Through its treasury, Tether, the issuer of USDT, has minted a significant amount of its stablecoin. On-chain data reveals that Tether Treasury minted 1 billion USDT on May 16, at 16:50 UTC.

Given Tether’s leading market position, many think this large USDT issuance could impact crypto market movements.

Tether’s Recent USDT Minting and Its Market Implications

Paolo Ardoino, Tether’s CEO, clarified the context of this substantial minting. He indicated that 1 billion USDT was added to the inventory on TRON blockchain, specifying that this was an authorized transaction not yet issued.

“Meaning that this amount will be used as inventory for next period issuance requests and chain swaps,” he added.

Read more: How to Buy USDT in Three Easy Steps – A Beginner’s Guide

The last time Tether minted USDT was on April 16, when the market experienced a liquidity drain. According to a report from the on-chain analytical platform Lookonchain, Tether Treasury has minted 31 billion USDT in the past year. It minted those amounts on the TRON and Ethereum blockchains.

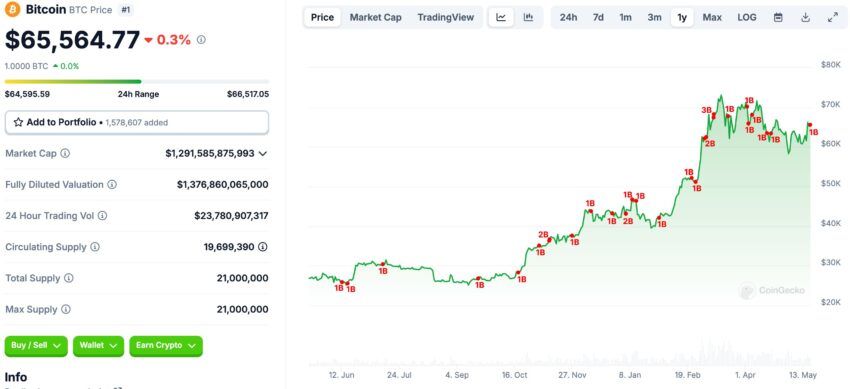

Interestingly, Tether minted these USDT when Bitcoin’s (BTC) price corrected to the $64,600 range. Since the end of 2022, each increase in the USDT supply has commonly had a positive effect on the development of the Bitcoin price.

Data from CryptoQuant reveals a high correlation between USDT supply and Bitcoin price movement, leading to an increase in volume and a dynamic environment for the Bitcoin price. Therefore, this sparks speculation among the crypto community that the new funds might be used to push Bitcoin’s price. Moreover, Lookonchain’s report indicated that the minted USDT last year pushed Bitcoin to reach above the $70,000 range.

“These minted USDT drove the price of BTC from $27,000 to $73,000,” it wrote.

Read more: Bitcoin Price Prediction 2024/2025/2030

Despite this speculation, Bitcoin’s price has stabilized between $64,000 and $66,000 in the last 24 hours. Last week, BTC fluctuated between $60,000 and $62,000 until the release of US inflation data. BeInCrypto reported a jump in Bitcoin’s price from $62,000 to $66,000 after April’s inflation data release suggests inflation might be slowing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.