SUI price has grown by 27.82% in the last 30 days, driven by notable changes in its Total Value Locked (TVL). After a strong surge in both TVL and price, SUI appears to be entering a consolidation phase. This stabilization suggests a pause in the upward momentum, possibly indicating a period of market indecision.

The future direction could depend on whether SUI’s TVL sees renewed growth or remains stagnant, with a potential correction in play.

SUI TVL: Consolidation After a Strong Surge

SUI’s Total Value Locked (TVL) experienced an impressive surge, rising from $308 million on August 4 to $1.096 billion by October 14. This remarkable 255% growth over roughly two months stands out, especially for a protocol as substantial as SUI.

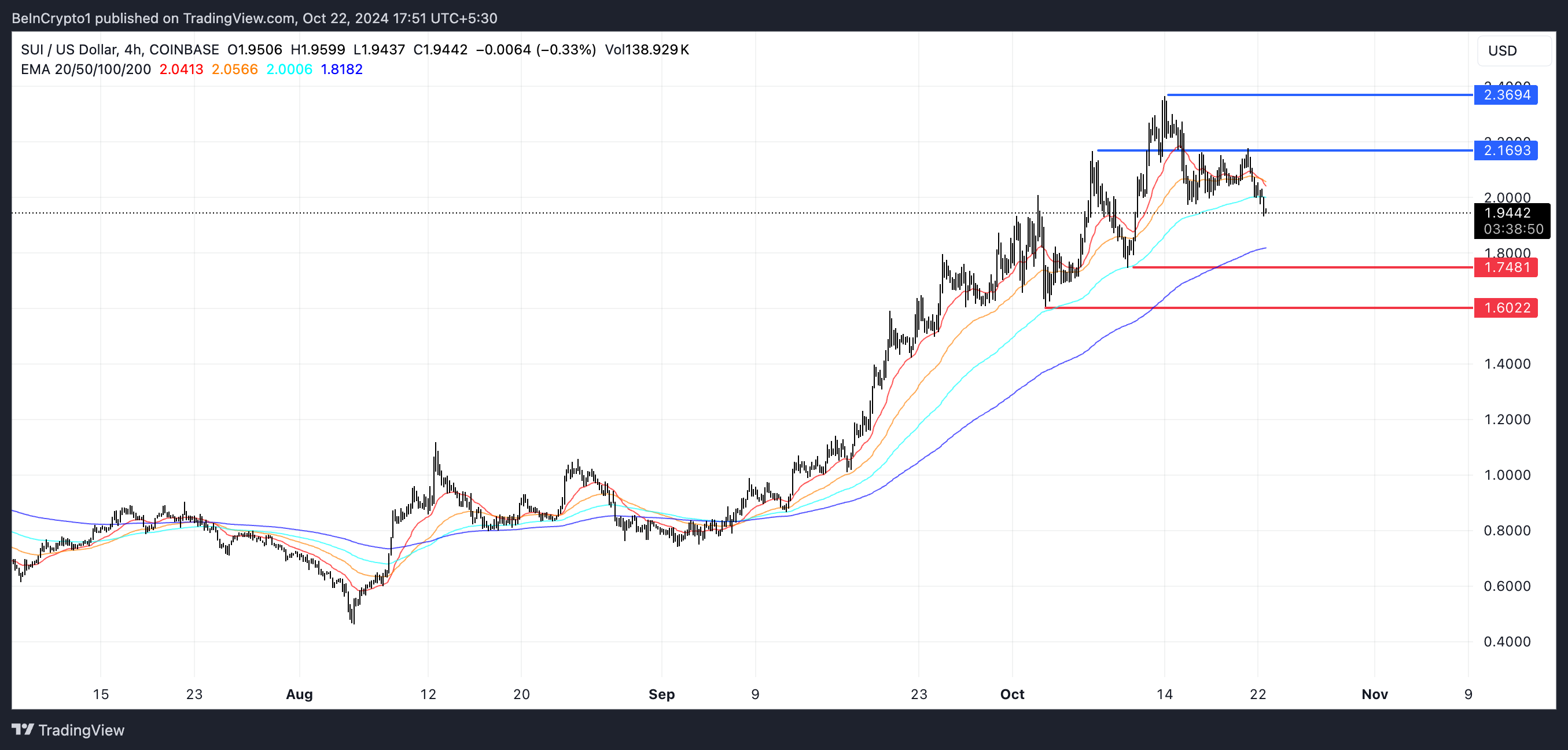

This growth was accompanied by a significant increase in SUI price itself, climbing from $0.46 to $2.36. That represents a staggering 391% growth in the same period.

However, following that surge, SUI’s TVL has shown signs of stability, consistently hovering around $1 billion without further gains since early October.

This plateau suggests that after the sharp rise in both TVL and price, SUI might be transitioning into a consolidation phase or potentially even gearing up for a correction, as the rapid growth appears to have cooled off.

Read more: A Guide to the 10 Best Sui (SUI) Wallets in 2024

SUI ADX Shows the Current Downtrend is Still Not That Strong

SUI’s ADX is currently at 16.82, indicating the strength of the current trend. With a value below 20, this suggests that the trend is still weak, implying limited directional movement in the market.

The ADX is a valuable indicator as it helps gauge the momentum of a trend, whether upward or downward.

The ADX (Average Directional Index) values are generally used to determine how strong a trend is, with numbers between 20 and 40 signaling moderate strength and anything above 40 showing a very strong trend. Just two days ago, SUI’s ADX was at 9, showing a noticeable increase recently.

As SUI seems to be heading into a downtrend, a continued rise in ADX would imply a strengthening bearish momentum, which could lead to a significant correction in the next few days.

SUI Price Prediction: Will SUI Form a Death Cross Soon?

SUI’s EMA lines currently indicate that its short-term averages are trending downward and could soon cross below its long-term averages. This is often referred to as a “bearish crossover,” which suggests that bearish momentum may be gaining strength.

Such a crossover can indicate the beginning of a potential downtrend as short-term price sentiment weakens compared to the longer-term outlook.

Read more: Everything You Need to Know About the Sui Blockchain

If this bearish crossover occurs, SUI has support levels at $1.74 and $1.60, pointing to a potential correction of up to 17%. On the other hand, if SUI’s Total Value Locked (TVL) starts to grow again and sparks a renewed price rally, the price could test resistance at $2.16.

Should that level be broken, SUI could also test $2.36, which would represent a possible 21% price increase.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.