The US Securities and Exchange Commission (SEC) is expected to appeal the judge’s ruling in its case against Ripple Labs. The appeal will likely focus on classifying XRP secondary sales as securities.

The anticipated appeal follows a partial summary judgment by Judge Analisa Torres in 2023.

Ripple’s Legal Victory Faces New Threat as SEC Eyes Appeal

Fox Business journalist Eleanor Terrett recently reported that the SEC may challenge the court’s decision on programmatic sales. The agency contends that these transactions also qualify as unregistered securities.

“As court after court has stated, the securities laws apply when firms offer and sell investment contracts, regardless of the technology or labels that they use,” the agency’s spokesperson said in the report.

The appeal will also likely target the reduced fine Ripple was ordered to pay, significantly lower than the SEC’s original demands. BeInCrypto reported that on August 7, Judge Torres ordered Ripple Labs to pay a $125 million penalty for selling XRP without proper registration. Despite the significant fine, Ripple’s executives, including CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty, expressed relief at the ruling. The court’s decision spared the company from the SEC’s initial demand of nearly $2 billion.

Read more: Everything You Need To Know About Ripple vs SEC

The partial summary judgment, delivered in July 2023, has sparked contention between Ripple and the SEC. Ripple hailed the ruling as a victory, but it fell short of establishing a clear legal precedent for other cryptocurrencies.

One of the unresolved issues is whether a written contract is necessary under the Howey test to classify an asset as a security. Ripple’s defense hinges on the argument that one cannot consider XRP security without a written contract — a position the SEC is likely to challenge in its appeal.

The stakes in this case are high because it can possibly influence the entire digital asset industry. The SEC’s enforcement actions and the resulting legal interpretations could set new standards for regulating digital assets in the US.

Read more: Ripple (XRP) Price Prediction 2024/2025/2030

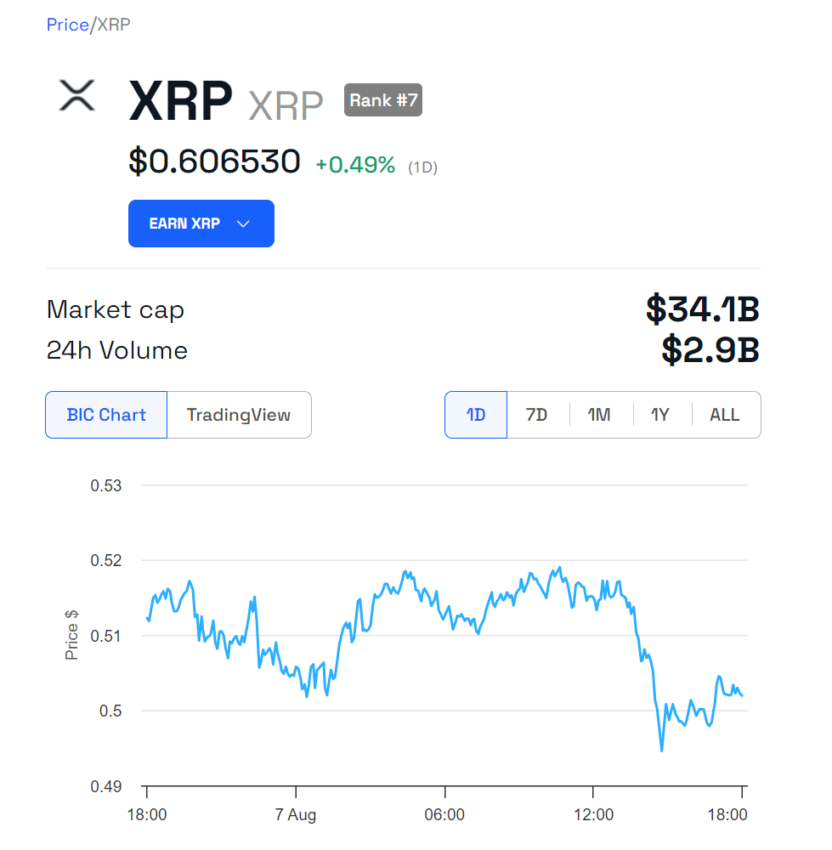

These developments have also had a noticeable impact on XRP’s market performance. After the court’s order, XRP’s price surged by 27%. It rose from $0.5018 to $0.6373 within just one and a half hours.

However, following reports of the SEC’s potential appeal, XRP’s price dropped by approximately 6%, from $0.6415 to $0.6008.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.