In Q1 2025, despite a 20% increase in app revenue, Solana faces a 64% drop in TVL, with transaction fees decreasing by 24% compared to the previous quarter.

Solana is solidifying its position in the crypto market, but its future will depend on its ability to address challenges and sustain growth momentum.

Q1 Revenue Hits $1.2 Billion: January Stands Out as a Highlight

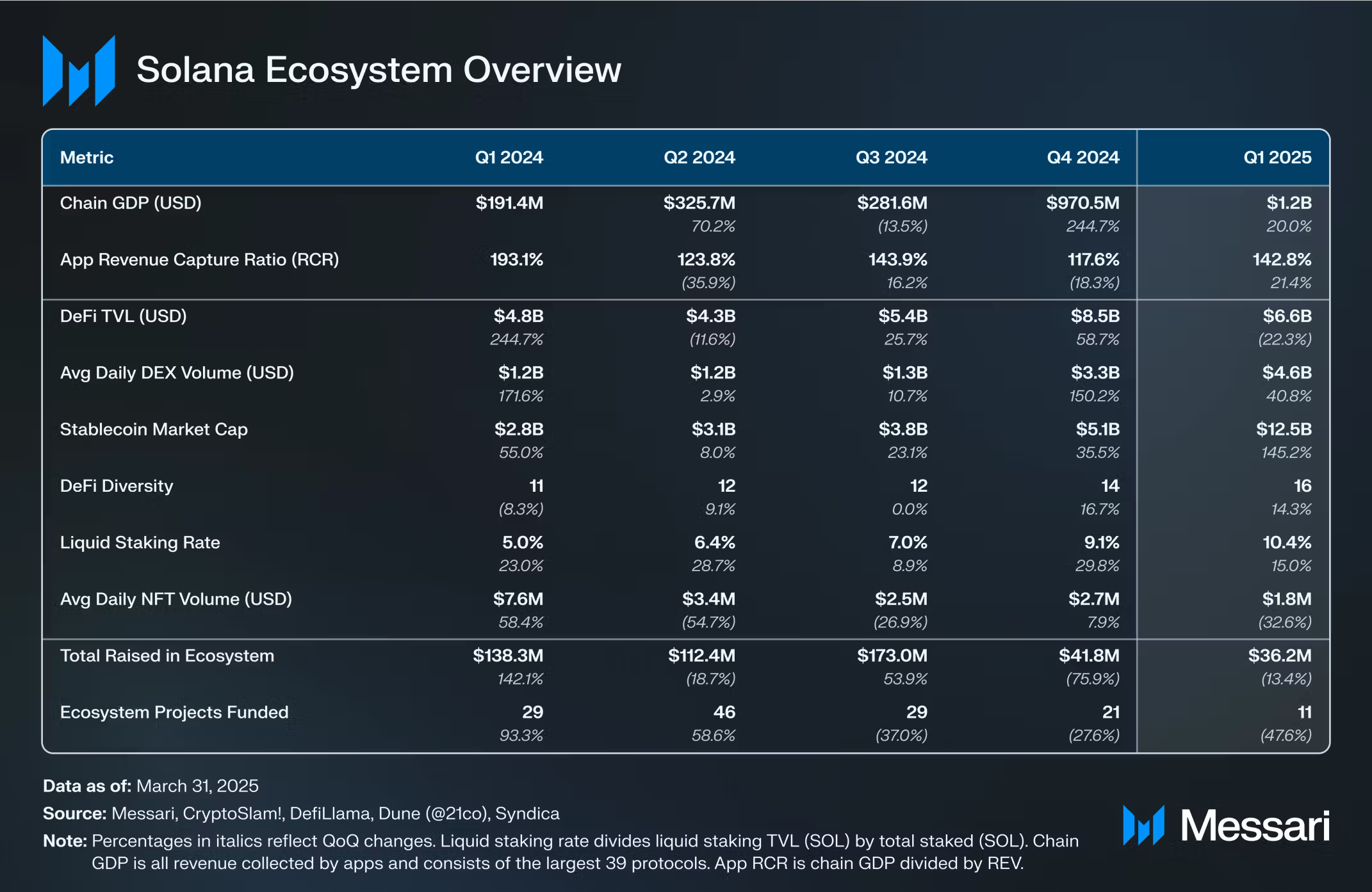

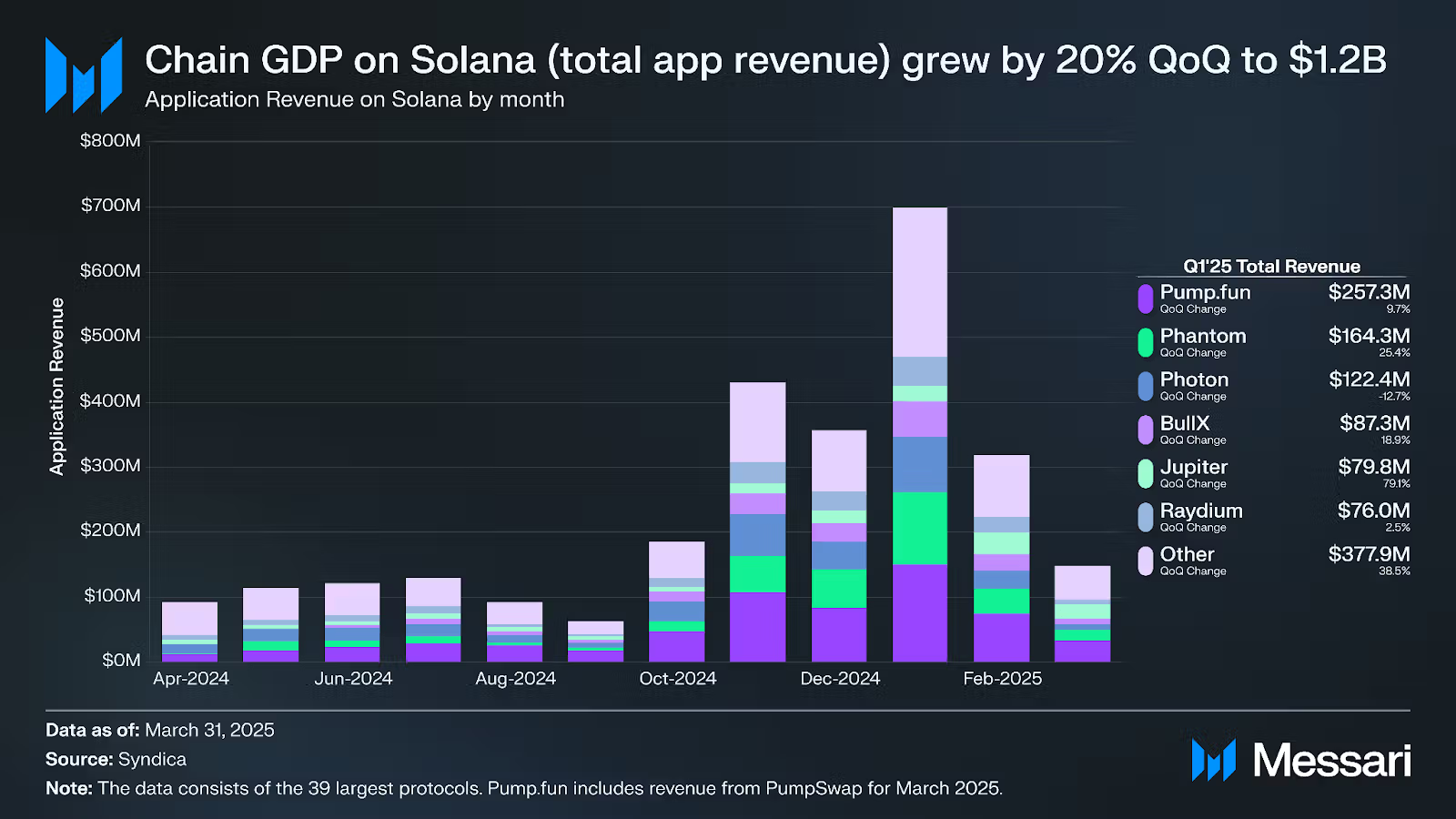

According to a report from Messari, Solana (SOL) achieved a total app revenue (Chain GDP) of $1.2 billion in Q1 2025. This result marks a 20% growth compared to the previous quarter, with $970.5 million. It is the highest-performing quarter for Solana in the past 12 months, demonstrating a strong ecosystem recovery after a year of significant volatility.

“Solana’s economy is booming,” Crypto Banter commented on X.

Notably, January contributed nearly 60% of the total revenue for the entire quarter. This growth reflects the increasing demand for applications on Solana, particularly in meme coins, DEXs, and cryptocurrency wallets.

Solana’s recovery can be attributed to several factors, including low transaction fees and high processing speeds, which are competitive advantages of this blockchain compared to rivals like Ethereum.

Pump.fun Takes the Lead

Among the Dapps on Solana, Pump.fun emerged as a standout leader with a revenue of $257 million, accounting for a significant portion of the ecosystem’s total revenue.

The success of Pump.fun can be explained by the ongoing trend of meme coins capturing the community’s attention, particularly following the launch of the Trump meme coin on January 17, which boosted trading activity on Solana. However, the rapid explosion of Pump.fun has brought many bad consequences to the market.

Following Pump.fun is the Phantom wallet, which secured second place with a revenue of $164 million. Phantom has long been one of the most popular wallets on Solana due to its user-friendly interface and seamless integration with various DeFi and NFT applications.

Photon ranks third with a revenue of $122 million, up 13% from the previous quarter, demonstrating steady growth for the application.

