Circle has recently integrated USDC, its flagship stablecoin, into both Sony’s Soneium, an Ethereum layer-2 solution, and the Sui blockchain.

By launching on these two platforms, USDC continues its strategy of expanding its stablecoin reach, particularly in decentralized finance (DeFi) and beyond.

USDC Expands Utility on Sui and Soneium to Boost Liquidity

On September 17, Sui, one of the prominent layer-1 blockchains in the market, announced the launch of Circle’s USDC stablecoin alongside the Cross-Chain Transfer Protocol (CCTP). CCTP facilitates secure USDC transfers between blockchains, enhancing the stability and interoperability of Sui’s ecosystem. This addition is expected to improve liquidity and transaction efficiency across multiple applications, including DeFi and digital commerce.

“The availability of USDC as a native asset on Sui marks yet another major milestone in the maturation of the Sui ecosystem. This brings our community seamless access to one of the world’s most trusted digital currencies,” Adeniyi Abiodun, Co-Founder and Chief Product Officer of Mysten Labs—Sui’s developer, told BeInCrypto in an email.

Read more: A Guide to the Best Stablecoins in 2024

The inclusion of USDC on Sui also strengthens its existing decentralized finance scene, which currently has over $700 million in total value locked (TVL) and $215 million in bridged USDC. Sui aims to transition from Ethereum-based bridged USDC to native USDC, ensuring a more seamless experience for developers and users. This transition will occur in collaboration with ecosystem apps, gradually shifting liquidity to the native stablecoin.

As USDC becomes a native asset, Sui’s ecosystem benefits from one of the most widely adopted digital currencies, which can be used for a wide range of financial products. By enabling more efficient cross-chain transactions, USDC helps streamline the user experience across Sui’s DeFi, gaming, and e-commerce sectors.

This development comes after Circle announced its partnership with Sony on September 15. The collaboration aims to integrate USDC as a primary token for transactions on Soneium, Sony’s Ethereum layer-2 (L2) solution. This move will also enable Soneium to offer decentralized solutions for industries ranging from entertainment to global finance.

“Bridged USDC Standard is a specification and process for deploying a bridged form of USDC on Ethereum Virtual Machine (EVM)-compatible blockchains. Bridged USDC serves as a proxy for native USDC held on Ethereum, enabling developers building on layer 2 blockchains like Soneium to readily power their apps with digital dollar payments,” Circle explained in its official statement.

Read more: What is a Stablecoin and How do They Work?

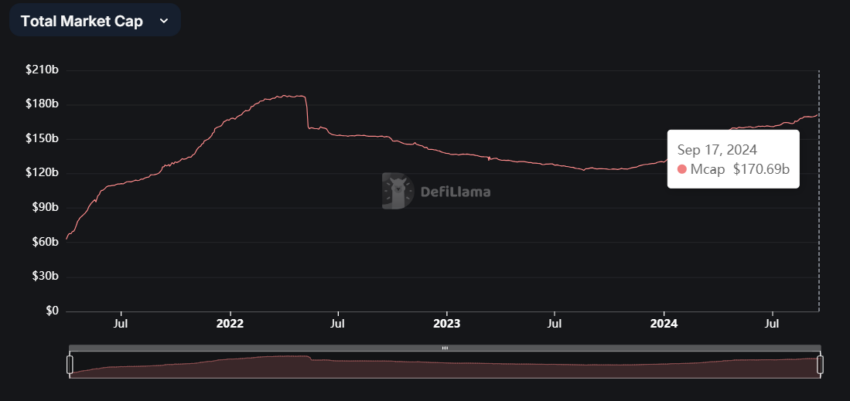

Circle’s decision to expand USDC’s presence on both Sui and Soneium aligns with the growing demand for stablecoins. BeInCrypto recently reported that the stablecoin market has reached $170 billion in total market capitalization, recovering from the downturn following TerraUSD’s collapse in 2022. USDC, with a market cap of $35 billion, remains one of the top stablecoins, alongside Tether (USDT) and Dai (DAI).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.