JPMorgan’s study reveals that BlackRock’s and Fidelity Investments’ spot Bitcoin exchange-traded funds (ETFs) have emerged as frontrunners in liquidity metrics, surpassing the long-established Grayscale Bitcoin Trust (GBTC).

This revelation comes while the market has witnessed intense competition for investors’ attention among ETF issuers.

BlackRock, Fidelity Take Over Grayscale

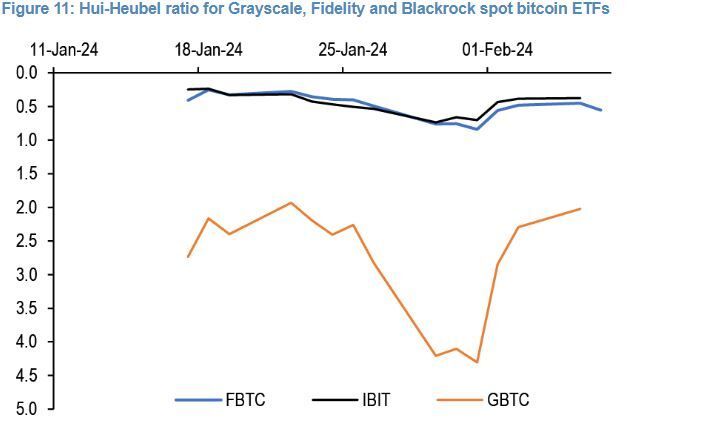

BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC), both newcomers in the arena, have shown superior performance in liquidity evaluations. JPMorgan strategists used the Hui-Heubel ratio for this analysis, which measures how market prices react to trading volumes. It also compares ETFs’ closing prices with their net asset values.

The findings suggest that BlackRock and Fidelity’s offerings are more adept at maintaining price stability in response to trades, a key market depth indicator.

Specifically, the Hui-Heubel liquidity ratio for these Bitcoin ETFs was significantly lower, indicating a broader market breadth. This aspect is crucial for investors seeking reliable and efficient trade execution without causing substantial price disruptions.

“We find evidence that the BlackRock and Fidelity Bitcoin ETFs have already an advantage versus the Grayscale Bitcoin Trust on certain liquidity metrics related to market breadth,” JPMorgan analysts said.

IBIT Surpasses GBTC in Trading Volume

Amidst the liquidity comparison, IBIT became the first spot Bitcoin ETF to surpass GBTC regarding trading volume on Thursday. According to Bloomberg Terminal, GBTC recorded a trading volume of $290.7 million, whereas IBIT’s trading volume recorded $301 million.

“Normally it takes 5-10 years for a newborn to get even close to toppling a category’s liquidity king(s). IBIT did it in under a month – trading more than both GBTC and BITO today,” Bloomberg analyst Eric Balchunas said.

| Date | Issuer | Ticker | Trade Volume | BTC Holdings |

| 2024-02-07 | BlackRock | IBIT | 13,732,811 | 78,026.84 |

| 2024-02-07 | Grayscale | GBTC | 7,623,517 | 470,637.41 |

| 2024-02-07 | Fidelity | FBTC | 5,237,150 | 66,613.47 |

| 2024-02-07 | Ark/21 Shares | ARKB | 1,966,724 | 16,690 |

| 2024-02-07 | Bitwise | BITB | 1,909,361 | 15,958 |

| 2024-02-07 | Invesco/Galaxy | BTCO | 494,065 | 7,057 |

| 2024-02-07 | VanEck | HODL | 386,258 | 3,111.53 |

| 2024-02-07 | Valkyrie | BRRR | 291,035 | 2,677.82 |

| 2024-02-07 | Franklin Templeton | EZBC | 207,685 | 1,595 |

| 2024-02-07 | WisdomTree | BTCW | 180,726 | 361 |

Read more: Who Owns the Most Bitcoin in 2024?

Despite the growing competition, Grayscale’s Bitcoin Trust remains a formidable player. Grayscale’s Vice President of ETFs, Louis Hsu, highlighted the GBTC’s dominant position since its inception as a spot Bitcoin ETF. Moreover, Grayscale CEO Michael Sonnenshein defended the higher fee structure, attributing it to the firm’s specialized expertise and track record in the crypto market.

Sonnenshein’s perspective extends beyond immediate liquidity advantages, pondering the long-term viability of the proliferating Bitcoin ETFs. He speculates that only a handful of these Bitcoin ETFs will survive. The Grayscale CEO boldly remarked that most spot Bitcoin ETFs will potentially exit the market due to insufficient investor interest.

Since their launch, the new entrants, including BlackRock and Fidelity’s ETFs, have attracted approximately $8 billion in net inflows, while Grayscale has seen a $6 billion outflow. Despite this shift, Grayscale’s fund remains the largest, with $21 billion in assets, trailed by BlackRock and Fidelity with $3.4 billion and $2.9 billion, respectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.