Ethereum (ETH) remains under pressure, struggling to break above $2,300. Its technical indicators still point to a downtrend. The BBTrend indicator is improving but remains negative, showing that bullish momentum hasn’t fully developed.

At the same time, the number of Ethereum whales has increased slightly, possibly due to the White House Crypto Summit, as investors anticipate regulatory shifts or the inclusion of ETH in the US strategic crypto reserve. For ETH to turn bullish, it needs to break key resistance levels and sustain buying pressure.

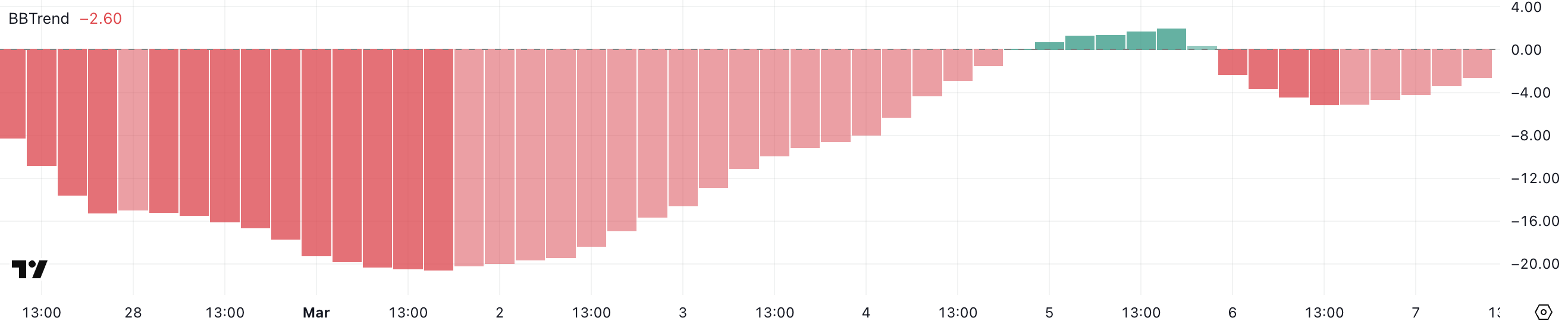

BBTrend Shows the Uptrend Isn’t Here Yet

Ethereum’s BBTrend indicator has climbed to -2.6, improving from -5.12 just a day ago. BBTrend, short for Bollinger Band Trend, is a technical indicator that helps identify price trends and momentum by measuring price deviations from a moving average.

When the BBTrend is deeply negative, it suggests strong bearish momentum, while a positive reading indicates bullish strength.

For Ethereum’s bullish uptrend to gain traction, BBTrend needs to cross above 0 and break higher levels. Two days ago, it briefly turned positive but only reached 1.98 before reversing lower, signaling weak buying pressure.

If BBTrend can push beyond its previous high and sustain positive levels, it would confirm stronger momentum, increasing the chances of Ethereum’s price maintaining a bullish trend.

