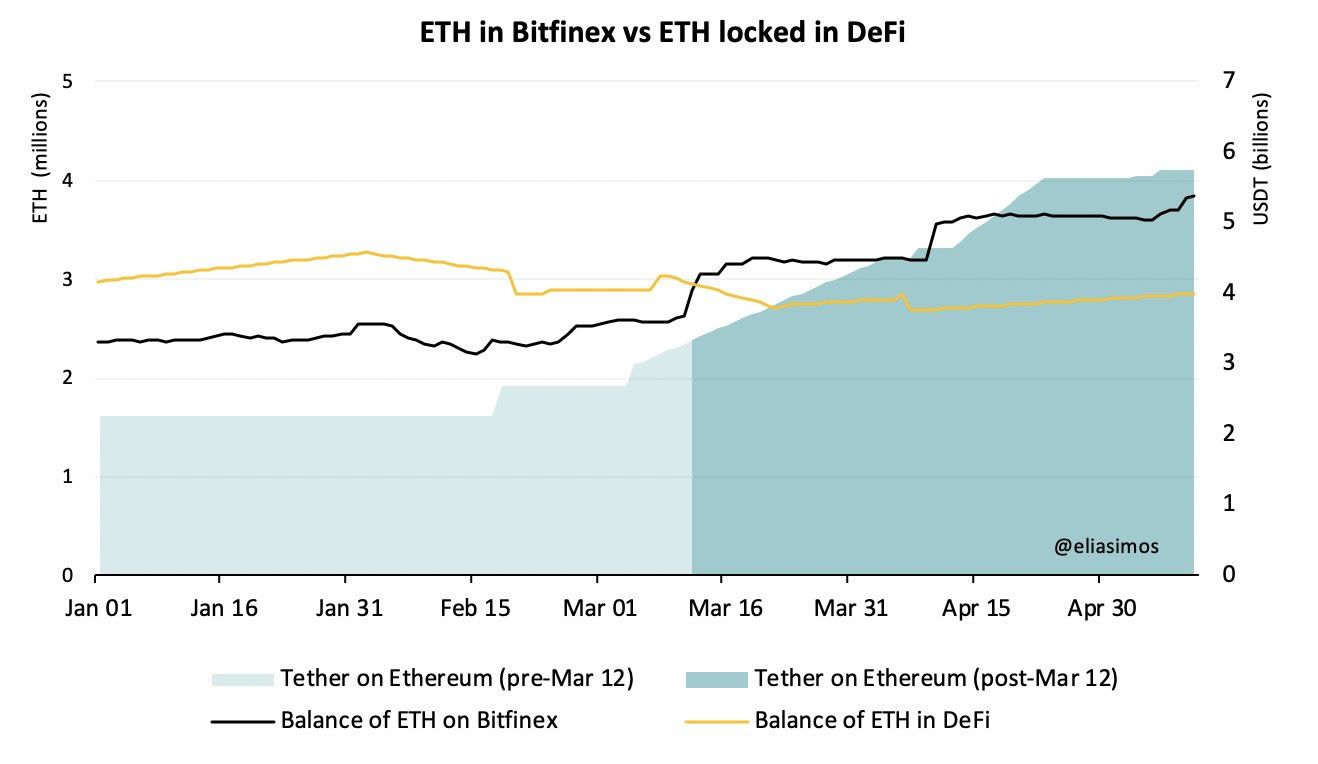

The amount of Tether that has been printed this year has not gone unnoticed. Most of it is based on Ethereum, which has started to have an effect on where ETH is locked up.

There is now so much Tether out in the markets that it temporarily eclipsed XRP in terms of market capitalization recently. This made USDT the third-largest crypto asset on the planet, with a total market cap of over $8 billion at the time.

It seems like not a week has gone by recently without the Tether Treasury churning out more USDT. So far this year, its market cap has surged 55%, with an additional $2.3 billion worth of dollar-pegged Tether tokens flooding the markets.

Tether on Exchanges Reaches Record Levels

The majority of Tether currently produced is based on the ERC-20 Ethereum token standard. Senior research analyst Elias Simos [@eliasimos] has noticed that there is now more Ethereum on some exchanges than locked in the entire decentralized finance ecosystem.There is now more $ETH locked in Bitfinex than in the whole of DeFi. Since mid-March, the balance of ETH on Bitfinex has increased from ~2.5M to ~4M ETH. Over the same period, ~3B Tether has printed on the Ethereum chain. Is Tether eating Ethereum…?

Ethereum on DeFi

The amount of Ethereum currently locked into DeFi markets is now a long way below that held on Bitfinex. According to Defipulse.com, it has been on a downward slide since its peak in early February and is currently at 2.7 million ETH.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored