The price of XRP has experienced a bearish trend throughout August, struggling to rebound after dropping below $0.60.

Investor sentiment appears to be reinforcing the broader market’s downtrend, potentially leading to further declines in XRP’s value.

Ripple Investors Are Turning Away

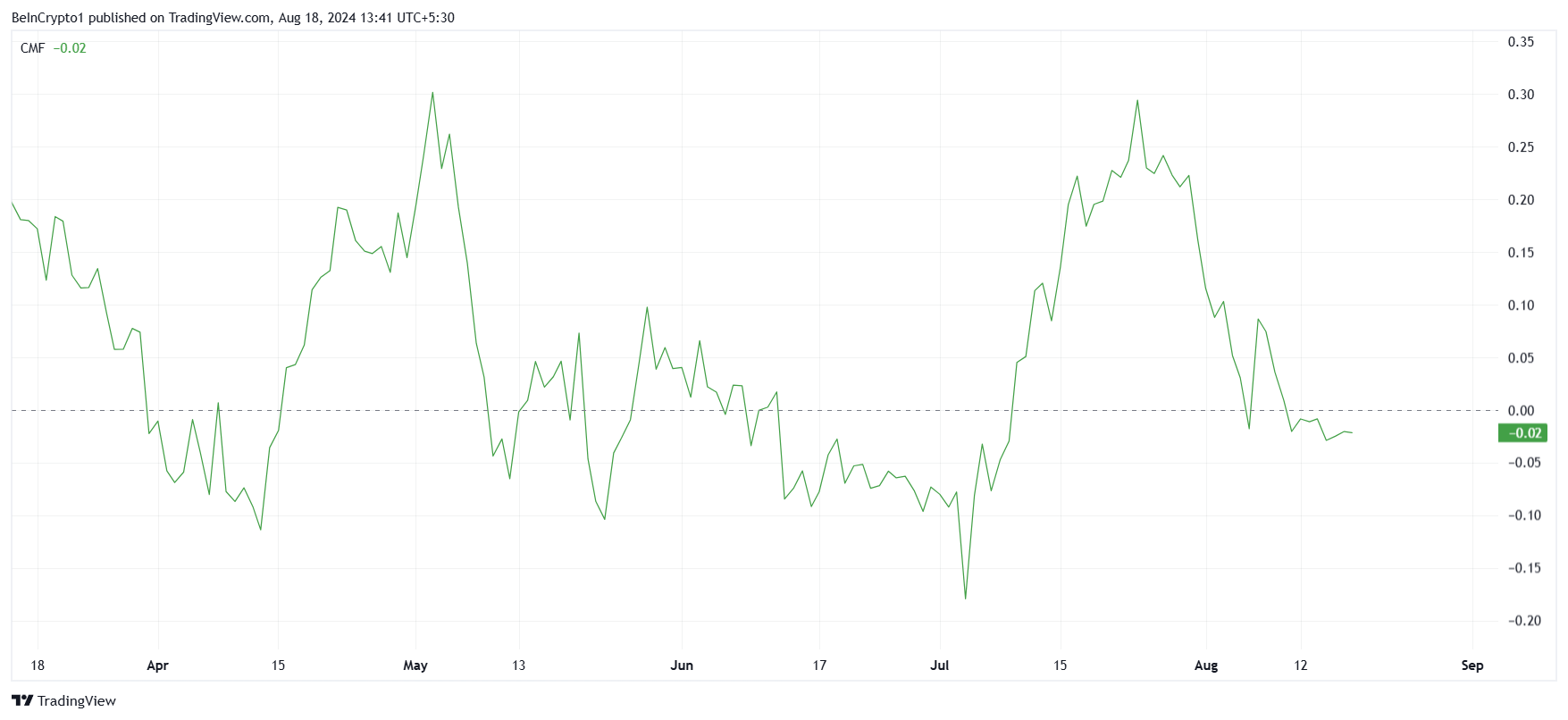

Indicators suggest that XRP’s price is being impacted by a shift in investor sentiment, with capital outflows intensifying. The Chaikin Money Flow (CMF) indicator, which tracks money moving in and out of the asset, shows a clear trend of withdrawals, reflecting declining confidence in XRP.

This outflow is placing downward pressure on the altcoin, leading to increased selling activity and weakening market performance. As investors pull back, XRP faces growing challenges in reversing its bearish trend.

Read more: XRP ETF Explained: What It Is and How It Works

If the trend persists, this could lead to further price declines as the market’s outlook appears increasingly uncertain.

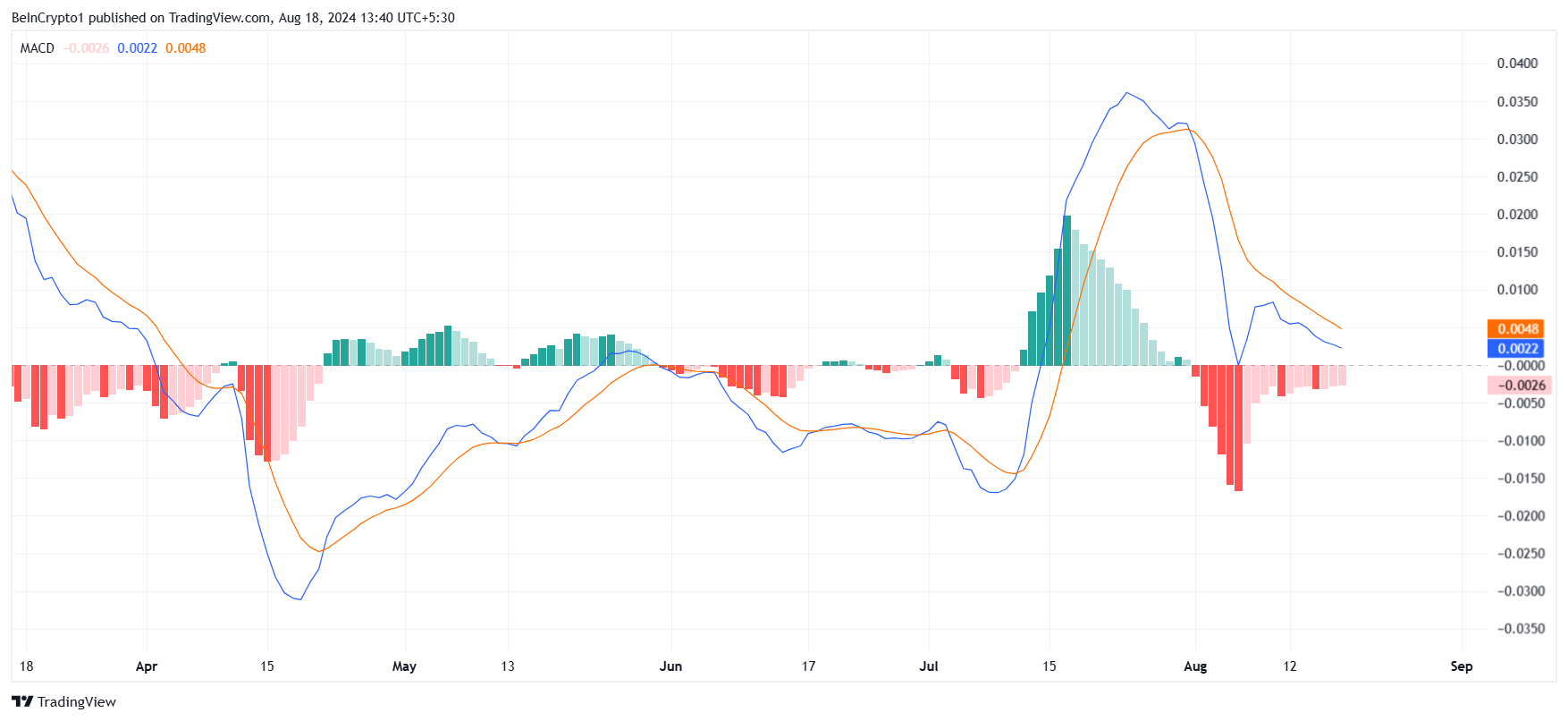

The Moving Average Convergence Divergence (MACD) indicator also reflects this diminishing confidence. The MACD, which is used to assess momentum, shows that XRP’s bullish momentum is fading. Thus, with the lines converging, the indicator hints at a potential continuation of ongoing bearishness.

Overall, the combination of heavy outflows and weakening bullish momentum suggests that XRP is currently under pressure.

XRP Price Prediction: Sideways Ahead

XRP price could fail at noting a recovery and instead keep on with its current consolidation under $0.58. This price coincides with the 38.2% Fibonacci Retracement line, which is currently acting as resistance.

If the factors mentioned above turn bearish, XRP could face another potential drawdown. This would likely push the price toward the 23.6% Fibonacci retracement level at $0.52, a critical support line also known as the bear market support floor.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

On the other hand, if the broader market recovers and XRP price manages to close above $0.58, it could initiate recovery. This would help the altcoin invalidate the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.