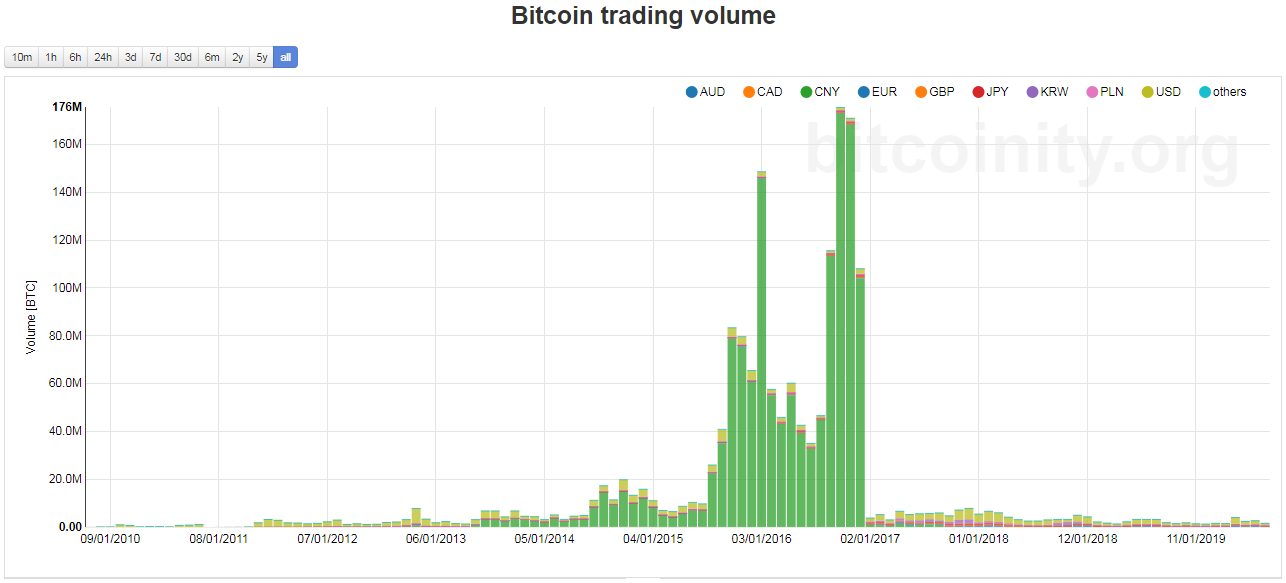

Over the past decade, China has had a turbulent relationship with the cryptocurrency market. While it was one of the biggest forces in the industry at one point, Chinese investors have almost all but pulled out in 2020.

Now, the Chinese government is planning to ride the wave once again with its own cryptocurrency offering, which is set to launch sometime next year.

It’s no secret that China has one of the world’s largest manufacturing hubs and financial markets, valued at approximately $45 trillion. With a low inflation rate of around 3%, China’s economy is relatively stable and investment-worthy, even in light of the ongoing US-China trade war.

As a result of its sheer size, China has a profound impact on the crypto market, especially in terms of price movements. However, recent regulations imposed by the government have made it difficult for citizens to trade.

Instead, China plans to dominate the industry with its own cryptocurrency, one that serves as a digital equivalent to its fiat currency, the RMB. In development for several years now, the digital equivalent should slowly replace physical cash altogether.

In this article, we explore how China became a leader in the digital currency space and how it plans to stay at the top.

The Rise and Fall of Chinese Crypto Dominance

China has always been a dominant force in crypto. Back in 2013, when Bitcoin media coverage was practically non-existent, Chinese companies had already begun accepting it as a payment method. However, a Chinese government Bitcoin ban forced them to revert this decision fairly quickly.

“illegal and disruptive to [China’s] economic and financial stability.”While companies have tried to skirt the ban, Chinese authorities have been quick to shut them down. In 2019, the government added some of the largest cryptocurrency-related websites to its nationwide internet blacklist, popularly labeled the ‘Great Firewall of China’.

