Meme coins have emerged as a controversial yet fascinating segment of the cryptocurrency market.

Despite their whimsical origins, these coins present a compelling opportunity for high returns, especially for those willing to embrace significant risk.

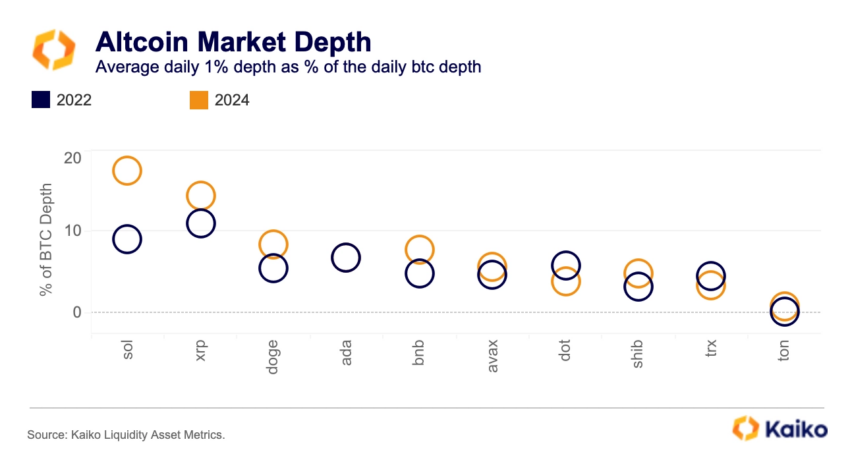

Altcoins Lost Appeal

Will Clemente, co-founder of Reflexivity Research, reflected on how the crypto market has significantly shifted from previous years. He believes that in 2020, the strategy was straightforward. Invest in high-beta altcoins and enjoy the ride as they outperform Bitcoin.

However, this approach has lost its edge. Many altcoins have declined against Bitcoin, a trend Clemente attributed to a maturing market.

“In 2020, you go out on the risk spectrum, those things are going to have higher beta to Bitcoin and you just get long all the vaporware and all that stuff goes up. We have not seen that this time. A lot of the altcoin to Bitcoin pairs have just been bleeding out for several months now and it hasn’t really been as simple as just buy whatever vaporware altcoin and you’ll outperform Bitcoin,” Clemente explained

Read more: 10 Best Altcoin Exchanges In 2024

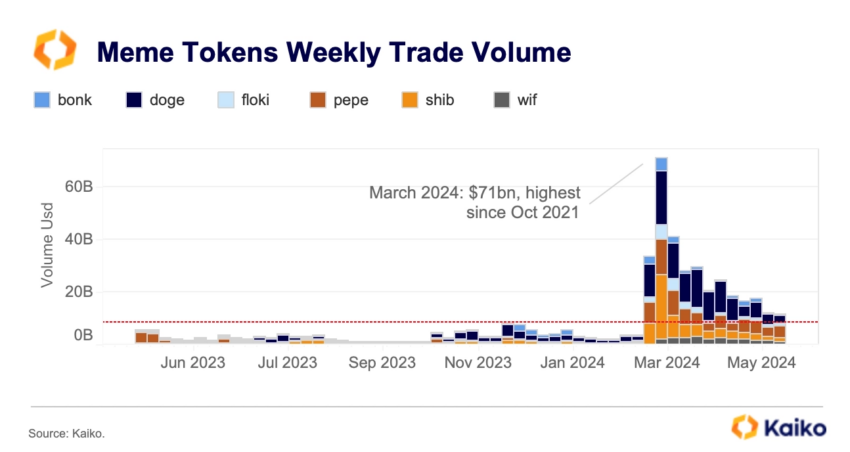

A striking contrast to this trend is the meteoric rise of meme coins. According to Clemente, these tokens have dramatically outperformed many established cryptocurrencies. This phenomenon, he argues, reflects the market’s sentiment and a growing sophistication among investors.

“We have seen dramatic outperformance in the AI coins, but more so the meme coins. That’s kind of this reflection of the market sentiment towards many of the tokens that frankly exist in crypto,” Clemente added.

All-In on Meme Coins

Meme coins stand out in this environment because of their often fair and transparent launches. Unlike many altcoins with low initial floats and high valuations, meme coins typically release their entire supply at launch. This approach resonates with retail investors, who prefer the equitable playing field it creates.

Clemente notes that these coins offer a rare chance for smaller investors to achieve significant gains, sometimes skyrocketing from modest market caps to hundreds of millions in value in days.

“Retail has the ability to capture a liquid unicorn which I don’t know any other market that you could do that… The reality is the average retail participant has a very low likelihood of 10x or 15x on something. But, they have a much higher probability of doing this with with meme coins. So many people coming into the space looking to speculate for the first time are participating in meme coins,” Clemente observed.

Read more: 11 Top Meme Coins to Watch in June 2024

Clemente emphasizes that these coins investing is akin to gambling, with little grounding in fundamentals. Yet, this does not deter many, especially younger investors. He attributes part of their appeal to broader socio-economic factors.

The wealth inequality exacerbated by monetary debasement and the accessibility of speculative activities has driven many to seek fortunes in volatile markets.

“There’s a wealth effect of asset prices going up, people have more money to play around with. People feel priced out of things like real estate. I don’t really see a path to create generational wealth from, you know, maybe if I’ve already created wealth I can preserve it by holding real estate but I don’t see really an option to create wealth of the same magnitude,” Clemente added.

Cultural, Virality Allure

Adding to the allure are meme coins’ cultural relevance and viral potential. Anthony Pompliano, another prominent crypto figure and host of The Pomp Podcast, highlights how these coins tap into internet culture.

“If you think of a meme on the internet, if the meme says the truth that no one wants to say but everyone believes, it usually takes off. When I have talked about some of the meme coins, sometimes it is culturally relevant, sometimes it’s like that made me laugh, sometimes it is understanding some sort of trend or something that fits a moment,” Pompliano explained.

Clemente’s personal investment strategy illustrates his balanced approach. While he holds Bitcoin for its stability and long-term potential, he also diversifies with stocks like Coinbase as a proxy for the broader crypto market. On the other end of the spectrum, he actively trades meme coins, leveraging their high-risk, high-reward nature.

“My portfolio is Bitcoin in cold storage that I’ve never touched and never plan to touch, and then Coinbase as kind of an index on the whole crypto space. On the other side for me is just a lot of these meme coins that I’ve been more actively trading,” Clemente shared.

Read more: How to Buy Meme Coins: A Step-By-Step Guide

In essence, Clemente’s enthusiasm for meme coins stems from their unique position in the crypto market. They offer a blend of cultural engagement and speculative potential, appealing to a new generation of investors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.