Over the past week, the Cardano (ADA) price seemed on track to break out of the bullish descending wedge.

However, the changing market conditions did not allow ADA to note a rise, delaying its potential breakout and maybe even invalidating it.

Cardano Investors Could End up Being Disappointed

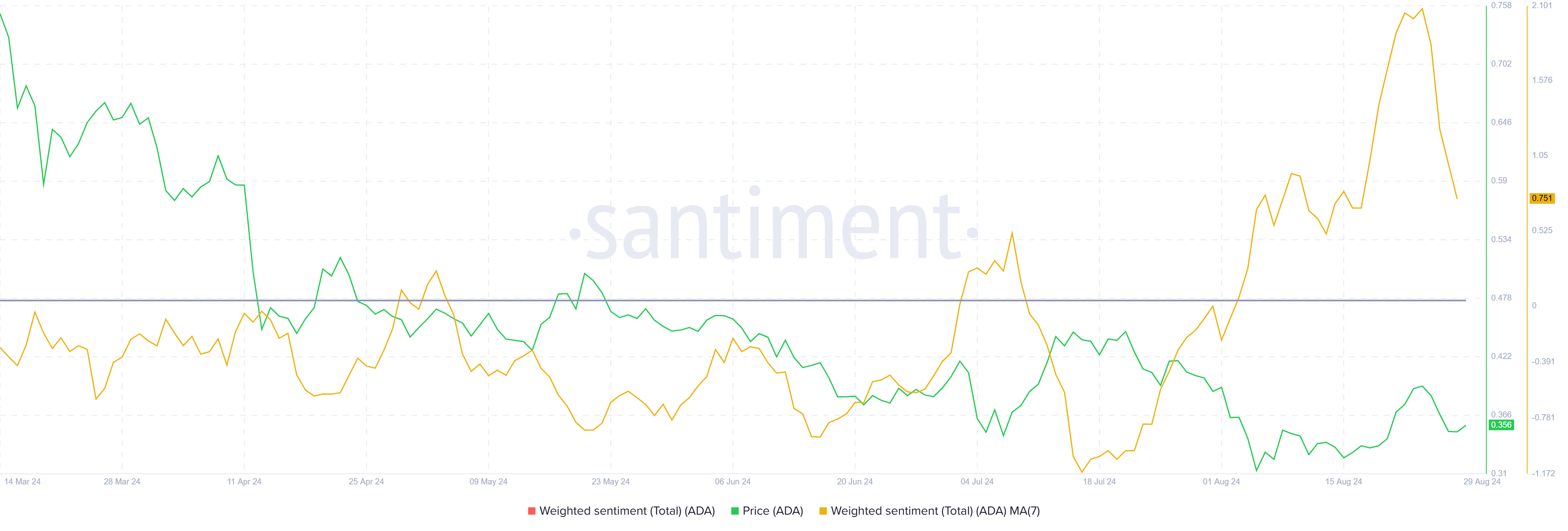

Cardano’s price has completely disregarded its investors’ sentiment over the last couple of weeks. Their bullishness towards Cardano (ADA) is quickly diminishing as the cryptocurrency continues to give in to the broader market’s bearish signals.

The failure of ADA to break out during key market rallies has led to a significant decline in investor confidence. As these failed breakouts accumulate, optimism is diminishing, potentially setting the stage for further downward movement in ADA’s price. This shift in investor sentiment could exacerbate existing bearish trends.

Read More: How To Buy Cardano (ADA) and Everything You Need To Know

Adding to the concerns is the noticeable decline in activity among large wallet holders or crypto whales. Over the past month, the transaction volume of these large holders has dropped by 32%, falling from $7.81 billion to $5.26 billion. This reduction in crypto whale activity reflects a decrease in interest and could further negatively impact ADA’s price.

The dwindling interest from crypto whales suggests a potential lack of confidence in ADA’s short-term prospects. As large investors pull back, their reduced activity might contribute to a deeper price drawdown. This trend indicates that ADA may struggle to regain upward momentum without the support of these influential market participants.

ADA Price Prediction: No Breakout, No Rally

Cardano’s price at $0.35 could end up facing trouble and potentially even failing to break out of the descending wedge. This pattern suggests a 47% rally is on the cards upon breakout, placing the target at $0.53.

However, diminishing optimism could impact keeping ADA under the upper trend line of the pattern. This leaves Cardano’s price vulnerable to a drop to $0.31, which will intensify the drawdown.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

However, if ADA manages to bounce back from $0.31 and break out of the pattern, it has a shot at recovery. For the same, $0.40 would need to be flipped into support, which would invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.