Binance Futures, the futures trading arm of the crypto exchange Binance, has announced significant operational changes that will impact various perpetual contracts. The exchange plans to delist and adjust the leverage and margin tiers for STP (STPTUSDT), Status (SNTUSDT), MovieBlock (MBLUSDT), Radworks (RADUSDT), and Convex (CVXUSDT) perpetual contracts.

These updates will take effect next week. It marks a critical shift for traders and investors using these instruments.

Delisted Assets’ Price Tumble

Starting on May 6, 2024, at 10.30 UTC, Binance Futures will update the leverage and margin requirements for the mentioned contracts. This adjustment is a proactive measure to align with market conditions and enhance trading safety. Traders in these contracts are advised to reassess their strategies, particularly their leverage settings, to prevent potential liquidations.

Following the adjustments, Binance Futures’ system will bar new position openings in these contracts. Automatic settlements of all positions will commence one hour and a half later on their respective dates.

Read more: 7 Best Crypto Leverage Trading Platforms in 2024

“Users are not allowed to open new positions for the aforementioned contracts starting from the following dates: 2024-05-13 08:30 (UTC): STPTUSDT, SNTUSDT and MBLUSDT […] perpetual contracts; 2024-05-14 08:30 (UTC): RADUSDT and CVXUSDT […] perpetual contracts,” the official announcements stated.

Moreover, Binance Futures retains the right to implement additional protective measures without prior notice. These measures could include alterations to leverage caps, position values, and maintenance margins across different tiers, among other possible adjustments.

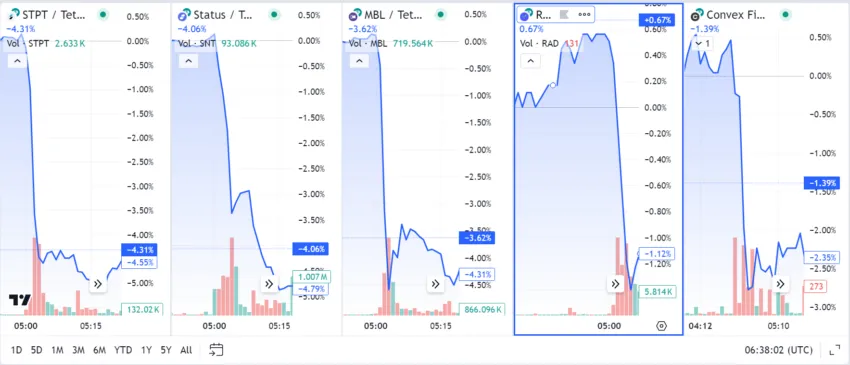

The reaction in the markets to these changes was immediate. According to data from TradingView, there was a noticeable decline in the prices of the affected tokens.

STPT decreased by 4.55%, SNT fell by 4.79%, and MBL by 4.31%. CVX and RAD also dropped by 2.35% and 1.12%, respectively.

Read more: Bitcoin Margin Trading: How To Multiply Your Profits with Leverage in 2024?

This delisting and updating process by Binance Futures highlights its ongoing effort to adapt to dynamic market conditions and maintain a secure trading environment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.