoQuant. Ki’s analysis highlights the rapid evolution of the Bitcoin ecosystem, particularly in mining and institutional involvement.

Satoshi Nakamoto, the mysterious creator of Bitcoin, once envisioned it as a decentralized, peer-to-peer (P2P) electronic cash system.

CryptoQuant Founder Envisions Bitcoin As A Future Currency

In the post on X (formerly Twitter), Ki hinted at a future where Bitcoin may be widely used as a low-volatility currency, not just a speculative investment asset. The vision is based on how Bitcoin mining has drastically changed since its inception in 2009.

Back then, individual miners could easily mine 50 BTC with a single personal computer. Today, the playing field is entirely different.

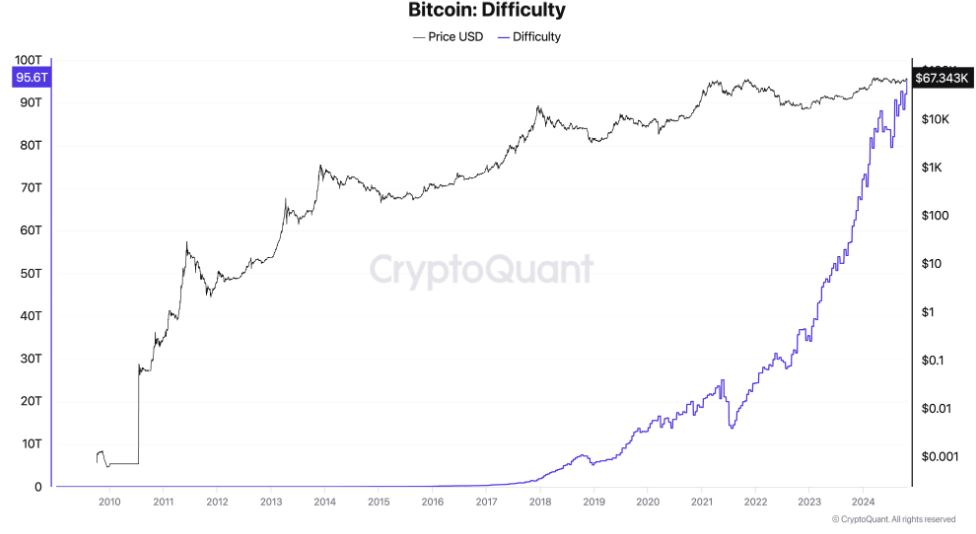

Bitcoin’s mining difficulty, which measures the complexity of mining new blocks, has surged by a staggering 378% in just the past three years. This reflects the increased competition within the industry, with the growth making it nearly impossible for individual miners to participate profitably.

Instead, large-scale mining companies backed by institutional investors now dominate the industry. This shift toward institutional control has had far-reaching consequences for Bitcoin’s future. As institutional investors take the reins, entry barriers to mining rise, and Bitcoin’s ecosystem grows more stable.

Read More: How To Buy Bitcoin (BTC) and Everything You Need To Know

Against this backdrop, Ki Young Ju suggests that stabilization could reduce Bitcoin’s infamous price volatility. Instead, it could make it less appealing to day traders but more attractive as a practical currency.

The CryptoQuant executive points to one key event – Bitcoin halving. This event occurs approximately every four years when the reward for mining Bitcoin transactions is cut in half. After the 2024 Bitcoin halving, the next one is expected to take place around April 2028.

Historically, significant price increases came after halving events. However, Ki Young Ju predicts that the 2028 halving could mark a new phase in Bitcoin’s evolution. As Bitcoin’s volatility decreases over time, the conversation around its use as a “currency” may begin in earnest by this time.

Institutional Adoption of Bitcoin To Soar By Next Halving

Ki Young Ju believes that by 2028, institutional adoption will reach a critical mass, paving the way for Bitcoin to become more widely accepted for everyday transactions. The increasing presence of major fintech companies could also play a role in Bitcoin’s transformation into a currency. For instance, Stripe’s recent foray into the stablecoin infrastructure space could draw more e-commerce and global markets.

As regulatory clarity emerges, stablecoins could see mass adoption. This could familiarize more people with blockchain wallets and other cryptocurrency-related technologies in turn.

Furthermore, volatility has long been a major barrier to Bitcoin’s use as a currency. Businesses and consumers are reluctant to use Bitcoin for transactions if its value fluctuates wildly from day to day. However, Ki Young Ju argues that this volatility is slowly decreasing as the ecosystem matures.

“As volatility decreases, Bitcoin’s role as a currency becomes increasingly inevitable,” Ju added.

This reduction may occur through advancements in protocol, Layer 2 (L2) networks, or the adoption of Wrapped Bitcoin (WBTC). Nevertheless, Ki Young Ju says for Bitcoin L2s to be competitive, they would need institutional support. As these improvements take hold, Bitcoin’s potential to serve as a stable currency grows.

This aligns with the vision of financial experts like billionaire investor Paul Tudor Jones, who sees Bitcoin as a hedge against inflation and economic uncertainty. Jones believes that Bitcoin’s finite supply, particularly in a world burdened by increasing debt and inflation, makes it an attractive store of value.

Similarly, MicroStrategy founder Michael Saylor believes Bitcoin’s unique properties make it a superior store of value over the long haul. This explains the business intelligence firm’s progressive BTC buying spree. The firm has been stacking Bitcoin since 2020 and is still holding.

This growing institutional trust could further stabilize Bitcoin’s price, enhancing its appeal as a currency by the end of the decade.

“We’re buying Bitcoin to hold it 100 years. That $66,000 to $16,000 crash shook out the tourists. When it was $16,000, we were all ready to ride it to zero,” Saylor said recently.

For Ki Young Ju, this transformation represents a return to Bitcoin’s original purpose. While many view Bitcoin as “digital gold,” Satoshi Nakamoto’s true aim was for it to function as a P2P electronic cash system.

Read more: Satoshi Nakamoto – Who is the Founder of Bitcoin?

As the ecosystem matures and volatility continues to decrease, the perception that Bitcoin cannot be a currency no longer exists. CryptoQuant’s founder believes the world could see Bitcoin used as a practical, low-volatility currency by 2030, effectively realizing Satoshi’s long-held dream.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.