Ethereum has long been the undisputed king of smart contract platforms. However, as 2025 progresses, cracks in its foundation have begun to show.

The Ethereum Foundation (EF), a nonprofit organization tasked with stewarding the blockchain’s development, is facing one of its most turbulent moments yet.

EF’s Leadership Turmoil: Conflict of Interest and Transparency Issues

Leadership shakeups, internal conflicts, and a controversial $165 million DeFi investment have raised concerns over Ethereum’s governance and neutrality. These struggles have come at a critical moment. The crypto market is changing, and new contenders are emerging as serious challengers for Ethereum’s position as the second-largest cryptocurrency.

Vitalik Buterin recently confirmed a restructuring within the Ethereum Foundation to address long-standing governance issues. This overhaul was prompted by controversies such as the EigenLayer scandal, where two Ethereum Foundation researchers, Justin Drake, and Dankrad Feist, took highly lucrative advisory roles with EigenFoundation.

“What is a core EF contributor doing when he accepts roles on projects that have conflicted incentives with Ethereum? Where’s the credible neutrality,” eMon, a popular user on X, quipped.

EigenLayer, a restaking protocol, allows users to leverage their liquid-staked ETH on other networks. Beyond increasing capital efficiency, this raises concerns about Ethereum’s security model. When crypto trader Cobie leaked that Drake and Feist had received millions in vested EigenLayer’s EIGEN tokens, the community reacted with outrage.

Critics saw this as a clear conflict of interest, with Ethereum insiders profiting from their influence over protocol development. The backlash led the Ethereum Foundation to introduce a formal conflict of interest policy in May 2024.

Drake eventually resigned from EigenLayer, but Ethereum’s credibility had already been damaged. Many questioned whether Ethereum’s researchers and decision-makers could be trusted to act in the network’s best interest rather than their financial gain.

Ethereum Foundation’s $165 Million DeFi Investment

As the EigenLayer controversy unfolded, the Ethereum Foundation made another eyebrow-raising decision. It committed 50,000 ETH (approximately $165 million) to DeFi. The move aimed to replenish EF’s treasury, which had shrunk by 39% over the past three years. The EF allocated the funds through a 3-of-5 multi-signature wallet and deployed them into lending protocols like Aave and Lido.

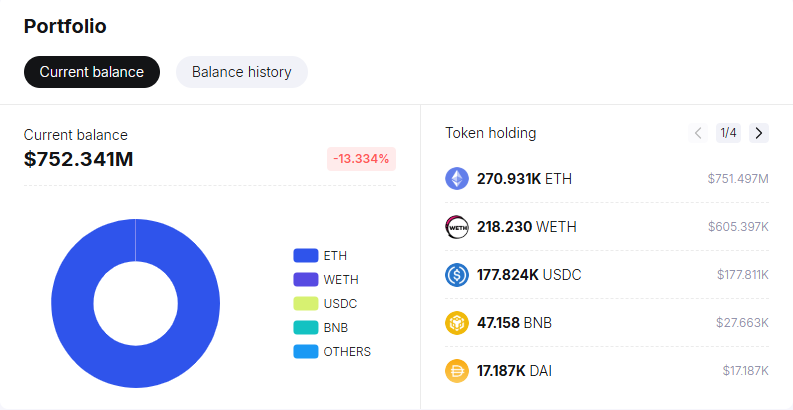

According to data on Spotonchain, the treasury held $752 million as of this writing.

The Ethereum Foundation avoided staking its ETH for years due to concerns about regulatory risks and network neutrality. However, with ETH struggling against Bitcoin and Ethereum losing ground in developer and user activity and market share, EF decided to take a more aggressive financial approach.

Some see this as a smart move to generate passive income, while others believe it signals desperation amid Ethereum’s declining dominance.

Gas Limit Debate: Scaling Solution vs. Network Risk

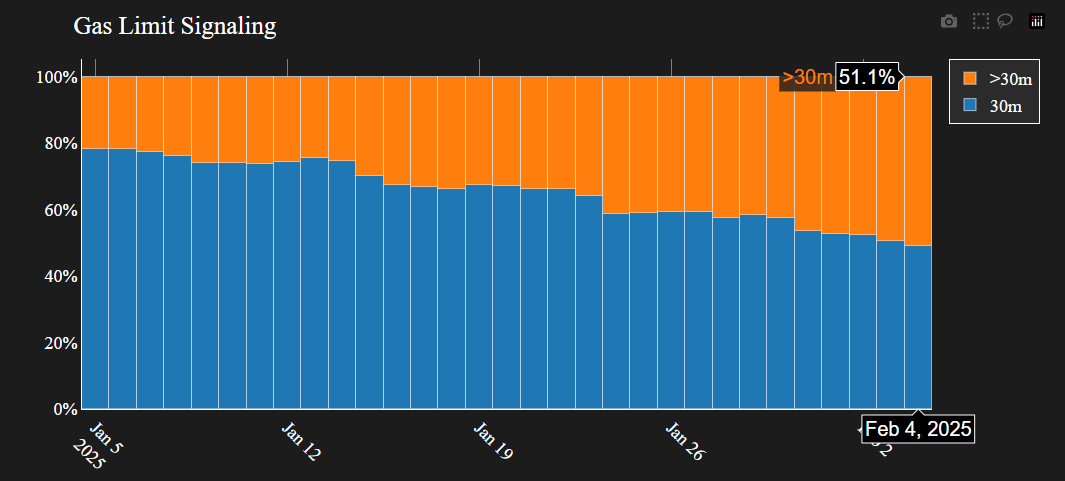

At the same time, Ethereum is undergoing another critical debate around increasing its gas limit. The Ethereum gas limit has surpassed 32 million, with nearly 52% of validators signaling support for an increase.

The argument is that raising the gas limit would lower transaction fees and improve network efficiency.

“This will be the first increase under proof of stake. Because PoS is so much more decentralized than obsolete tech like PoW, it took longer to coordinate. Who will be the hero to put us over the top,” posed Evan Van Ness, the former Consensys director of operations.

However, not everyone agrees. Critics warn that increasing the gas limit too aggressively could destabilize Ethereum. Specifically, they say it would make it harder for smaller validators to participate, potentially leading to further centralization.

Meanwhile, Ethereum co-founder Vitalik Buterin calls for the Pectra Fork, which promises better network usability.

“…IMO we should make the blob target also staker-voted so that it can increase in response to technology improvements without waiting for hard forks,” Buterin shared on X.

With Ethereum already grappling with restaking risks, conflicts of interest, and governance disputes, the gas limit debate adds another layer of uncertainty to the blockchain’s future.

Ethereum vs. the Competition: Possibilities of a New #2

With ETH underperforming compared to other assets, investors are looking at potential challengers. Solana, for example, has seen a resurgence, attracting developers and users with its low fees and high-speed transactions. Nevertheless, IntoTheBlock’s senior research analyst Juan Pellicer says Solana still has a long way to go before it can dethrone Ethereum.

“While Solana may continue to grow and potentially challenge Ethereum in specific niches, overcoming Ethereum’s entrenched position as the dominant platform in the immediate future is still unlikely, though the competitive landscape is dynamic and evolving,” Pellicer told BeInCrypto in an exclusive.

Meanwhile, Binance Smart Chain (BSC), Avalanche (AVAX), and even modular blockchain solutions like Celestia (TIA) are gaining traction. Against this backdrop, the question is no longer whether Ethereum will remain the dominant smart contract platform. Instead, it is whether it can maintain its position as the second-largest cryptocurrency.

If Ethereum continues to struggle with governance issues and scalability challenges while competitors offer better efficiency and user experiences, its place in the market could be at risk. Given all these developments, should investors still consider Ethereum in 2025?

Despite its ongoing issues, Ethereum remains the most decentralized and widely adopted smart contract platform. Its strong developer ecosystem, deep liquidity, and established infrastructure give it a significant edge. The recent leadership restructuring, the conflict of interest policy, and treasury management changes indicate that EF is taking steps to correct its course.

However, the risks are undeniable. Ethereum is at a crossroads, where its next moves will determine whether it can maintain its dominance or if a new market leader will dethrone it. Investors should weigh these factors carefully, balancing Ethereum’s strong fundamentals with the uncertainty surrounding its governance and future development.

Nevertheless, Ethereum is changing, and the community must decide whether these changes are for the better or signal the beginning of its decline.

BeInCrypto data shows ETH was trading for $2,812, up by almost 9% since Tuesday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.