The Future of Cryptocurrencies in China: Digital Yuan

Only a few months after the ICO and crypto exchange ban, authorities from the People’s Bank of China (PBOC) revealed plans for a Central Bank Digital Currency (CBDC). Nicknamed the ‘digital yuan,’ the project was spearheaded by a blockchain research institute that was set up way back in 2014. Unlike traditional cryptocurrencies, the Chinese government would issue and back the digital yuan token. This would allow the Central Bank to monitor transactions and dictate its own policies on token issuance. In March 2018, an official from the PBoC said that digital currencies were ‘inevitable’ and that the central bank was keen on developing its own competing solution. The digital yuan would simplify cross-border transactions, allowing Chinese nationals abroad to access and exchange their funds at any time. Similar to Facebook’s goal of making Libra accessible to users worldwide, China’s token would theoretically increase the use of the yuan internationally.Why the Digital Yuan Will Likely Succeed

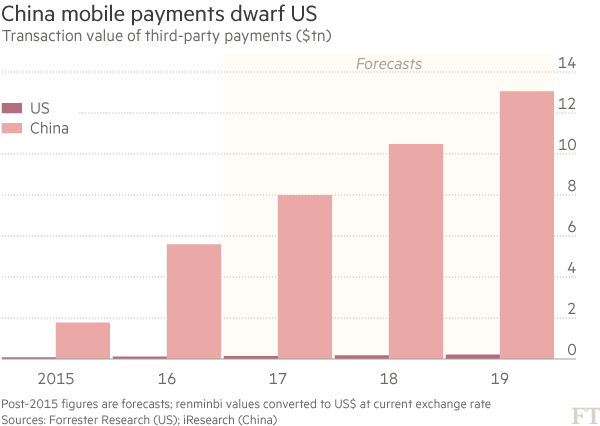

Unlike most of the developed world, a significant percentage of China’s payments ecosystem is already digital and cashless. Between mobile-based QR code and contactless payment interfaces, the Chinese were able to skip credit and debit cards entirely.

“almost everyone in major Chinese cities is using a smartphone to pay for just about everything.”With the digital yuan rumored to be integrated within these apps at launch, its adoption rate should be far higher than for any other country. While an official release date has not been confirmed, the Nikkei Asian Review reports that the token will likely be tested at the 2022 Winter Olympics. Currently, trials are being conducted in the Chinese cities of Shenzhen, Suzhou, Chengdu, and Xiong’an. Fully-fledged issuance may take place as early as next year. Putting aside the token’s promising prospects, it’s worth noting that Chinese individuals and enterprises are still contributing to the broader cryptocurrency market.

How China Took Over the Cryptocurrency Mining Industry

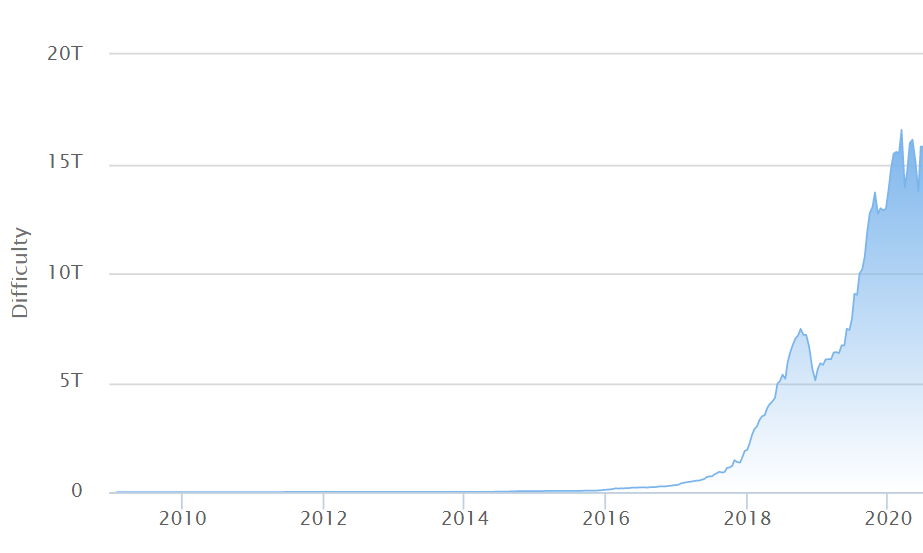

Long before China came up with plans for the digital yuan, decentralized cryptocurrencies were extremely popular in the region. From Bitcoin to Ethereum and newer projects, Chinese citizens invested significantly in almost every token. It all started in the early 2010s when China grew to become the single largest Bitcoin mining hub in the world.

