In an escalating effort to regulate the burgeoning cryptocurrency market, the Central Bank of Nigeria (CBN) has sharpened its focus on several leading global cryptocurrency platforms, warning financial entities nationwide.

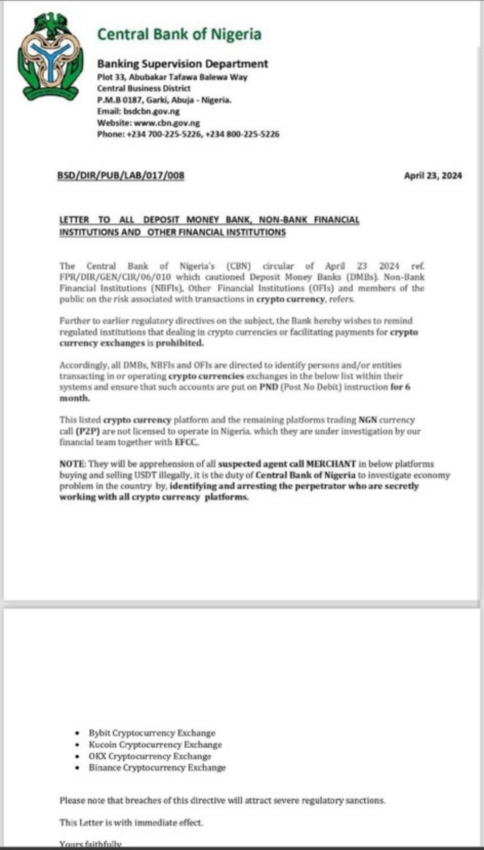

In a letter that came to light this week, CBN directed financial institutions to closely monitor and report on the activities involving Bybit, KuCoin, OKX, and Binance.

Nigeria’s CBN to Arrest USDT Traders in Economic Probe

The mandate instructs Deposit Money Banks (DMBs), Non-Bank Financial Institutions (NBFIs), and Other Financial Institutions (OFIs) to flag and restrict accounts suspected of engaging in cryptocurrency transactions. The CBN’s directive particularly demands implementing a post-no-debit (PND) order for six months on relevant accounts. Additionally, warning of heavy sanctions for non-compliance.

Furthermore, the CBN clarified its stance on illicit activities amid these developments. It stated that any individual or “suspected agent” clandestinely trading or facilitating the sale of USDT would face arrest. This move continues the CBN’s campaign to probe economic disturbances within Nigeria.

Despite the broad sweep of the directive, local cryptocurrency exchanges seem to have been spared in the recent circular. Nathaniel Luz, CEO of Flincap, remarked on the omission of indigenous crypto exchanges. He attributes it to their proactive efforts in obtaining necessary operational licenses.

“It’s noteworthy that the recent circular did not mention any indigenous crypto exchanges, likely because many Nigerian crypto companies, such as Flincap, have been actively pursuing the required licenses,” said Nathaniel Luz, CEO of Flincap.

Read More: Is KuCoin Safe in 2024? Exploring the Crypto Exchange’s Legal Status

Binance Under Fire: Nigeria Alleges Tax Evasion, Detains Executives

Similarly, Binance has come under fire from the Nigerian Federal Inland Revenue Service (FIRS) over allegations of tax evasion. This includes omissions in VAT and Company Income Tax. This legal challenge against Binance follows a hefty $4.3 billion penalty for breaching US anti-money laundering regulations. Which underscores the crypto giant’s global regulatory pressures.

Moreover, the Nigerian government’s detention of two Binance senior executives has raised a potential diplomatic fray, given their links to the US and UK. Observers perceive the detentions as part of Nigeria’s broader financial reforms aimed at stabilizing the Naira and curtailing crypto operations implicated in currency manipulation

Nonetheless, the latest actions by Nigerian authorities reflect an intensified approach to crypto oversight that resonates with the global trend of tighter regulation in the digital currency space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.