Decentralized exchanges (DEXs) on the Solana blockchain have outperformed those on other networks, recording 210 million transactions over the past 30 days.

This performance reflects Solana’s increasing role in the decentralized finance (DeFi) ecosystem and its capacity to efficiently handle a high volume of transactions.

What Drives Solana’s Success in DEX Transactions?

Data from the Dune dashboard shows that Solana’s DEXs have significantly outperformed 15 other layer-1 (L1) and layer-2 (L2) blockchains. These include Ethereum, BNB Chain, and Arbitrum.

Solana’s 210 million transactions over the past 30 days place it far ahead of its nearest competitors. BNB Chain recorded 29 million transactions, while Arbitrum had 13 million. Ethereum, a major player in the DeFi space, managed only 6.7 million transactions, putting it in fifth place.

Moreover, Solana’s DEXs also saw a remarkable total volume of $47.75 billion and over 11 million unique traders within the same timeframe. These numbers contrast sharply with BNB Chain, which reported a total volume of $20.54 billion and over 4.6 million unique traders.

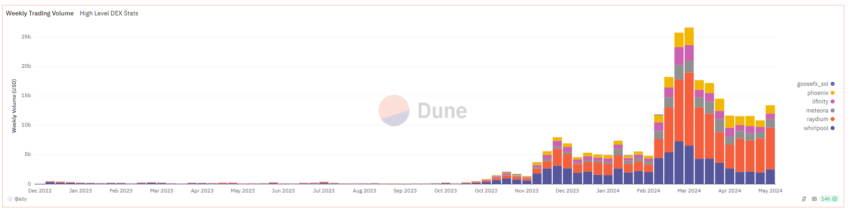

Raydium, a leading Solana DEX, emerged as a key player with an average weekly trading volume of approximately $5 million. Whirlpool and Meteora followed closely, each with average weekly trading volumes of around $1.4 million. Notably, these figures do not include data from some popular Solana DEXs, such as Orca.

Read more: Top 7 Projects on Solana With Massive Potential

The Solana native token (SOL) primarily drove the high transaction numbers. It accounted for roughly 40% of the transactions. Additionally, meme coins and low-capitalization tokens contributed between 20% and 30% of the transactions.

These figures are particularly noteworthy given that meme coins played a significant role in Solana’s performance in Q1 2024. BeInCrypto reported that the market cap of the top 10 Solana meme coins skyrocketed by over 800% during that period. By the end of March, these assets reached a total market capitalization of $9.36 billion.

Solana’s achievements extend beyond transaction numbers. A recent report from CoinGecko highlighted Solana as the fastest among major blockchains. As of April 6, 2024, it had an actual daily average of 1,504 transactions per second (TPS). This speed is 46 times faster than Ethereum and more than five times faster than Polygon—the fastest Ethereum scaling solution.

Read more: How to Buy Solana Meme Coins: A Step-By-Step Guide

“Despite ranking as the fastest blockchain, Solana has still only achieved 1.6% of its theoretical maximum speed of 65,000 TPS,” the report reads.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.