The demand for stablecoins has reached record levels, prompting the world’s largest producer to keep on minting them. Tether has hit an all-time high in terms of market capitalization and has been trading at a premium on some exchanges.

Crypto analytics tracker Skew has just reported that Tether’s market capitalization has reached $7 billion.

Other analytics trackers, such as Coinmarketcap.com, are reporting a slightly lower figure of around $6.4 billion at the time or writing.USDT just breached $7bln market cap and consistently trades at a premium to USD suggesting continuous demand pic.twitter.com/3JsHMD2kK2

— skew (@skewdotcom) April 18, 2020

Tether Minting at Record Levels

Since the beginning of the year, USDT market cap has increased by a whopping 56%, which dwarfs that of Bitcoin only gaining 2.3% in terms of market cap over the same period. As a percentage of the entire crypto market, Tether now commands 3%, which is more than Litecoin and EOS combined. As reported by BeInCrypto, Tether minted another $120 million late last week and has done so several times already this month. Stablecoin issuance surged to $8 billion during the first quarter of this year, more than all of 2019 combined. When USDT trades at over a dollar it signifies greater demand for the asset, which has been the case in recent months.

What Is Driving USDT Demand?

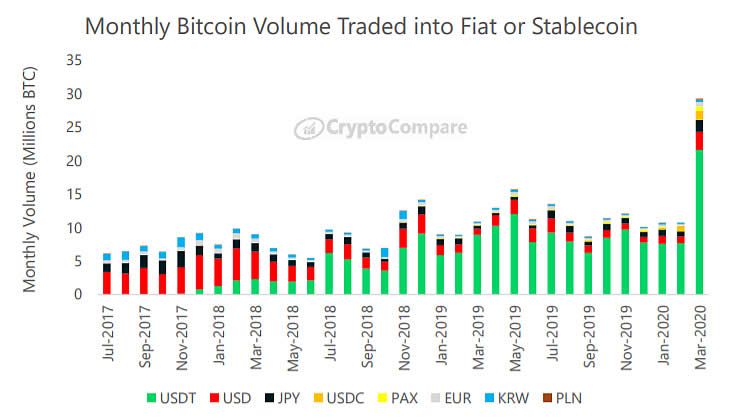

According to CryptoCompare’s monthly exchange review, stablecoin volume surged in March; over 21 million in BTC representing 73% of the total BTC volume traded into fiat or stablecoins.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored