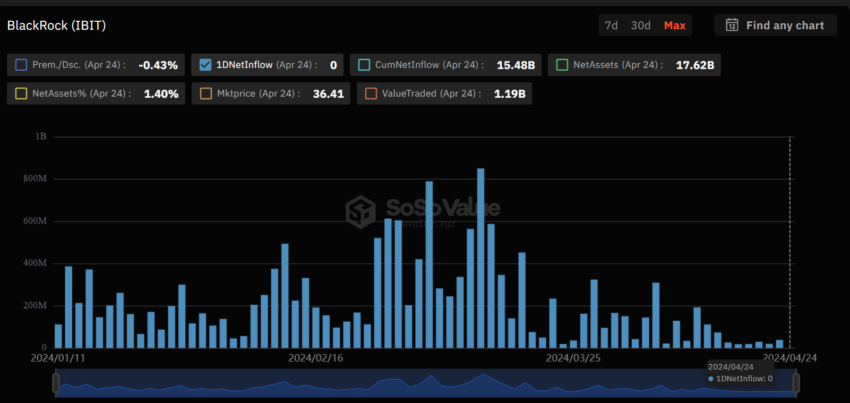

BlackRock’s iShares Bitcoin Trust (IBIT) has recorded no new inflows for the first time in over two months. This marks a significant pause in its steady growth.

This stagnation comes amid broader fluctuations within the US spot Bitcoin exchange-traded funds (ETFs) market, contrasting sharply with the excitement in overseas markets like Hong Kong.

US Spot Bitcoin ETFs Stall as Hong Kong Innovates

On April 24, the cumulative daily inflow of US Bitcoin ETFs dipped to a negative $120.64 million, according to data from SoSo Value. Notably, IBIT, which previously enjoyed a continuous inflow for 71 trading days, experienced zero inflows on the reporting date.

Despite this, IBIT still maintains the largest cumulative inflow among its peers, amassing an impressive $15.4 billion.

Read more: What Is a Bitcoin ETF?

The other US spot Bitcoin ETFs saw minimal positive movement during the same period. Only Fidelity Wise Origin Bitcoin (FBTC) and ARK 21 Shares Bitcoin ETF (ARKB) recorded inflows of $5.61 million and $4.17 million, respectively.

Meanwhile, Grayscale Bitcoin Trust ETF (GBTC) continues to face challenges. It recorded $130.42 million in daily outflows, bringing its negative cumulative flows to a staggering $16.96 billion.

The lack of inflows into IBIT raises questions about the future appetite for Bitcoin ETFs in the US. Moreover, this coincides with the occurrence of its counterparts in Hong Kong.

Recently, the HashKey Exchange announced its collaboration with Boshi International and HashKey Capital. They aim to launch the Boshi Hashkey Bitcoin Spot ETF and Boshi Hashkey Ethereum Spot ETF through the collaboration.

These funds allow for the physical redemption of assets. Furthermore, it highlights a strategic advantage that could appeal to investors seeking direct exposure to cryptocurrencies without the immediate need to sell.

This innovation in Hong Kong contrasts with the more conservative approaches in the US market. The Hong Kong ETFs are set to begin fundraising. Finally, the Hong Kong Stock Exchange will list them on April 30.

Kevin Lee, Chief Executive Officer at Gate.HK, believes the SFC’s approval of spot Bitcoin and Ethereum ETFs is a strategic move. He emphasizes that “Hong Kong’s regulatory bodies have an advanced understanding of virtual assets.”

Lee further notes that this, alongside robust regulatory frameworks and government support, positions Hong Kong to become a leader in integrating crypto into traditional finance.

“Hong Kong is now in the race not only to be a hub of the web3 ecosystem, but also as the leading player in integrating the crypto industry into traditional finance and capital markets,” Lee told BeInCrypto.

Despite the optimism in Hong Kong, analysts remain cautious about the immediate impact of these new ETFs on the broader market. Eric Balchunas, Senior ETF Analyst at Bloomberg Intelligence, has pointed out the limitations of the Hong Kong market.

“The underlying ecosystem there is less liquid and efficient, which could affect the performance of these ETFs,” he said.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

However, he remains optimistic about the long-term benefits. Balchunas stated that “other countries adding BTC ETFs is no doubt additive for Bitcoin.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.