Japanese financial services group SBI Holdings has partnered with US investment firm Franklin Templeton to establish a digital asset management company in Japan.

This move prepares Japan to approve Bitcoin exchange-traded funds (ETFs).

SBI and Franklin Templeton Set to Prepare for a New Era of Crypto Investments in Japan

Nikkei recently reported that SBI Holdings will hold a 51% majority stake. Franklin Templeton will own the remaining shares.

“The new company will be ready to launch crypto ETF products as soon as the Financial Services Agency gives approval,” the report reads.

The introduction of Bitcoin ETFs in Japan is anticipated to ease access for retail investors significantly. They can trade these ETFs through regular securities accounts without needing specialized crypto exchange accounts.

“The potential approval of a Bitcoin ETF could prompt serious discussions for much-needed cryptocurrency tax reform. With the current disparity between securities and cryptocurrency tax rates, ETF approval could highlight the need for a more uniform approach. This reform could unlock significant investment in the crypto space, potentially leading to a major shift in market dynamics,” Sota Watanabe, CEO of Startale and Founder of Astar Foundation, told BeInCrypto.

Read more: Crypto ETN vs. Crypto ETF: What Is the Difference?

Additionally, the joint venture plans to offer digital asset securities, leveraging Franklin Templeton’s early involvement in asset tokenization. This approach uses blockchain technology to create tradable ownership tokens for assets like real estate and government bonds.

Jeremy Ng, co-founder of OpenEden, highlighted the strategic importance of this development, particularly regarding geographic diversification for projects seeking approval for ETFs or similar products in more crypto-friendly jurisdictions outside the US, including Japan. He believes the Japanese market for digital assets has tremendous untapped potential.

“Over the past two decades, Japan has struggled to maintain its status as a finance and tech hub, relative to cities like Singapore and Hong Kong. This new push may well see Japan find its way back up the list of global fintech hubs,” Ng explained to BeInCrypto.

Both SBI and Franklin Templeton have been showing interest in the digital assets sector. BeInCrypto reported that SBI has partnered with several prominent players in the Web3 industry, such as Chiliz, Ripple, and Circle.

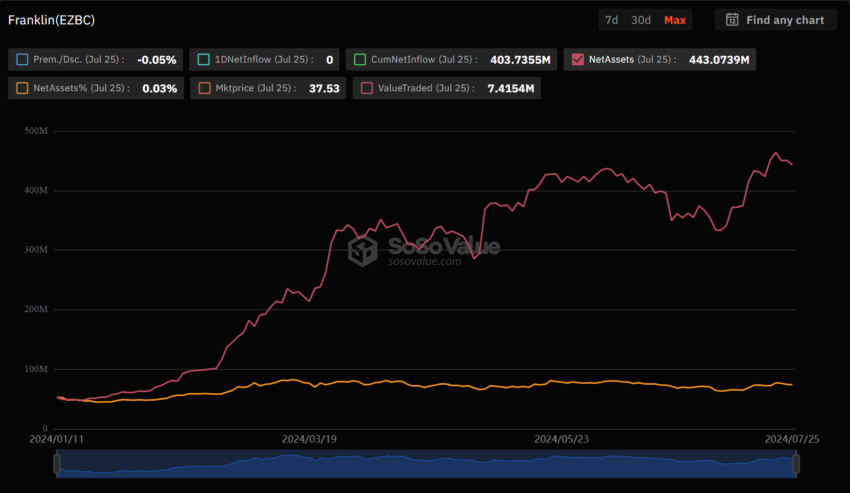

On the other hand, Franklin Templeton, with approximately $1.6 trillion in assets under management, has recently expanded into digital assets by becoming the spot crypto ETF issuer in the US. According to SoSo Value data, Franklin Templeton’s spot Bitcoin ETF, EZBC, currently has net assets of $403.74 million. Meanwhile, its spot Ethereum ETF, EZET, manages assets of $17.79 million.

Japan’s entry into the crypto ETF market aligns it with other Asian nations like Hong Kong and Thailand, which have also embraced these financial products. In April, Hong Kong began trading spot Bitcoin and Ethereum ETFs. Additionally, in June, Thailand’s Securities and Exchange Commission (SEC) endorsed One Asset Management’s launch of a spot Bitcoin ETF limited to wealthy and institutional investors.

Read more: Why do Hong Kong Spot Crypto ETFs Matter?

These developments showcase the growing acceptance and integration of crypto investment products in traditional Asian financial markets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.