Circle, the issuer of USDC, is soaring, just weeks after the firm went public. Beyond a surge in stablecoin supply, the company’s market cap is rising.

The surge comes amid a rising trend, the stablecoin summer, which threatens to overshadow analysts’ calls for an altcoin summer.

Circle Flips USDC Supply as IPO Momentum Fuels 800% Rally

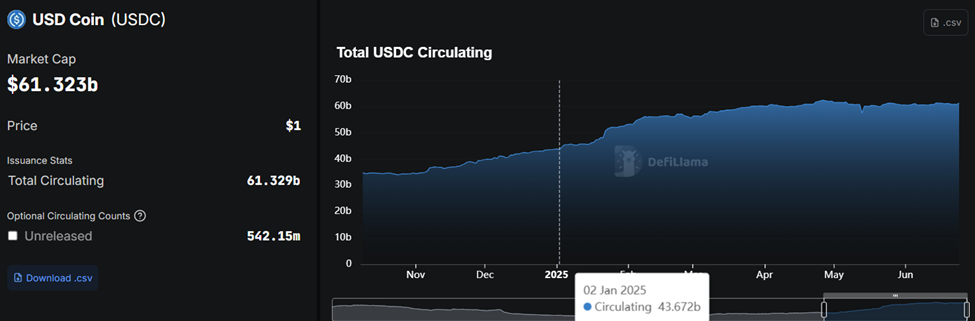

On Monday, the fintech firm’s market capitalization hit $63.89 billion, surpassing the total circulating supply of USDC, around $61.68 billion.

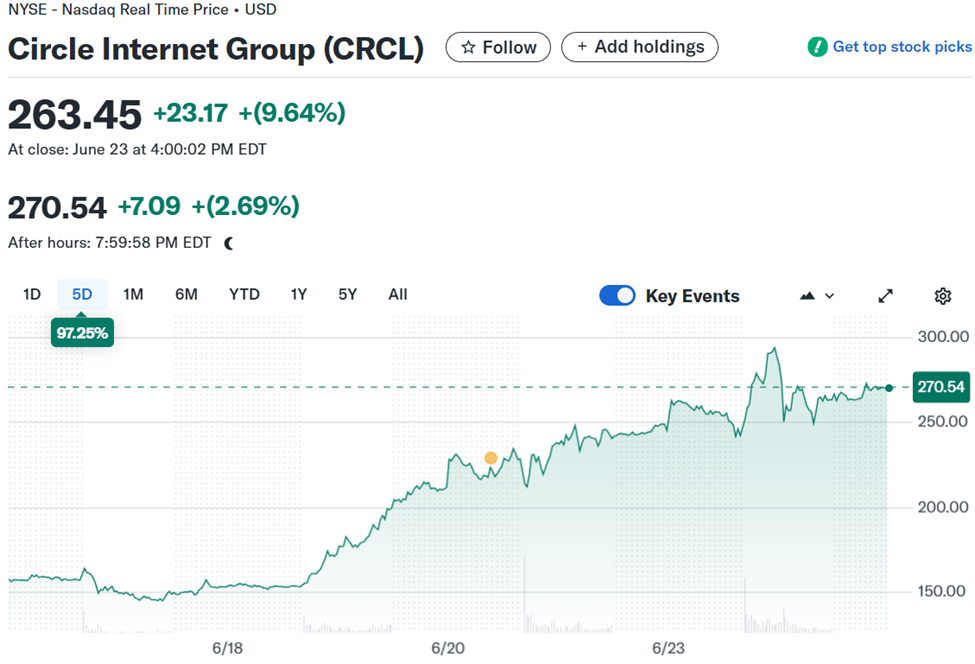

During Monday’s trading session, Circle’s stock briefly approached the $300 mark before closing at $263.45.

This milestone arrives just three weeks after Circle’s high-profile IPO, making it the first stablecoin issuer to debut on the NYSE (New York Stock Exchange). The stock has increased by over 800% in 18 trading days since its launch on the NYSE.

The meteoric rise reflects deepening investor confidence in Circle’s broader fintech potential beyond stablecoin issuance. Circle’s IPO, as BeInCrypto reported, generated substantial institutional interest, recalibrating market expectations, including around Circle’s long-term business model.

Traders increasingly view Circle as a full-stack digital finance operator, beyond a mint-and-burn shop for USDC. Its CRCL stock flipping the circulating value of its USDC stablecoin reflects this shift.

It also points to a larger momentum behind what many call “Stablecoin Summer”, a phrase embraced by major players like Tron DAO and Kraken Exchange.

The firm appears to be gaining attention as stablecoins increasingly power real-world assets (RWAs), DeFi yield farming, and cross-border payments. Circle recently launched USDC stablecoin on the XRP Ledger.

Circle’s USDC Supply Surges 40% in 2025

According to data on DefiLlama, Circle’s USDC supply has surged from $43.672 billion in January to $61.323 billion as of this writing. The 40% surge in 2025 suggests a growing allure for fiat-backed tokens.

However, not all the attention has been rosy. BeInCrypto recently reported that Circle employees may have missed out on as much as $3 billion in unrealized profits following the IPO due to strict equity structuring.

That revelation sparked frustration internally and skepticism externally, especially given the firm’s valuation trajectory.

Meanwhile, BitMEX co-founder Arthur Hayes recently argued that Circle’s deep integration with Coinbase could become a strategic limitation. He alluded to Circle’s reliance on Coinbase, limiting USDC’s market reach, suggesting that the company’s future may hinge on greater independence and diversification.

“If you stop reading here, the only question you must ask yourself when evaluating an investment in a stablecoin issuer is this: how will they distribute their product?” Hayes wrote in a recent blog.

For now, however, the market appears to be buying the Circle vision wholesale. The firm’s dual momentum in traditional finance (TradFi) and Web3 translates into capital inflows and cultural clout.

Surpassing its stablecoin in market cap goes beyond a financial milestone, reflecting a psychological paradigm shift. It points to investors seeing Circle as central to the next phase of digital money infrastructure, not merely a product of it.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.