Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to read how crypto markets are entering a new phase, with lawmakers in Washington moving closer to defining the industry’s regulatory future.

Crypto News of the Day: CLARITY Act May Create ‘On-the-Run’ Crypto Valuation Like Bonds, Matt Hougan

Two landmark bills passed the US House on Thursday. The first, the CLARITY Act, creates clear definitions for digital assets and divides regulatory oversight between the SEC and CFTC.

Meanwhile, the second, the GENIUS Act, is the first federal crypto law in US history, setting national standards for stablecoin issuance and oversight. Institutional investors and market analysts are beginning to reimagine how digital assets will be valued, traded, and structured in the future.

Following the votes, Bitwise Chief Investment Officer Matt Hougan weighed in on the implications for the digital asset market. According to Hougan, the CLARITY Act, in particular, could usher in a new pricing dynamic for crypto assets, akin to how bonds are valued in traditional finance (TradFi).

“The CLARITY Act and generic listing standards for crypto ETPs will create an ‘on-the-run/off-the-run’ valuation element in crypto,” Hougan posted on X (Twitter).

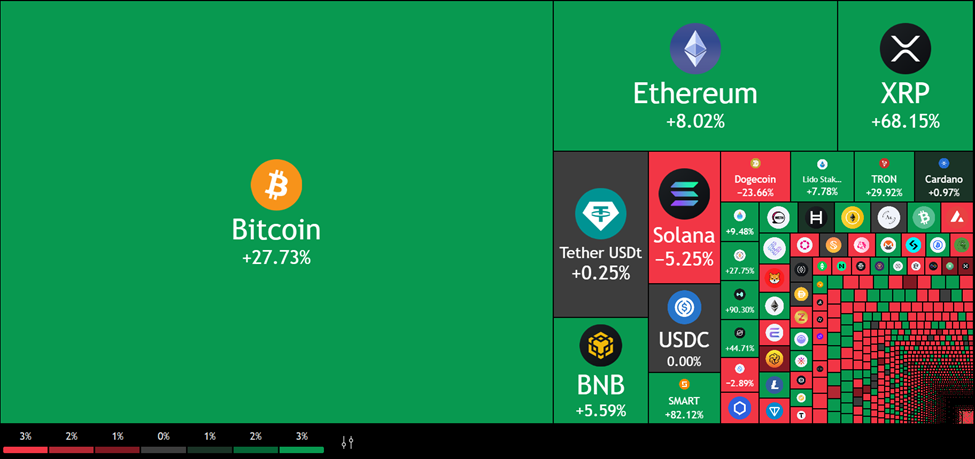

According to the Bitwise executive, this is already happening, with the year-to-date (YTD) heatmap showing large market cap tokens outperforming the small-sized ones.

The surge in large-cap cryptos like Bitcoin, Ethereum, and XRP comes as investors favor regulatory clarity over riskier altcoins.

In fixed income markets, on-the-run securities refer to the most recently issued and liquid assets. These assets, comprising the latest US Treasury bonds, often trade at a premium, as a recent US Crypto News publication indicates.

ETFs and Institutional Flows Are Targeting Blue Chips

Hougan suggests a similar structure is emerging in crypto, where top-tier tokens like Bitcoin and Ethereum could command higher valuations and greater liquidity due to favorable regulatory treatment and institutional inclusion in ETFs.

Indeed, since the start of 2025, regulatory momentum in the US has helped drive institutional interest toward large-cap digital assets, leaving smaller altcoins lagging.

A recent US Crypto News publication indicated public companies pushing Ethereum to new highs. This bifurcation may widen with the introduction of clearer listing standards and federal-level definitions. Such an outcome would benefit tokens perceived as “regulatory safe.”

After concluding its longstanding case with the US SEC, Ripple’s XRP may well fit in this fold.

The Senate’s position on these bills remains uncertain. Notwithstanding, industry leaders view the House’s passage as a meaningful step toward unlocking broader capital flows and mainstream adoption.

“…it laid the foundation for institutional-grade crypto finance,” one user wrote in a post.

The CLARITY Act could become a foundation for future crypto product development, ETF expansion, and valuation models that mirror TradFi instruments if passed into law.

Chart of the Day

This chart shows daily price performance of major cryptocurrencies, with Bitcoin, Ethereum, XRP, and Dogecoin leading gains. Meanwhile, smaller-cap tokens show mixed or underperforming movements across the market.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Ripple CTO warns of fake airdrop after XRP hits all-time high.

- Backpack opens FTX claims sale channel amid global payout disputes.

- Peter Brandt outlines the conditions for XLM to surge above $7.

- Will Bitcoin treasury companies kickstart the next crypto bear market?

- Crypto VC roars back: Q2 raises top $10 billion with institutional momentum.

- Institutional investors flock to Ethereum: SharpLink and BitMine are in ETH’s top $1 billion.

- Bitcoin faces whale pressure, meaning a new all-time high might have to wait.

- US Treasuries go on-chain: Ondo’s USDY fund debuts on the Sei network.

- Chainlink surges as the Genesis Act clears the path for crypto compliance.

- Here are four analyst signals for when to take profits as altcoin season heats up.

Crypto Equities Pre-Market Overview

| Company | At the Close of July 17 | Pre-Market Overview |

| Strategy (MSTR) | $451.34 | $452.07 (+0.16%) |

| Coinbase Global (COIN) | $410.75 | $419.36 (+2.10%) |

| Galaxy Digital Holdings (GLXY) | $26.04 | $28.84 (+10.75%) |

| MARA Holdings (MARA) | $19.97 | $20.10 (+0.65%) |

| Riot Platforms (RIOT) | $13.33 | $13.44 (+0.83%) |

| Core Scientific (CORZ) | $13.47 | $13.52 (+0.37%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.