ASIC Specialization

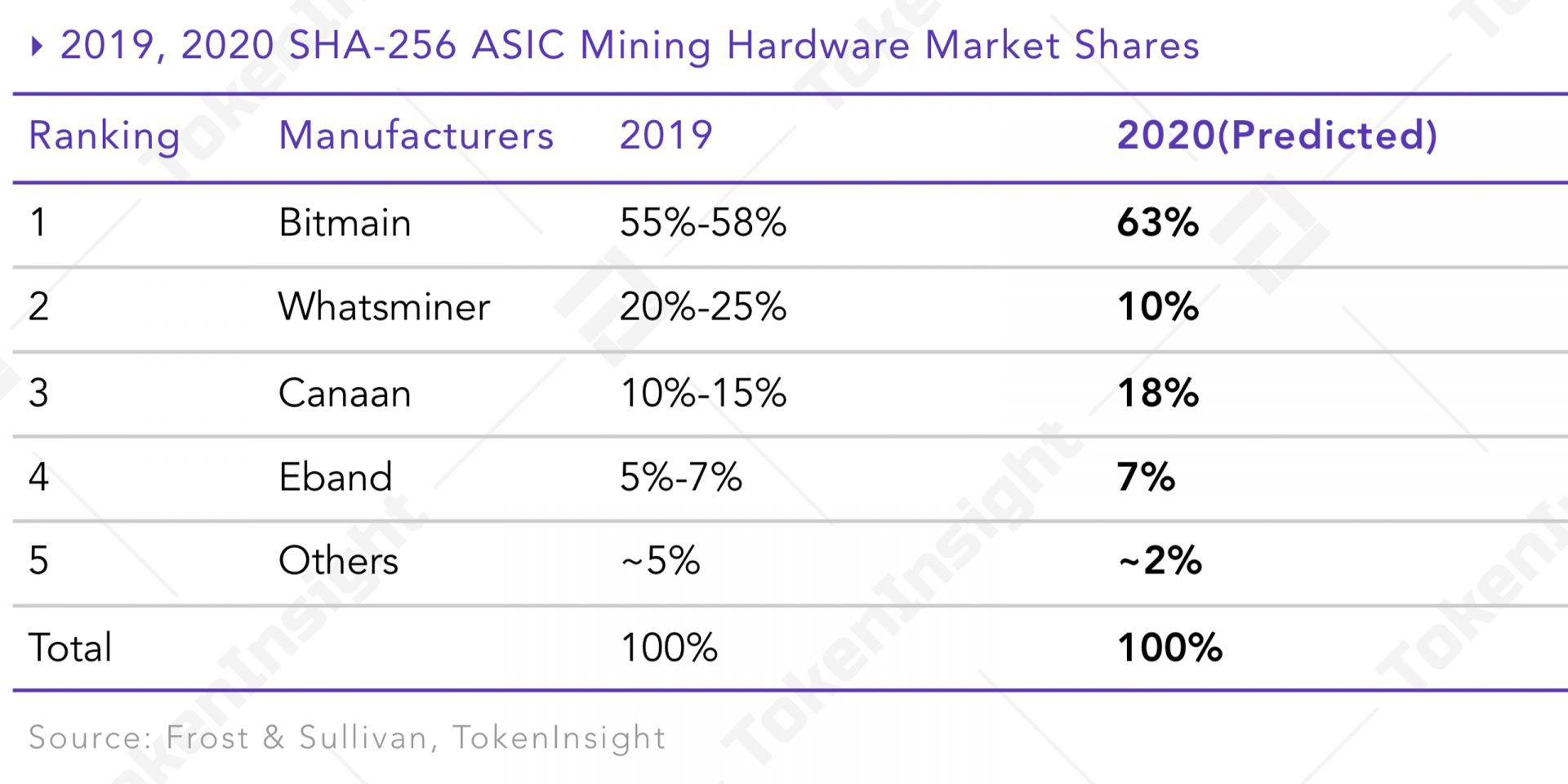

A few years later, cryptocurrency enthusiasts uncovered a new mining technique that could leverage specially designed hardware to mine Bitcoin blocks. This dedicated hardware, called Application-Specific Integrated Circuits (ASICs), far outstripped traditional consumer hardware in terms of performance and efficiency. In 2013, a Chinese hardware company called Canaan Creative became the first manufacturer to create an ASIC machine specifically for Bitcoin mining. Within a matter of months, other Chinese companies, such as Bitmain, joined the fray and released their own competing solutions. Since ASICs outclass traditional solutions, the Chinese had the upper hand in Bitcoin mining for a fairly long time. In 2013, the cryptocurrency market’s valuation skyrocketed, equipping manufacturers, and miners with the resources to scale up their production. Some Chinese enterprises like Bitmain even created their own mining farms in China. This brings us to the second reason why the nation flourished as a Bitcoin mining behemoth:The Birth of Chinese Mining Pools

Since the latter half of the 20th century, China has witnessed most of its rapid growth via industrialization. Consequently, the government offers businesses a host of financial incentives and subsidies, especially in regions that have seen little development so far. Cryptocurrency mining is a fairly automated process that requires very little human oversight. Taking advantage of this, entrepreneurs set up huge ASIC farms in remote regions of China where it made the most economic sense. By strategically basing these farms near sources of renewable energy, they could also reap the benefits of inexpensive and limitless electricity supplies. Since each modern ASIC miner consumes around 1350 watts of power, even a small difference in electricity prices can change the financial viability of a large mining operation. China’s dominance in the cryptocurrency mining industry has continued to this very day, despite its ban on almost every single decentralized token. As the sole manufacturer of cryptocurrency-optimized ASIC hardware, China remains, so far, unchallenged.Collusion and Corruption: Is Chinese Mining Dominance a Concern?

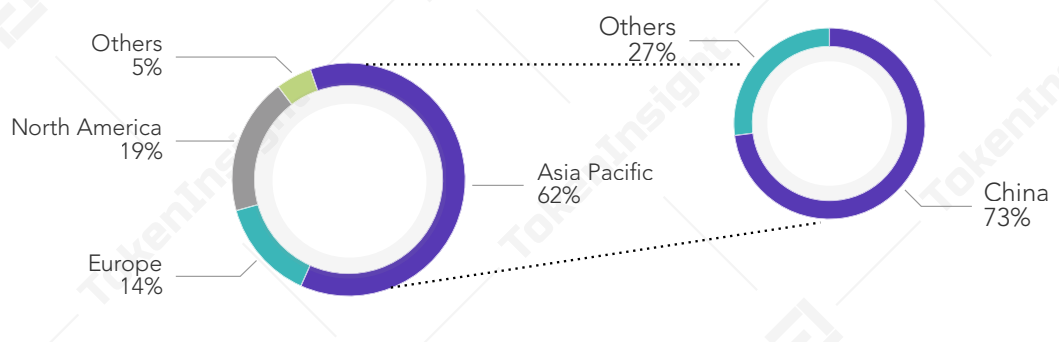

The concentration of Chinese mining farms has generated a fair deal of controversy in the crypto community over the past few years. Many claim that the trend has led to collusion and the centralization of major digital currencies. In 2015, half of all miners on the Bitcoin network were reportedly located somewhere in China, albeit under four different mining pools. A Reuters report revealed that, by 2019, Chinese miners controlled as much as 66% of the global Bitcoin hash rate.

The 51% Attack

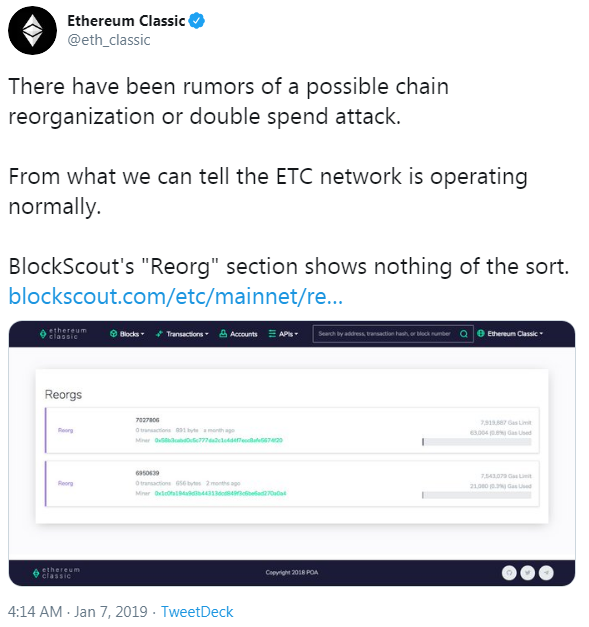

Ethereum Classic, one of the top 30 cryptocurrencies by market capitalization, suffered a 51% attack in early 2019. According to Donald McIntyre, founder of Etherplan, one miner briefly controlled 60% of the network’s hash rate. The unknown actor had disproportionate access to the blockchain. Cryptocurrency exchange Coinbase later issued a release stating that the attacker made off with $460,000 worth of Ethereum Classic. Eventually, honest miners regained control from the malicious actor. The damage had, however, already been done.

“If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest and outpace any competing chains.”In other words, a cryptocurrency needs a majority of miners to be honest. While no party has attempted to attack the Bitcoin network so far, many fear that excessive mining hardware centralization in China could lead to catastrophe.

The Exodus of Chinese Mining Farms and Pool

Fortunately, the Chinese government does not appear keen on letting the mining industry flourish. In 2018, China’s central state planner, the National Development and Reform Commission, proposed banning crypto mining entirely. The commission cited e-waste and high energy consumption as the primary motivations for a ban. The news reverberated across the crypto community and caused mining pools to shut down their operations prematurely. Geographical centralization is a bad idea for Chinese miners anyway, given that a single weather-related event could wreak havoc on infrastructure. In August 2019, a mining farm in China’s Sichuan province recorded damages worth 1 million yuan ($140,000) after a flood destroyed dozens of machines. Fearing an official ban, Chinese miners took their hardware to remote corners of the world in search of cheap energy sources. They eventually settled in a wide variety of locations, including a remote town in Canada, and spots in Russia, Mongolia, and Iran. The Chinese commission later rescinded any potential decision to eliminate the country’s mining industry.Where Chinese Cryptocurrency Users Stand Today

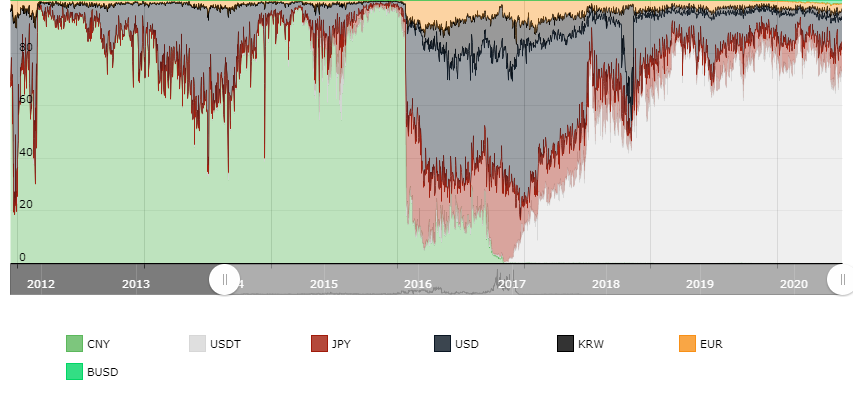

Thanks to the 2017 ban on exchanges, Chinese individuals today have no official channels to purchase big-name cryptocurrencies. In 2018, the Chinese yuan accounted for a mere 1% of global Bitcoin transactions, according to the Asia Times.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored