The crypto markets are gearing up for a news-packed week, with several key events on the horizon.

Meanwhile, Bitcoin (BTC) flipped green after climbing above $63,000, signaling that “Uptober” might be in play again.

FTX Court Hearing

The deadline for the court hearing related to FTX creditor repayments is on October 7, amid chatter that the exchange will begin distributing $16 billion to its creditors sometime this month. BeInCrypto reported on the controversy, with creditors angry about the abysmal compensation coming their way.

FTX creditor activist Sunil Kavuri explained expectations in a recent post on X. He said that if the court approves the repayment plan, claimants expecting amounts below $50,000 could start receiving payments by late 2024. However, those owed larger sums may have to wait until mid-2025.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

However, FTX token FTT recorded significant volatility amidst buzz about the upcoming hearing. Token deposits increased as traders positioned for potential exits amid volatility ahead of a crucial hearing.

OKX Delists These Five Tokens

OKX exchange also makes it to the top crypto news this week, with five tokens up for delisting, according to a late September announcement. On October 8, the exchange will delist spot trading for REN, TAKI, LEASH, ORB, and KINE tokens.

“We advise users to cancel orders on these trading pairs (REN/USDT, REN/USDC, TAKI/USDT, LEASH/USDT, ORB/USDT, and KINE/USDT) before the delisting. Otherwise, the system will automatically cancel these orders. The cancellation may take 1-3 working days,” the exchange said.

Token delisting typically causes a drop in trading volume and liquidity, making it harder for holders to sell at fair prices. It often leads to sharp price declines as investors panic sell or lose confidence in the token. Consequently, holders may face significant losses in the value of their assets.

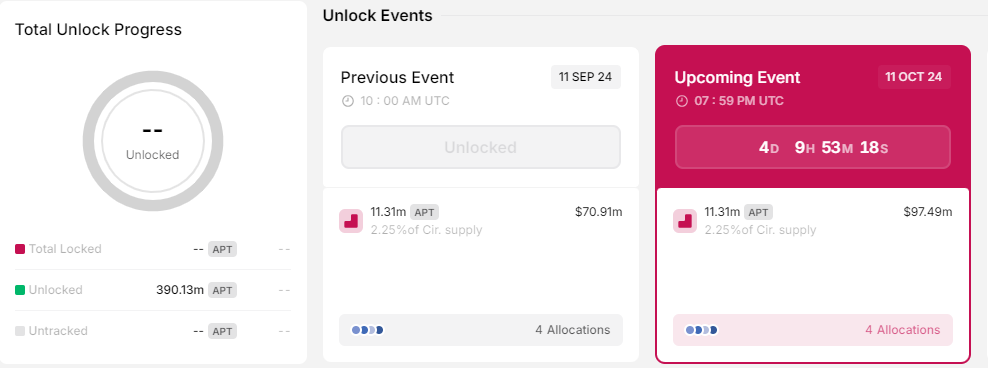

EIGEN and APT Token Unlocks

EIGEN token holders should brace for volatility ahead of a $35.75 million worth of unlocks on Tuesday. An official announcement from the Eigen Foundation said this unlock event would bring new opportunities for participation across the EigenLayer ecosystem. Notably, this will mark the network’s first cliff unlock event.

On Friday, October 11, the Aptos ecosystem is set to unlock 11.31 million APT tokens, valued at $97 million based on current prices. These tokens will be distributed among the foundation, community, core contributors, and investors.

Tokens allocated to the community and investors may enter the market quickly as holders cash in for short-term profits. This influx could potentially impact APT’s price, creating downward pressure.

HBO’s Big Satoshi Nakamoto Reveal

Satoshi Nakamoto’s identity may become public information this week, with American television network HBO due to premiere its much-awaited documentary on Tuesday. Opinion polls on Polymarket suggest Len Sassaman may be the creator of Bitcoin.

Sassaman, now late, was an American technologist, cryptographer, and privacy advocate, a befitting profile for the pseudonymous Satoshi Nakamoto. He is said to be the biggest crypto billionaire ever, holding 1.1 million BTC tokens worth almost $67.5 billion at current rates.

“Len Sassaman’s wife had direct communication with the “creator” of Bitcoin After he died she was “thinking about” fundamentally altering Bitcoin She still has access to his “old hard drives” which means she has access to 1 million Bitcoin (5% of all Bitcoin, worth nearly$65 billion),” one X user commented.

Stacks Nakamoto Hard Fork

Nakamoto is making headlines twice in crypto news this week, with the second being the upcoming Stacks hard fork on October 9. It is a major upgrade on the Stacks network designed to bring several benefits, the main ones being increased transaction throughput and 100% Bitcoin finality.

With this upgrade, the Stacks blockchain would realize new capabilities and improvements, focusing on key advancements. These include improved transaction speed, enhanced finality guarantees for transactions, mitigated Bitcoin miner MEV (miner extractable value) opportunities that affect PoX, and enhanced robustness against chain reorganizations.

PEPPER Airdrop Snapshot

After the first snapshot on September 30, fan engagement Web3 project Chiliz (CHZ) has another airdrop of its PepperChain (PEPPER) token to CHZ holders on October 10 across major exchanges outside the US.

PEPPER airdrop is part of a continued strategy to expand and diversify the Chiliz ecosystem. The ecosystem is popular for its fan token platform and is deeply involved in the sports and entertainment industries.

Read more: What are Crypto Airdrops?

The addition of PepperChain positions Chiliz for community-centric initiatives that will reward active participation and engagement.

Upbit Suspends MKR and DAI Trading

Korea’s largest exchange, Upbit, will suspend trading pairs for MKR/BTC and DAI/BTC from 14:00 local time on October 11, 2024. This will support brand reshaping as Maker transitions to Sky Protocol and its MKR token changes to Sky.

Similarly, Dai stablecoin will change to USDS. The suspension will last until the rebranding and token exchange is completed.

The DeFi community has its reservations about the rebranding. Some laud the move as a necessary evolution in response to market demands. Meanwhile, others are concerned that it shifts away from the decentralized principles that originally defined MakerDAO.

“MakerDAO was an OG DeFi protocol aiming to build an autonomous, decentralized stablecoin with low volatility against fiat currency, backed by ETH. DAI is now migrating to USDS, a stablecoin that goes against its original vision,” Lumberg, one of the prominent DeFi community members, commented.

Still, others say the change could have long-term effects on the DeFi sector, as introducing USDS and SKY could lead to a centralization trend within the space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.