Since mid-June, BNB’s price has struggled to break through the resistance block between $575 and $619 despite attempts to rally. Although market sentiment initially pointed to a potential breach, technical indicators now suggest that BNB may face another rejection.

The altcoin’s recent price action indicates that a drop could be imminent, even as the broader crypto market tries to stabilize.

BNB Is on the Edge of Reversal

The Relative Strength Index (RSI) for BNB has shown a repeated pattern of reversals each time the indicator approaches the overbought zone. Historically, whenever the RSI nears this level, BNB’s price has pulled back.

At present, the RSI is at its highest since mid-June, signaling a potential drawdown. Given the RSI’s tendency to trigger reversals in BNB’s price, this could be an early warning for investors.

This consistent behavior in the RSI suggests that BNB may struggle to maintain its current upward momentum. With the indicator once again near the overbought zone, the altcoin could face selling pressure in the days ahead, contributing to a potential price drop.

Read More: How To Trade Crypto on Binance Futures: Everything You Need To Know

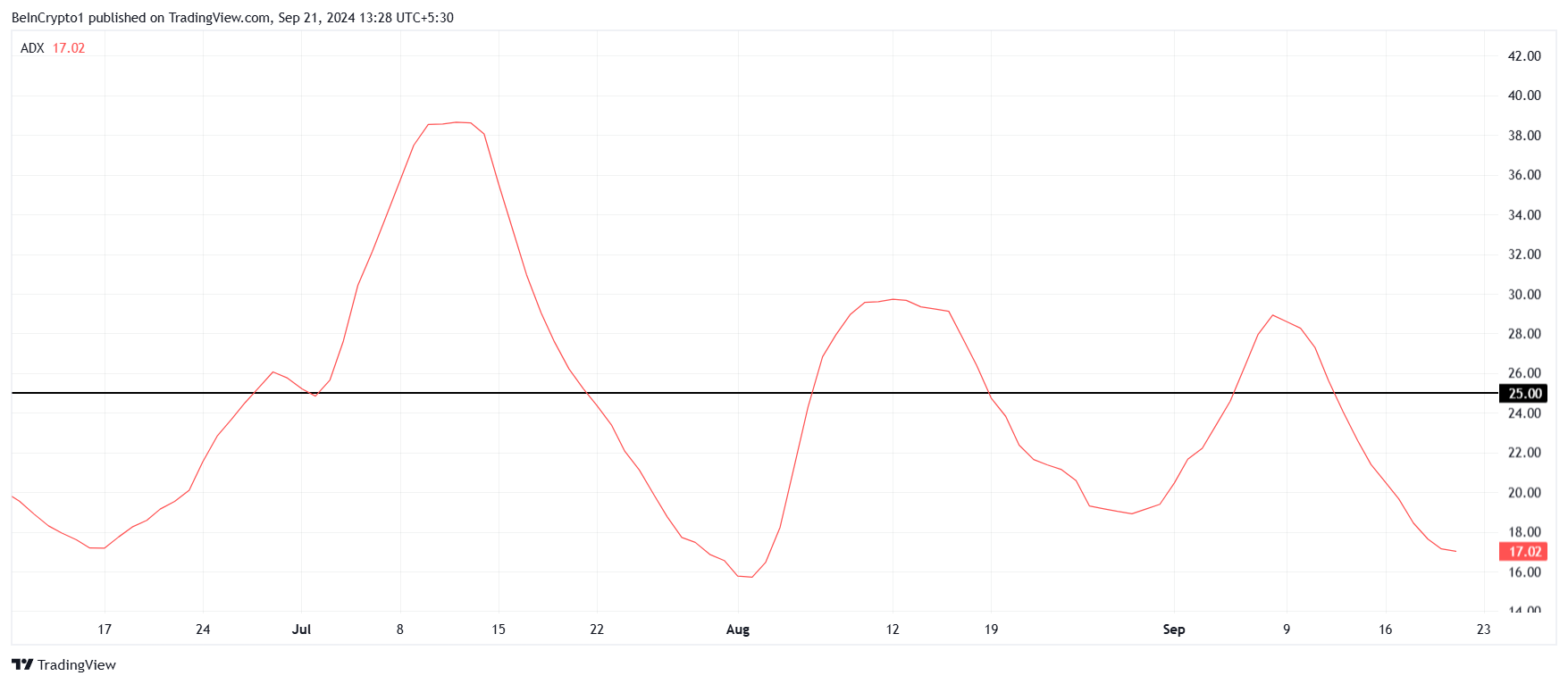

BNB’s macro momentum is backed by the Average Directional Index (ADX), which measures the strength of a trend. ADX is currently well below the key threshold of 25.0, which indicates that the current uptrend lacks the strength needed to sustain itself. As a result, the likelihood of BNB losing its uptrend and entering a downtrend is high.

With the ADX signaling weak momentum, BNB’s price rally may be short-lived. If the active trend loses strength, the altcoin could face a broader market correction, leading to a further decline in its price.

BNB Price Prediction: No New Highs

BNB’s price has risen by more than 9% over the past five days, currently trading at $582. While the altcoin managed to breach the initial resistance at $575, it is likely to fall back before successfully breaching the barrier at $619.

Given the current market conditions and technical indicators, a fall to $550 seems likely. This key level has been tested multiple times and could act as a floor for BNB’s price. However, if BNB falls below $550, the next support level would be at $520.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

Nevertheless, if broader market conditions turn extremely bullish, BNB could test the $619 resistance block again. While a breach of this level is unlikely, it would invalidate the bearish outlook and potentially enable BNB to rise toward $656.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.