Solana’s (SOL) price is observing support from the institutions to observe considerable gains this month.

As the retail investors also join in, the question remains whether SOL can return to $200 before June.

Solana Is Regaining Institutions’ Favor

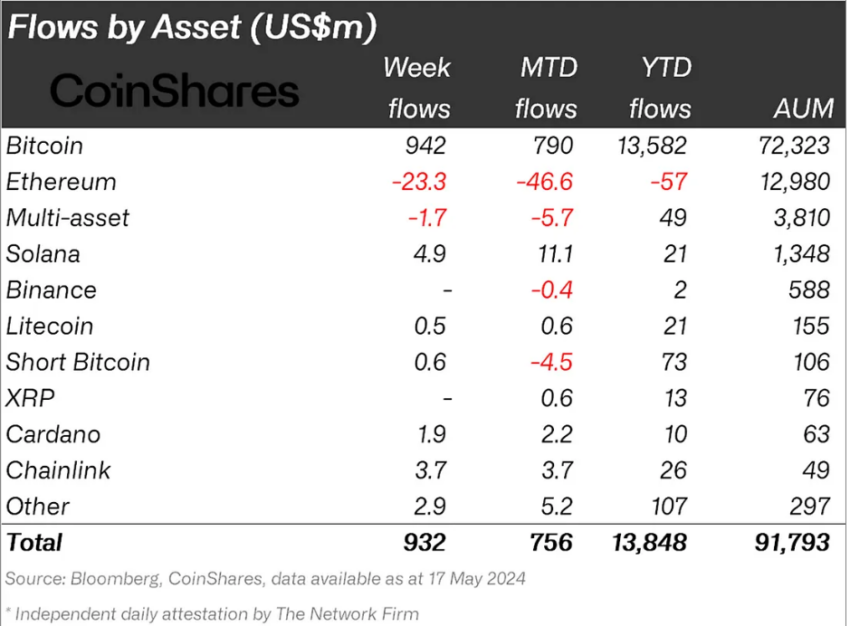

Institutional investors’ actions have always impacted Solana’s price throughout 2022 and 2023. The same bullishness is reviving, with SOL noting $11.1 million in inflows this month.

This surge has made Solana the second best-performing altcoin in institutions’ portfolios after Chainlink, in line with Litecoin’s year-to-date performance.

For the week ending May 17, SOL recorded about $5 million worth of inflows, as the CPI report induced optimism in the crypto market. Since these large wallet holders are known to influence an asset’s price action, it would not be surprising to see Solana react positively in the coming days.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

It’s not just institutions but retail investors who are pining for growth. This is visible in open interest, which represents the total number of active derivative contracts, like options or futures, that have not yet been settled.

It is an important measure of market activity and liquidity, indicating money flow into or out of the market.

This Open Interest rose by $800 million in the past week from $1.77 billion to $2.5 billion. Since the funding rate is positive, it can be ascertained that most of the money has gone towards long contracts.

This means that investors are betting on Solana’s price to rise.

SOL Price Prediction: Key Resistance to Watch

Solana’s price bounced off the support at $169 to trade at $180 at the time of writing. While the aforementioned cues are bullish, the altcoin still faces resistance at $191. Breaching this resistance level will enable further growth.

Should SOL reclaim $200 as a support floor, it could rise above $201, marking a new year-to-date high.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

However, if the breach fails, Solana’s price is vulnerable to falling below the support at $175 to hit $169. If the latter support floor is broken, the bullish thesis would be invalidated, potentially sending SOL to $156.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.