DeFi TVL Plummets, But Stablecoins See Breakthrough Growth

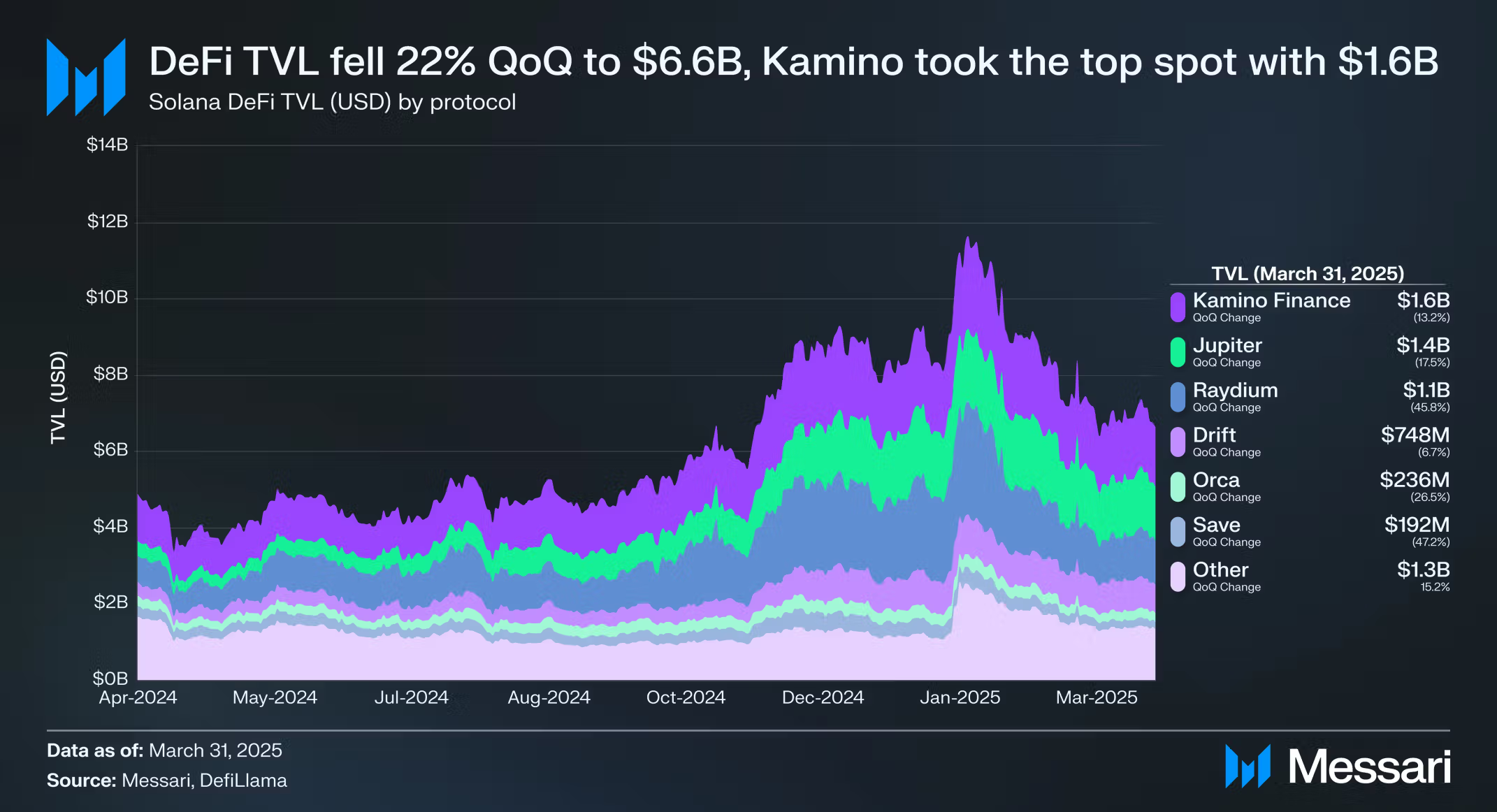

Despite the impressive growth in Dapp revenue, the total value locked (TVL) in DeFi protocols on Solana dropped sharply by 64%, reaching $6.6 billion. This decline may result from volatile market sentiment, as investors withdrew capital from DeFi protocols to shift toward safer assets like stablecoins.

Meanwhile, the stablecoin market on Solana witnessed breakthrough growth, with its total value surging by 145% to $12.5 billion. Notably, USDC—the leading stablecoin on Solana—recorded a 148% increase compared to the previous month, reaching a value of $9.7 billion, four times that of its main competitor, USDT.

USDT also showed strong performance, growing by 154% to reach a value of $2.3 billion.

Transaction Fees Drop

Another highlight from Messari’s report is the reduction in transaction fees on Solana. The average transaction fee in Q1 2025 fell by 24% compared to the previous quarter, dropping to 0.000189 SOL (equivalent to $0.04).

This low fee level is one of the primary reasons Solana continues to attract users and Dapps, particularly in sectors like meme coins, DeFi, and NFT trading.

Q1 2025 marked a significant step forward for Solana, with app revenue reaching $1.2 billion. However, the 64% drop in DeFi TVL is a concerning signal. The ecosystem faces numerous challenges, including volatile market sentiment and competition from other blockchains.

To maintain its growth momentum, Solana must continue leveraging its advantages in low transaction fees and high processing speeds while addressing DeFi-related issues to attract more capital from investors.

SOL is trading at $161.22 at press time. Technical indicators suggest SOL is entering a likely consolidation phase near key support. However, some traders remain very optimistic about it.

“$SOL – Sol monthly chart is forming a massive ascending triangle pattern. breakout will trigger a massive leg up,” an analyst commented

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.