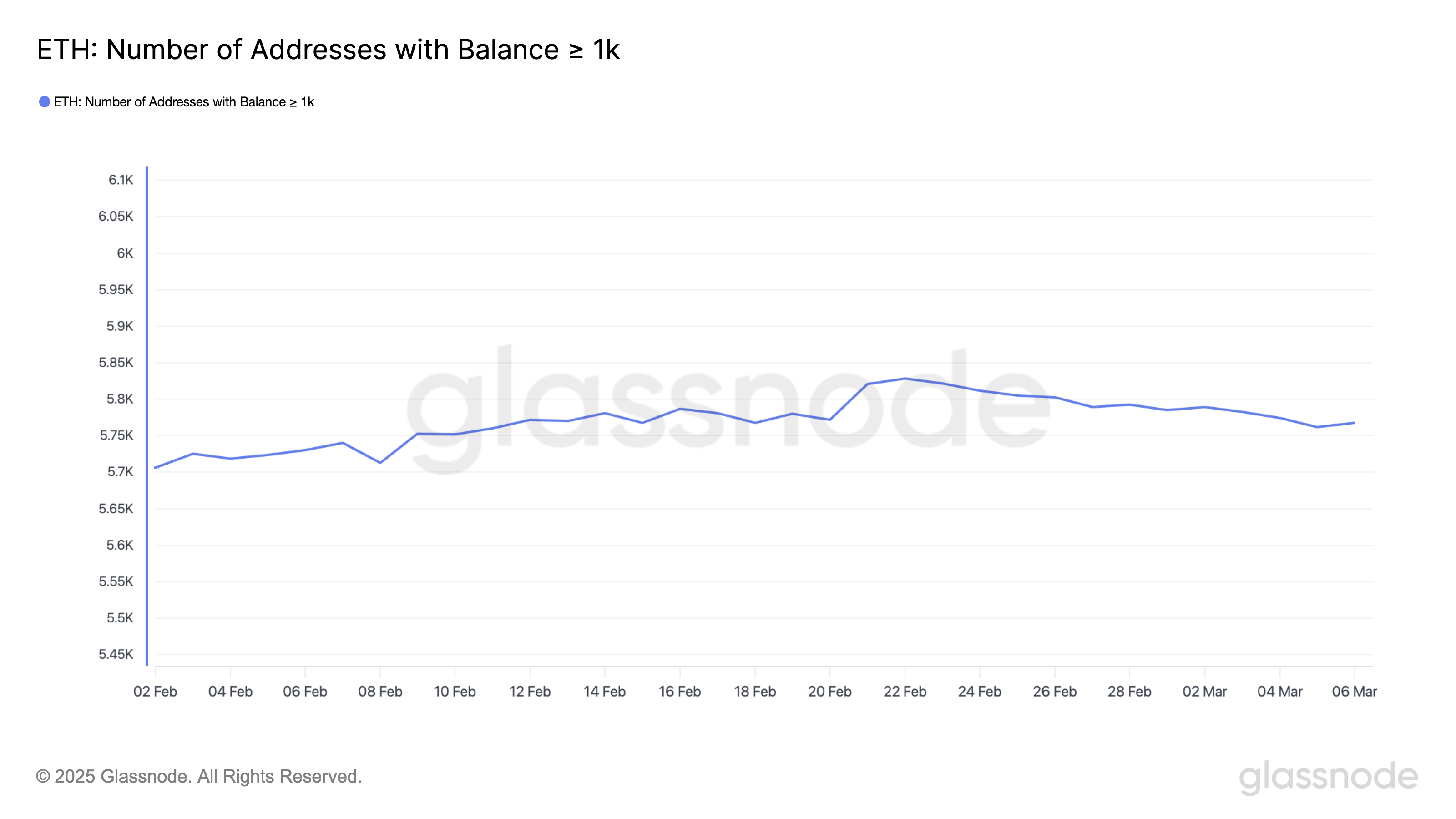

Whales Accumulated ETH, But The Overall Trend Is Still Down

The number of Ethereum whales – addresses holding at least 1,000 ETH – has risen slightly to 5,768, up from 5,762 on March 5. However, the broader trend remains downward, as the count was 5,828 on February 22.

Tracking these large holders is crucial because whale activity often signals shifts in market sentiment, with accumulation suggesting confidence in price appreciation and distribution indicating potential selling pressure.

This recent uptick in whale numbers could be linked to the White House Crypto Summit, as major investors may be positioning themselves ahead of potential regulatory developments and the inclusion of ETH in the US strategic crypto reserve.

If this increase continues, it could indicate renewed confidence in Ethereum’s long-term outlook. However, for a stronger bullish case, a sustained rise in whale accumulation would be needed, reversing the recent downtrend.

Will the White House Crypto Summit Benefit Ethereum?

Ethereum has struggled to break above $2,300 in recent days. Its EMA lines still signal a downtrend as short-term averages remain below long-term ones.

If selling pressure increases, Ethereum price could test support at $2,077, and a breakdown below this level might push it as low as $1,996, reinforcing the bearish outlook.

However, if Ethereum reverses its trend, it could challenge resistance at $2,550 and potentially climb toward $2,855.

A strong breakout above these levels could set the stage for ETH to reclaim $3,000, a level it hasn’t reached since February 1, 2025, signaling renewed bullish momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.